- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

ASML (ENXTAM:ASML): Assessing Valuation After a Strong 9% Monthly Share Price Gain

Reviewed by Simply Wall St

ASML Holding (ENXTAM:ASML) has quietly pushed higher this month, and that is catching investors attention. With the stock up around 9% in the past month and 41% over the past year, the key question is whether the gains still make sense relative to its earnings power.

See our latest analysis for ASML Holding.

That latest move comes on top of a strong backdrop, with a 30 day share price return of around 9 percent feeding into a one year total shareholder return of roughly 42 percent. This suggests momentum is still firmly with the bulls as investors lean into ASML Holding growth story and reassess the long term upside from its dominant lithography position.

Given how central ASML Holding has become to the semiconductor supply chain, this can also be a good moment to scan other high growth tech names and see which ones stand out in high growth tech and AI stocks.

But with the shares now trading near €950 and only a modest gap to analyst price targets, the dilemma is clear: is ASML still mispriced relative to its earnings potential, or is the market already discounting years of future growth?

Most Popular Narrative: 4.8% Undervalued

With ASML Holding last closing at €951.60 versus a narrative fair value of €1,000, the story points to modest upside still on the table.

Why ASML Remains a Long-Term Buy 1. Monopoly in Advanced Chipmaking. ASML is the only company in the world producing EUV lithography tools. These machines are essential for making the world’s most powerful semiconductors. This gives ASML a near-monopoly in a fast-growing market driven by AI, 5G, and high-performance computing.

Want to see what is really baked into that premium price tag? According to Investingwilly, the narrative leans on robust growth, thick margins, and a future profit multiple more often reserved for elite compounders. Curious which assumptions actually power that €1,000 per share view, and how long they need to hold to make it work?

Result: Fair Value of $1000.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors cannot ignore export controls to China and management’s caution on 2026 demand, which could quickly compress growth expectations and valuation.

Find out about the key risks to this ASML Holding narrative.

Another View On Valuation

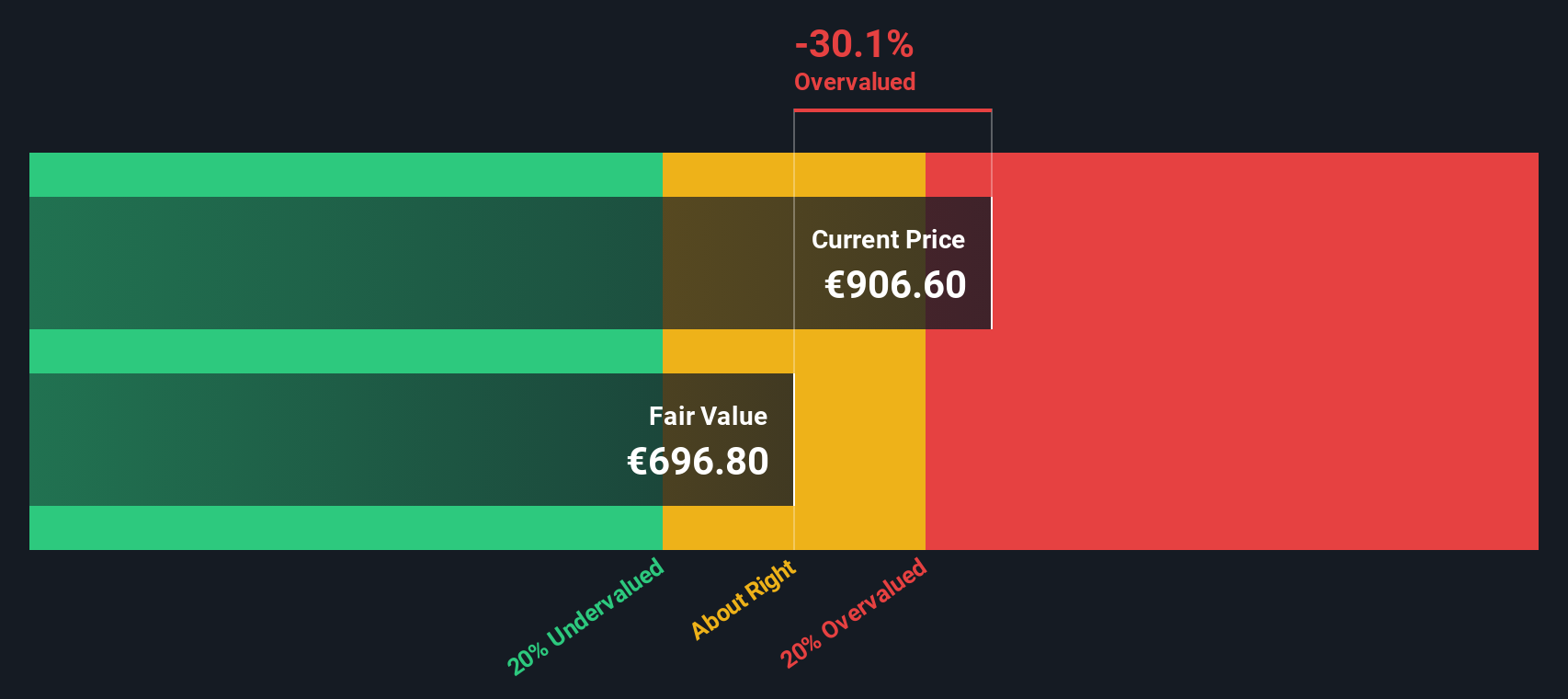

While the popular narrative sees ASML as roughly 4.8 percent undervalued, our DCF model tells a very different story. Based on those cash flow assumptions, fair value sits closer to €701, which implies the stock is trading richly. Which perspective do you rely on if volatility returns?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASML Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASML Holding Narrative

If you are not fully convinced by this view, or would rather dive into the numbers yourself, you can build your own narrative in just a few minutes: Do it your way.

A great starting point for your ASML Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing opportunities?

Do not stop at ASML, or you will miss out on other powerful ideas Simply Wall Street users are uncovering right now with targeted screeners built for serious investors.

- Explore potential bargain opportunities by tracking companies trading below their cash flow value through these 908 undervalued stocks based on cash flows and consider how you might position yourself if valuations change.

- Focus on cutting edge innovation by looking at companies harnessing artificial intelligence using these 26 AI penny stocks before their stories are widely followed.

- Seek reliable income streams by targeting businesses with strong yields via these 15 dividend stocks with yields > 3%, so your portfolio continues to generate income as markets move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026