In 2014, Geir Bergskaug was appointed CEO of Sparebanken Sør (OB:SOR). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Sparebanken Sør

How Does Geir Bergskaug's Compensation Compare With Similar Sized Companies?

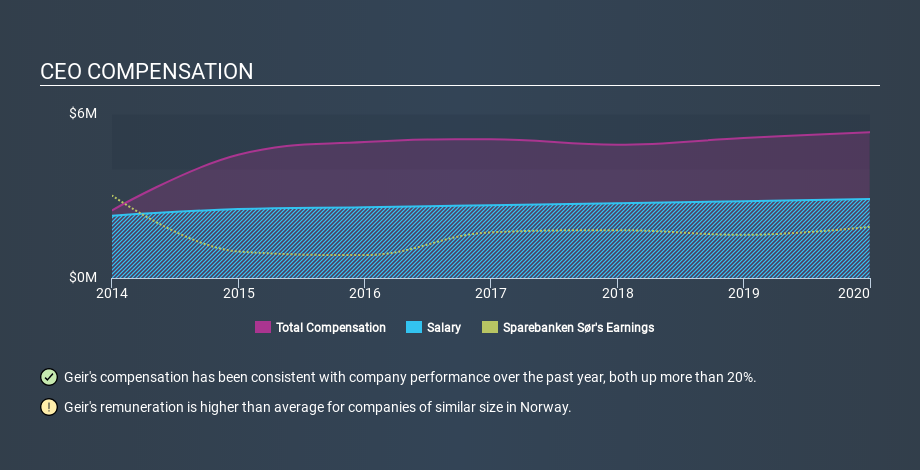

According to our data, Sparebanken Sør has a market capitalization of kr1.4b, and paid its CEO total annual compensation worth kr5.3m over the year to December 2019. That's a fairly small increase of 4.1% on year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at kr2.9m. We looked at a group of companies with market capitalizations under kr2.0b, and the median CEO total compensation was kr3.9m.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Non-salary compensation represents a greater slice of the remuneration pie for Sparebanken Sør, in sharp contrast to the overall sector.

As you can see, Geir Bergskaug is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Sparebanken Sør is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see a visual representation of the CEO compensation at Sparebanken Sør, below.

Is Sparebanken Sør Growing?

On average over the last three years, Sparebanken Sør has shrunk earnings per share by 2.5% each year (measured with a line of best fit). It achieved revenue growth of 14% over the last year.

Unfortunately there is a complete lack of earnings per share improvement, over three years. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that earnings per share has gone backwards over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has Sparebanken Sør Been A Good Investment?

Sparebanken Sør has not done too badly by shareholders, with a total return of 1.9%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

We compared the total CEO remuneration paid by Sparebanken Sør, and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. And while shareholder returns have been respectable, they have hardly been superb. So we doubt many shareholders would consider the CEO pay to be particularly modest! Moving away from CEO compensation for the moment, we've identified 1 warning sign for Sparebanken Sør that you should be aware of before investing.

Important note: Sparebanken Sør may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OB:SOR

Sparebanken Norge

Operates as an independent financial institution in Norway.

Average dividend payer and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026