AutoStore Holdings (OB:AUTO): Assessing Valuation After Q3 Earnings Reveal Declining Sales and Profitability

Reviewed by Simply Wall St

AutoStore Holdings (OB:AUTO) released its third quarter and nine-month earnings report, revealing a slight drop in sales compared to the same period last year. There was also a sharper decline in revenue and net income over nine months. Investors are weighing these results closely.

See our latest analysis for AutoStore Holdings.

AutoStore Holdings’ share price has shown notable momentum lately, surging 58% over the last 90 days even as total shareholder return for the past year sits at -14%. This sharp swing suggests investors are responding to changing expectations, likely shaped by the company’s latest earnings report and the evolving outlook for automation stocks.

If AutoStore’s recent volatility has you thinking about other opportunities, this might be the perfect time to discover See the full list for free.

With shares rebounding sharply despite mixed financials, investors face a key question: Is AutoStore Holdings trading at a bargain, or has the market already factored in any future growth prospects?

Most Popular Narrative: 5% Overvalued

AutoStore Holdings’ current share price is slightly above the fair value suggested by the most-followed narrative, highlighting investor optimism despite tepid recent financial momentum.

With revenue growth likely accelerating in the 11 to 14% range, the company should expand its market share, driven by its proven high-density, scalable systems. Profit margins are expected to remain robust, around 22 to 25%, as operational efficiencies and economies of scale take effect.

Want to know what assumptions power this upbeat price target? The narrative’s confidence hinges on a future where growth rebounds and margins rival industry leaders. But are these forecasts realistic or a stretch? Dive in for the numbers and surprises behind the valuation.

Result: Fair Value of $10.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish technology adoption or slower global expansion could undermine revenue growth and challenge the bullish outlook for AutoStore Holdings in the short term.

Find out about the key risks to this AutoStore Holdings narrative.

Another View: Discounted Cash Flow Perspective

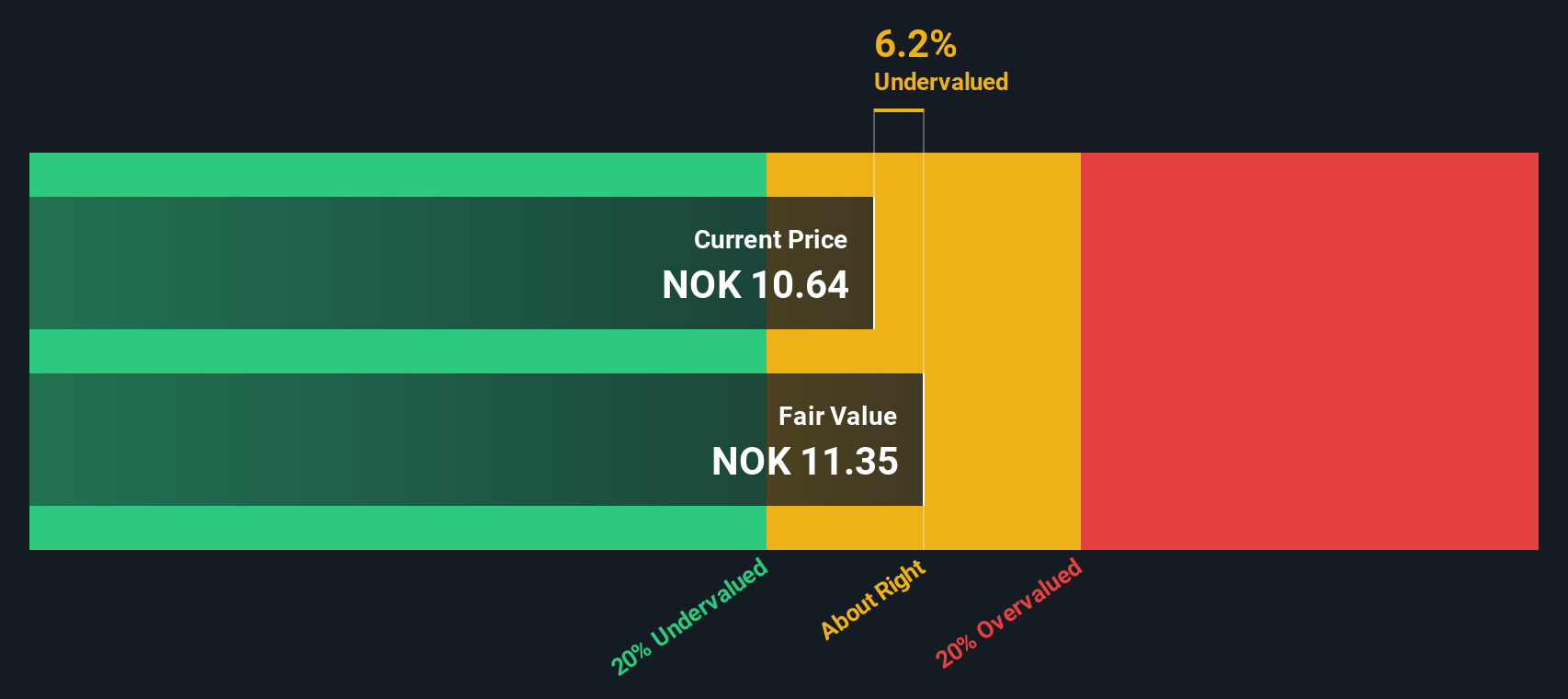

Looking at AutoStore Holdings from the perspective of the SWS DCF model, the analysis shifts. DCF analysis indicates that shares are trading below estimated fair value, with a 7% discount. This raises an important question: Is the recent surge still underestimating long-term earnings power, or has the market moved ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AutoStore Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AutoStore Holdings Narrative

If you want to look beyond the headlines or prefer to chart your own path, it takes just a few minutes to build a personalized view, Do it your way

A great starting point for your AutoStore Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on opportunity. Step ahead of the pack with fresh stock picks tailored to your strategies. Broaden your watchlist with these curated ideas:

- Unlock the potential of high-yield investments by reviewing these 16 dividend stocks with yields > 3%. This option offers robust returns and steady income, which can be useful for building long-term wealth.

- Supercharge your portfolio with growth stories at bargain prices by checking out these 874 undervalued stocks based on cash flows. Here, strong cash flows meet attractive valuations.

- Tap into the fast-evolving intersection of healthcare and artificial intelligence with these 32 healthcare AI stocks, targeting pioneers improving patient outcomes and scaling digital health solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AUTO

AutoStore Holdings

Provides robotic and software technology in Norway, Germany, Europe, the United States, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives