- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Assessing Aker BP (OB:AKRBP) Valuation After New North Sea Gas and Condensate Discoveries

Reviewed by Simply Wall St

Aker BP (OB:AKRBP) is back in focus after a fresh gas and condensate discovery at the Lofn and Langemann wells in the Sleipner area, adding to a string of recent exploration wins.

See our latest analysis for Aker BP.

Against that backdrop, Aker BP’s share price has inched up recently, with a 7 day share price return of 2.76 percent and a year to date share price return of 8.67 percent. The 1 year total shareholder return of 28.34 percent suggests steadily building momentum despite short term swings.

If this latest discovery has you rethinking energy exposure, it could be worth exploring aerospace and defense stocks as another way to uncover mission critical plays tied to global security and infrastructure themes.

With fresh reserves, double digit earnings growth and the shares trading below some intrinsic estimates yet only modestly under analyst targets, is Aker BP a rare value opportunity or already reflecting its next leg of growth?

Most Popular Narrative Narrative: 3.4% Undervalued

With Aker BP last closing at NOK253.10 against a narrative fair value of NOK262, the story hinges on how efficiently future production is monetised.

The Yggdrasil project is designed to be technologically advanced and low emission, powered by renewable electricity from shore, ensuring efficient and cost effective operations that will likely improve net margins by reducing operational costs and environmental compliance expenses.

Curious how modest top line growth, rising margins and a leaner earnings multiple can still point to upside from here? The full narrative unpacks the production targets, profit expansion and valuation reset that sit behind this calculated fair value call.

Result: Fair Value of $262 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising emissions costs and heavy reliance on a few core fields could compress margins and unsettle the seemingly straightforward upside story.

Find out about the key risks to this Aker BP narrative.

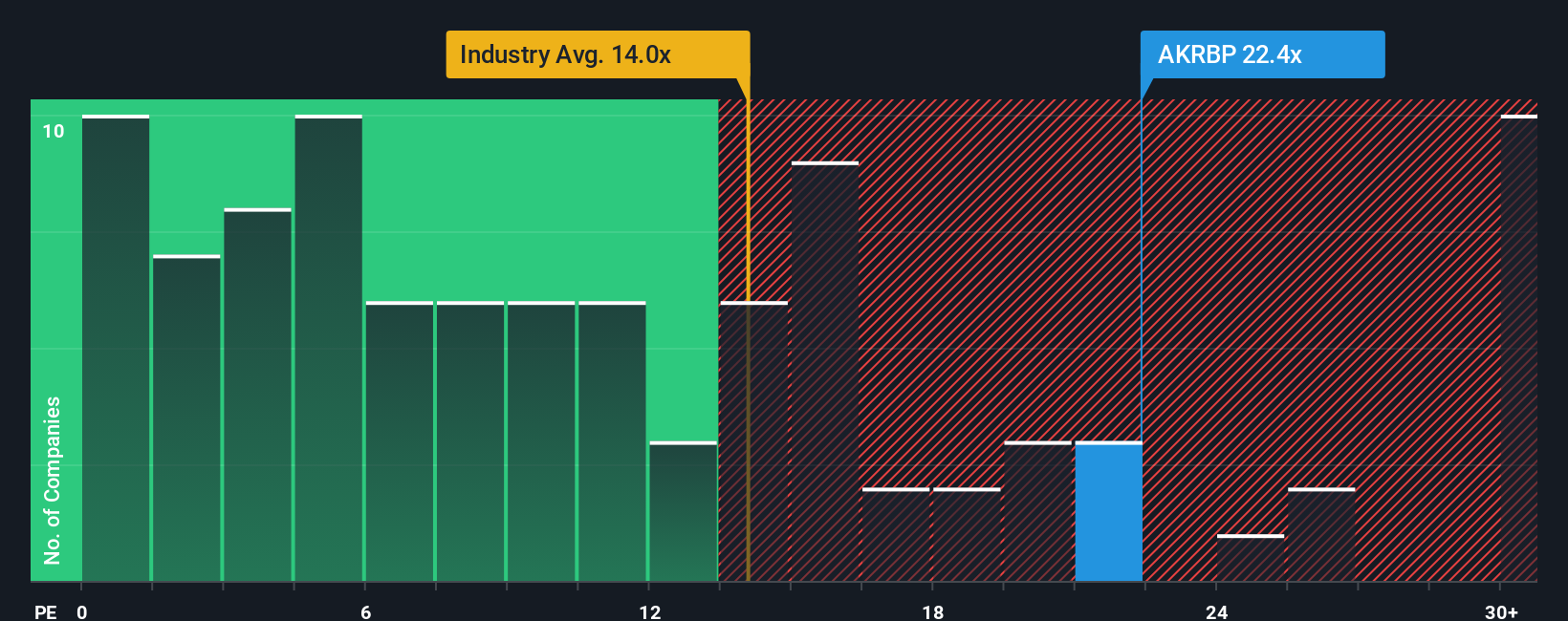

Another View, Valuation Through Earnings

On earnings, the picture is less generous. Aker BP trades on a P/E of 18.8 times versus 9.2 times for peers and a fair ratio of 11.2 times, implying the market is paying a hefty premium that could unwind if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aker BP Narrative

If you see the numbers differently or want to stress test your own thesis, you can quickly build a custom narrative in minutes, Do it your way.

A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

If you stop at Aker BP, you may miss other stand out opportunities. Use the Simply Wall Street Screener to uncover focused ideas tailored to your strategy.

- Capture mispriced potential by targeting companies that look cheap on future cash flows with these 909 undervalued stocks based on cash flows before the wider market catches on.

- Ride the wave of intelligent automation by zeroing in on these 26 AI penny stocks that could reshape entire industries and earnings power.

- Strengthen your income stream by evaluating these 15 dividend stocks with yields > 3% that can support reliable, compounding returns year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026