Does Skue Sparebank (OB:SKUE) Have A Place In Your Dividend Portfolio?

Is Skue Sparebank (OB:SKUE) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

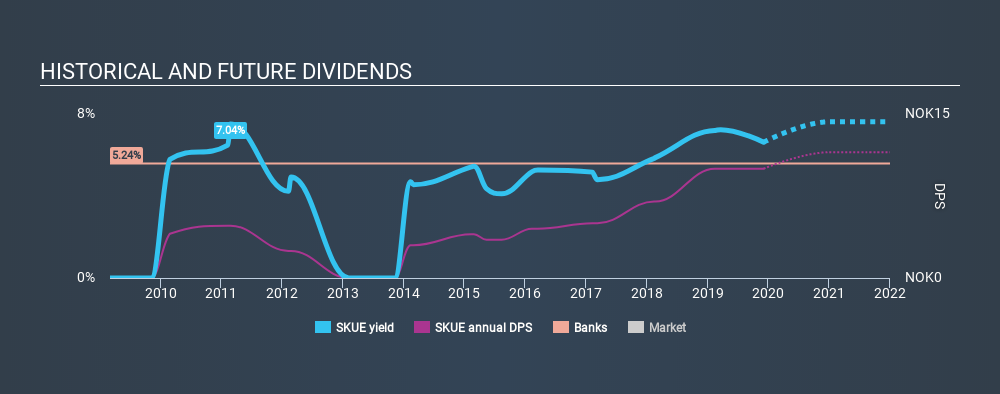

In this case, Skue Sparebank likely looks attractive to investors, given its 6.2% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on Skue Sparebank!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Skue Sparebank paid out 47% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Plus, there is room to increase the payout ratio over time.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Skue Sparebank has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was kr4.05 in 2009, compared to kr10.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.5% a year over that time. Skue Sparebank's dividend payments have fluctuated, so it hasn't grown 9.5% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? In the last five years, Skue Sparebank's earnings per share have shrunk at approximately 6.1% per annum. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see Skue Sparebank has a low payout ratio, as this suggests earnings are being reinvested in the business. Earnings per share are down, and Skue Sparebank's dividend has been cut at least once in the past, which is disappointing. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Skue Sparebank out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Skue Sparebank stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OB:SKUE

Skue Sparebank

Provides various banking products and services for individual and business in Norway.

Undervalued with solid track record.

Market Insights

Community Narratives