- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:ACOMO

Exploring Three Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainties and fluctuating market conditions across Europe, the Euronext Amsterdam remains a focal point for investors seeking stability through dividend stocks. In this context, understanding the intrinsic qualities that contribute to a robust dividend stock becomes crucial, especially in an environment where economic indicators and investor sentiment are rapidly evolving.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.58% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.90% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.02% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.77% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.41% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

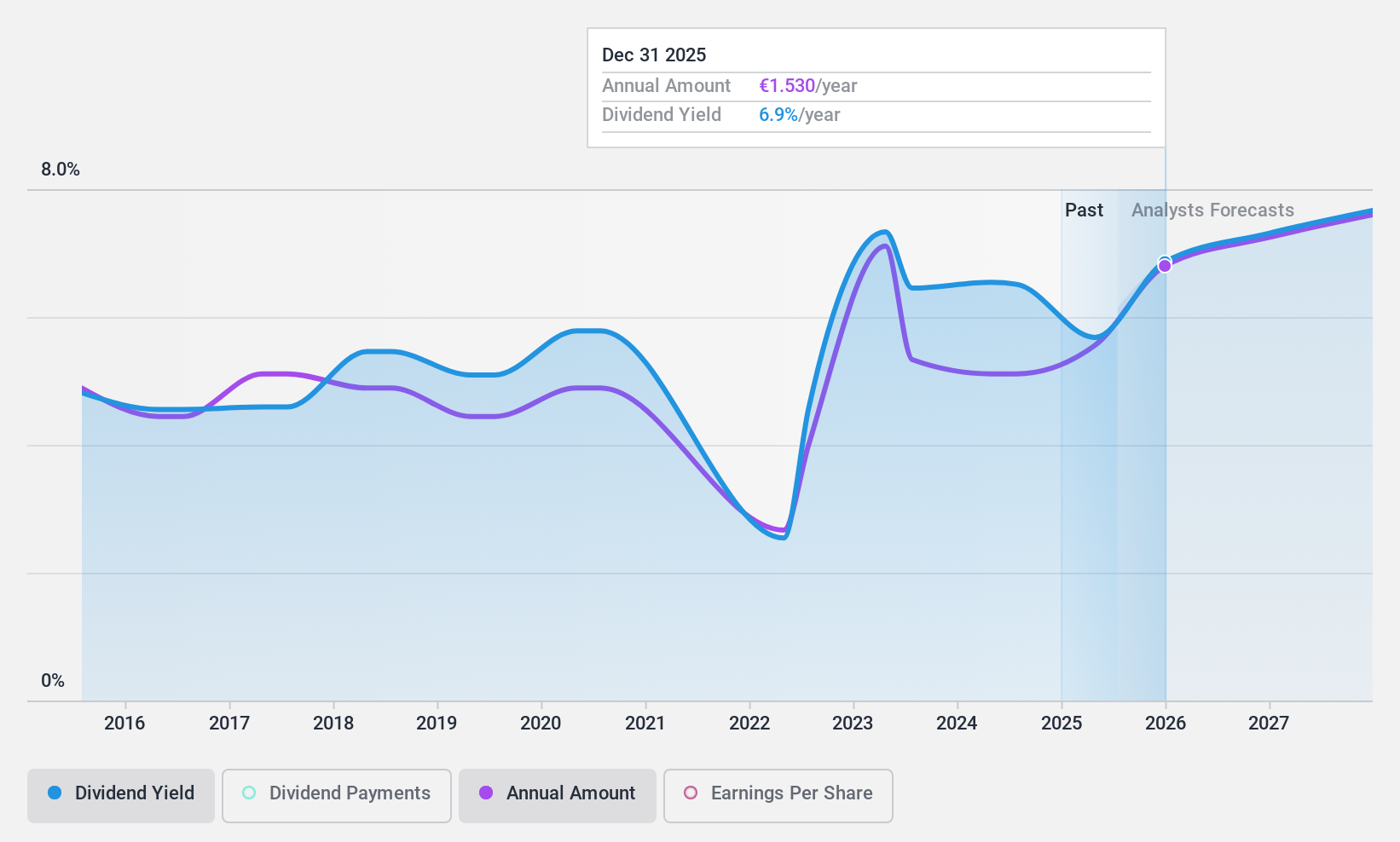

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. operates in the sourcing, trading, processing, packaging, and distribution of conventional and organic food ingredients for the food and beverage industry across Europe, North America, and other international markets, with a market capitalization of approximately €517.72 million.

Operations: Acomo N.V.'s revenue is generated from several segments including Tea (€120.62 million), Edible Seeds (€257.29 million), Food Solutions (€24.07 million), Spices and Nuts (€429.96 million), and Organic Ingredients (€436.38 million).

Dividend Yield: 6.6%

ACOMO's dividend yield of 6.58% ranks well in the Dutch market, but its dividend history shows volatility and unreliability over the past decade. Despite this, dividends are sustainably covered by earnings with a payout ratio of 85.7% and strongly supported by cash flows at a low cash payout ratio of 26.1%. However, concerns about ACOMO's high debt levels might caution dividend-focused investors, especially considering its unstable track record in maintaining consistent payouts.

- Dive into the specifics of Acomo here with our thorough dividend report.

- Our valuation report unveils the possibility Acomo's shares may be trading at a discount.

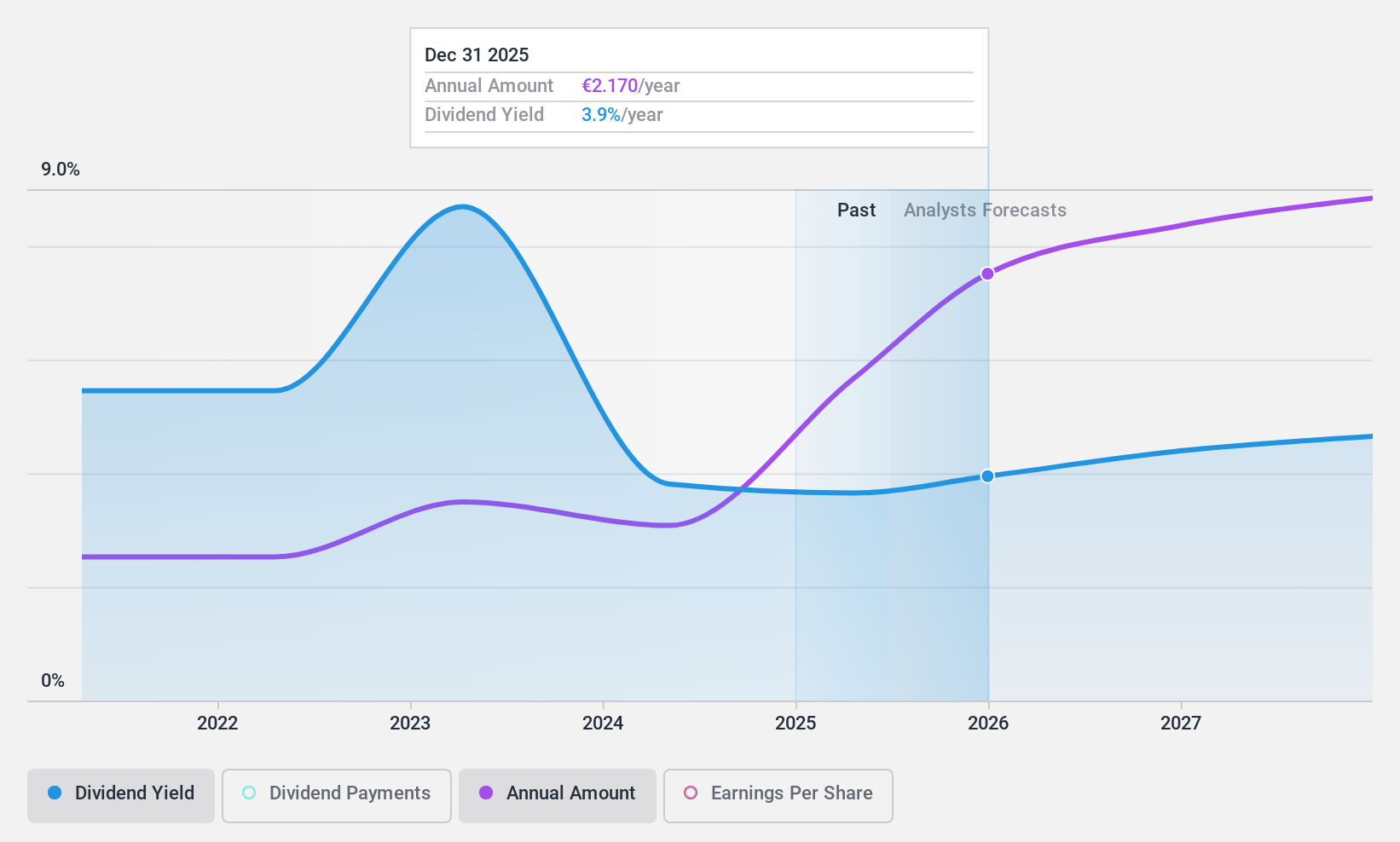

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands, with a market capitalization of approximately €541.88 million.

Operations: Koninklijke Heijmans N.V. generates revenue through several segments, including Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

Dividend Yield: 4.4%

Koninklijke Heijmans has shown a volatile dividend history over the past decade, with fluctuations in payments and a recent 1:1.1236 stock split announced for May 7, 2024. Despite this instability, the dividends are reasonably covered by both earnings and cash flows, with payout ratios of 37.1% and 59% respectively. Earnings have grown at 19.4% annually over the last five years and are expected to increase by about 10.21% per year moving forward. However, its current dividend yield of €4.41 is below the top quartile in the Dutch market at €5.71.

- Click to explore a detailed breakdown of our findings in Koninklijke Heijmans' dividend report.

- In light of our recent valuation report, it seems possible that Koninklijke Heijmans is trading behind its estimated value.

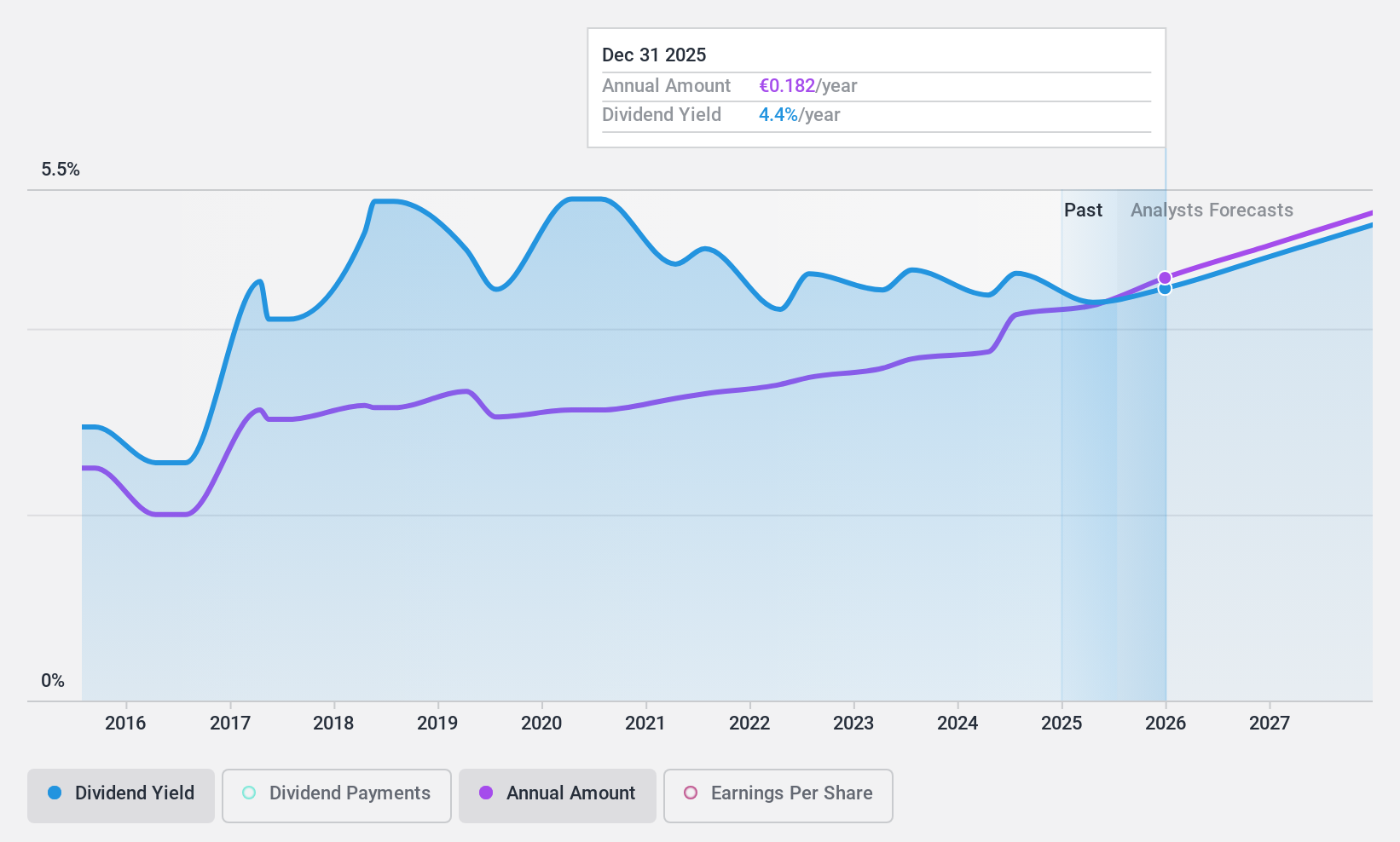

Koninklijke KPN (ENXTAM:KPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €13.74 billion.

Operations: Koninklijke KPN N.V. generates revenue through three primary segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.3%

Koninklijke KPN offers a modest dividend yield of 4.29%, below the top quartile in the Dutch market. Despite a volatile history, dividends have shown growth over the past decade. The current payout is supported by both earnings and cash flows, with payout ratios of 78.4% and 59.6% respectively, suggesting reasonable coverage but highlighting potential concerns about sustainability given its high level of debt and unstable track record. Recent strategic moves include forming TowerCo with ABP to optimize infrastructure assets, potentially enhancing long-term shareholder value without affecting employment levels; this includes an upfront payment of €120 million to NOVEC/OTC's shareholders and expected impacts on KPN’s EBITDA AL by approximately €30 million for 2024.

- Unlock comprehensive insights into our analysis of Koninklijke KPN stock in this dividend report.

- The analysis detailed in our Koninklijke KPN valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 6 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ACOMO

Acomo

Engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry in the Netherlands, other European countries, North America, and internationally.

Adequate balance sheet average dividend payer.