How Investors May Respond To SpareBank 1 SMN (OB:MING) Reporting Lower Net Income and Earnings Per Share

Reviewed by Sasha Jovanovic

- SpareBank 1 SMN recently reported third-quarter and nine-month 2025 earnings, highlighting a decrease in net interest income and net income compared to the same periods last year.

- This financial performance included a year-over-year drop in basic earnings per share, which reflects a downward shift in the bank's profit generation from continuing operations.

- We'll explore how the decline in both net income and earnings per share may shape SpareBank 1 SMN's investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is SpareBank 1 SMN's Investment Narrative?

An investor in SpareBank 1 SMN typically wants to believe in the bank's ability to deliver consistent earnings, solid dividends, and maintain its value proposition in Norway’s banking sector. The recent Q3 numbers, however, show a decline in both net interest income and net income, as well as another year-over-year fall in earnings per share. This update introduces some uncertainty around the near-term earnings picture, especially since prior analysis indicated moderate earnings and revenue growth expectations, attractive value metrics, and a stable dividend yield as key short-term catalysts. For now, the market’s reaction has been relatively muted, suggesting that the downturn may not significantly change the prevailing risk and reward profile unless weaker performance becomes a pattern. However, if these pressures persist, one catalyst, reliable profit growth, may shift closer to being a risk for shareholders, warranting close attention in the coming quarters.

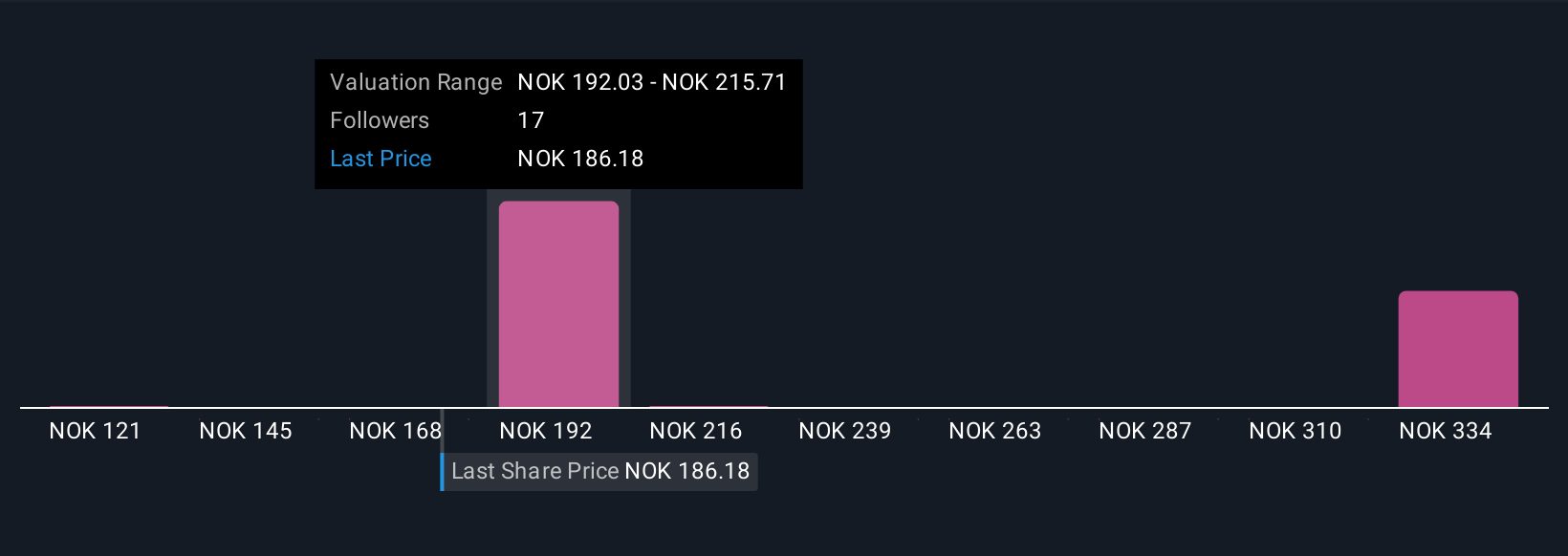

But margins have softened and that’s an issue every shareholder should keep in mind. Despite retreating, SpareBank 1 SMN's shares might still be trading 48% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on SpareBank 1 SMN - why the stock might be worth 35% less than the current price!

Build Your Own SpareBank 1 SMN Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SpareBank 1 SMN research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SpareBank 1 SMN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SpareBank 1 SMN's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MING

SpareBank 1 SMN

Provides various banking, accounting, and real estate products and services to private individuals and companies in Norway and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives