Exploring STIF Société anonyme And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and shifting economic indicators, small-cap stocks present intriguing opportunities for investors looking to capitalize on untapped potential. In this environment, identifying promising companies like STIF Société anonyme and other small caps with strong fundamentals and growth prospects can be a strategic move for those seeking to diversify their portfolios amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

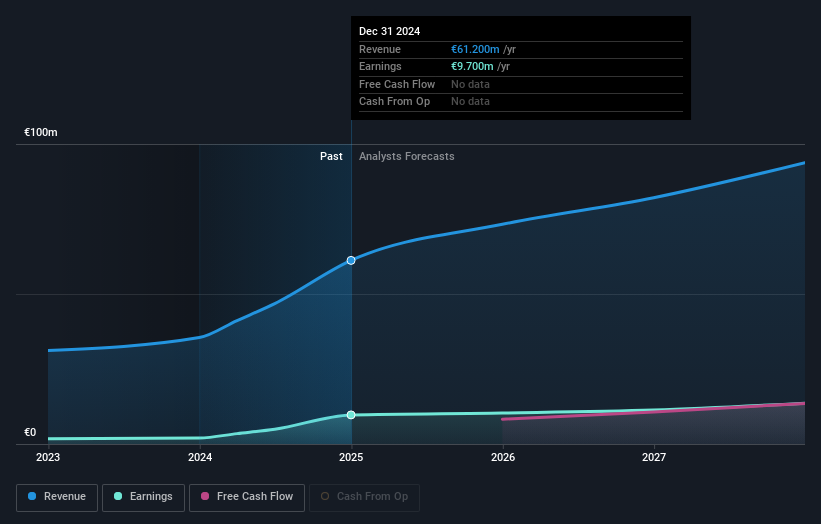

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market capitalization of €295.80 million.

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, which accounts for €63.70 million. The market capitalization stands at €295.80 million.

STIF Société anonyme, a smaller player in the European market, has shown impressive financial performance over the past year. Its earnings surged by 384%, significantly outpacing the Machinery industry's growth of 17.8%. The company reported net income of €9.7 million for 2024, up from €2 million in the previous year, with sales reaching €61.2 million compared to €35.5 million before. Despite a volatile share price recently, STIF seems undervalued by about 27% against its fair value estimate and announced an annual dividend increase to €0.59 per share payable in June 2025, suggesting strong shareholder returns ahead.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Value Rating: ★★★★☆☆

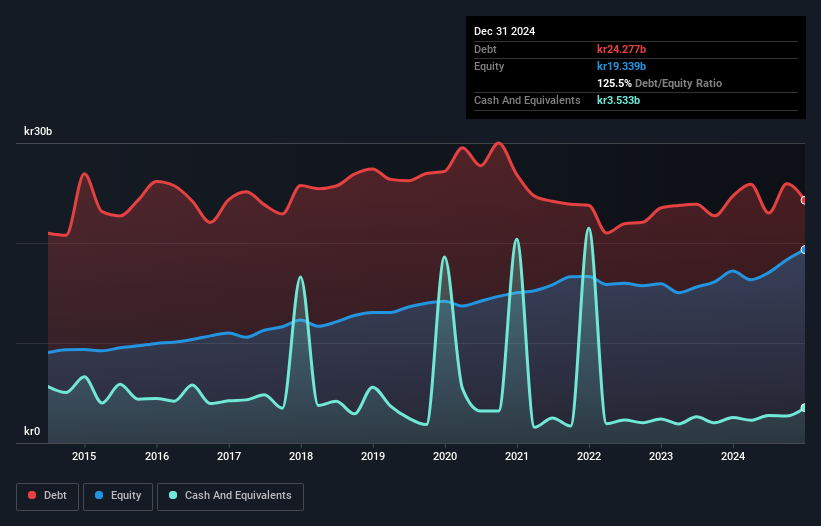

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market capitalization of NOK15.18 billion.

Operations: SpareBank 1 Nord-Norge generates revenue primarily from its Retail Market segment, contributing NOK2.53 billion, and Corporate Banking (Excluding SMB), which adds NOK1.71 billion. The bank also benefits from contributions by Sparebank 1 Finans Nord-Norge and Sparebank 1 Regnskaps-Huset Nord-Norge, adding NOK353 million and NOK331 million respectively. Segment Adjustment accounts for an additional NOK1.64 billion to the total revenue stream.

SpareBank 1 Nord-Norge, with total assets of NOK139 billion and equity of NOK20.1 billion, stands out in the financial landscape. The bank's total deposits are NOK89.1 billion against loans of NOK69.6 billion, reflecting a net interest margin at 3%. Despite its high-quality earnings and impressive earnings growth of 48.8% last year, it has a concerning bad loan allowance at just 2.3% of total loans, which is considered high for the industry standard. Trading at approximately 40% below estimated fair value highlights its potential appeal to investors looking for undervalued opportunities in Europe’s banking sector.

- Take a closer look at SpareBank 1 Nord-Norge's potential here in our health report.

Evaluate SpareBank 1 Nord-Norge's historical performance by accessing our past performance report.

Cicor Technologies (SWX:CICN)

Simply Wall St Value Rating: ★★★★★☆

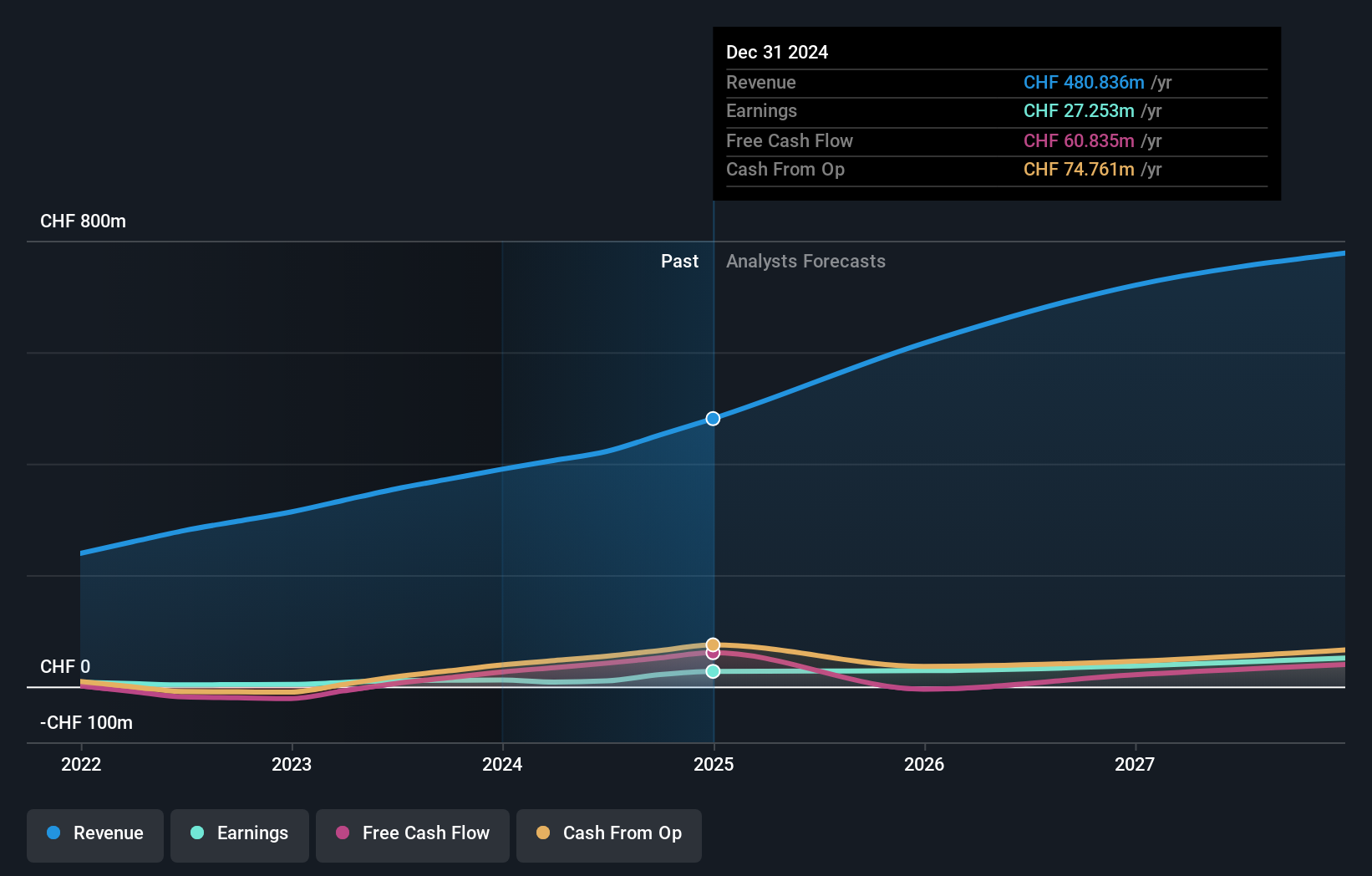

Overview: Cicor Technologies Ltd., along with its subsidiaries, specializes in the development and manufacturing of electronic components, devices, and systems globally, with a market capitalization of CHF563.94 million.

Operations: Cicor Technologies generates revenue primarily from its Electronic Manufacturing Services (EMS) Division, contributing CHF438.01 million, and the Advanced Substrates (AS) Division, adding CHF45.31 million.

Cicor Technologies, a nimble player in the electronics manufacturing sector, has seen its earnings skyrocket by 131.7% over the past year, outpacing industry growth of 38.1%. Despite an increased debt to equity ratio from 63.9% to 86.5%, its net debt to equity remains satisfactory at 32.2%, with interest payments well covered by EBIT at a multiple of 10.5x. The company recently acquired Mercury's Geneva site and seven Eolane sites in France and Morocco, reinforcing its European footprint in aerospace and defense electronics—a move likely to bolster revenue as it integrates these strategic acquisitions into its operations.

Where To Now?

- Dive into all 328 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives