- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

A Fresh Look at ASML (ENXTAM:ASML) Valuation Following This Week’s Share Price Momentum

Reviewed by Simply Wall St

ASML Holding (ENXTAM:ASML) shares have seen a modest return over the past week, moving up about 8%. The company remains in focus for investors, especially as the semiconductor industry continues to experience ongoing shifts.

See our latest analysis for ASML Holding.

ASML Holding’s recent 8% weekly share price jump adds to a year marked by powerful momentum. The stock’s 30.9% share price return year-to-date and impressive 38.6% total return over the past year reflect renewed optimism in the semiconductor space. Investors are responding to both sector tailwinds and ASML’s essential role in chip manufacturing.

If you’re curious about other innovative tech companies driving market attention, this is a great moment to discover See the full list for free.

While ASML’s strong returns and crucial tech leadership may excite investors, the key question remains: is there real value left in the stock, or has the market already accounted for all of ASML's future growth prospects?

Most Popular Narrative: 9.7% Undervalued

According to Investingwilly, the popular narrative sets ASML Holding’s fair value at €1,000, well above the last close price of €903.40. With this gap, there is a lively debate over what is driving the new number and whether the market has more catching up to do.

ASML repurchased €1.4 billion worth of shares during the quarter and declared an interim dividend of €1.60 per share, reaffirming its commitment to shareholder returns.

Want to know what is behind this higher fair value? The key factor is a financial outlook powered by robust margins and recurring revenue. But there is an unexpected twist—one growth assumption most investors overlook sparks the biggest upside. See what makes this calculation so compelling.

Result: Fair Value of €1,000 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, macroeconomic uncertainty and heightened geopolitical risks could quickly challenge ASML's bullish outlook and limit its upside potential in the near term.

Find out about the key risks to this ASML Holding narrative.

Another View: A More Cautious Valuation

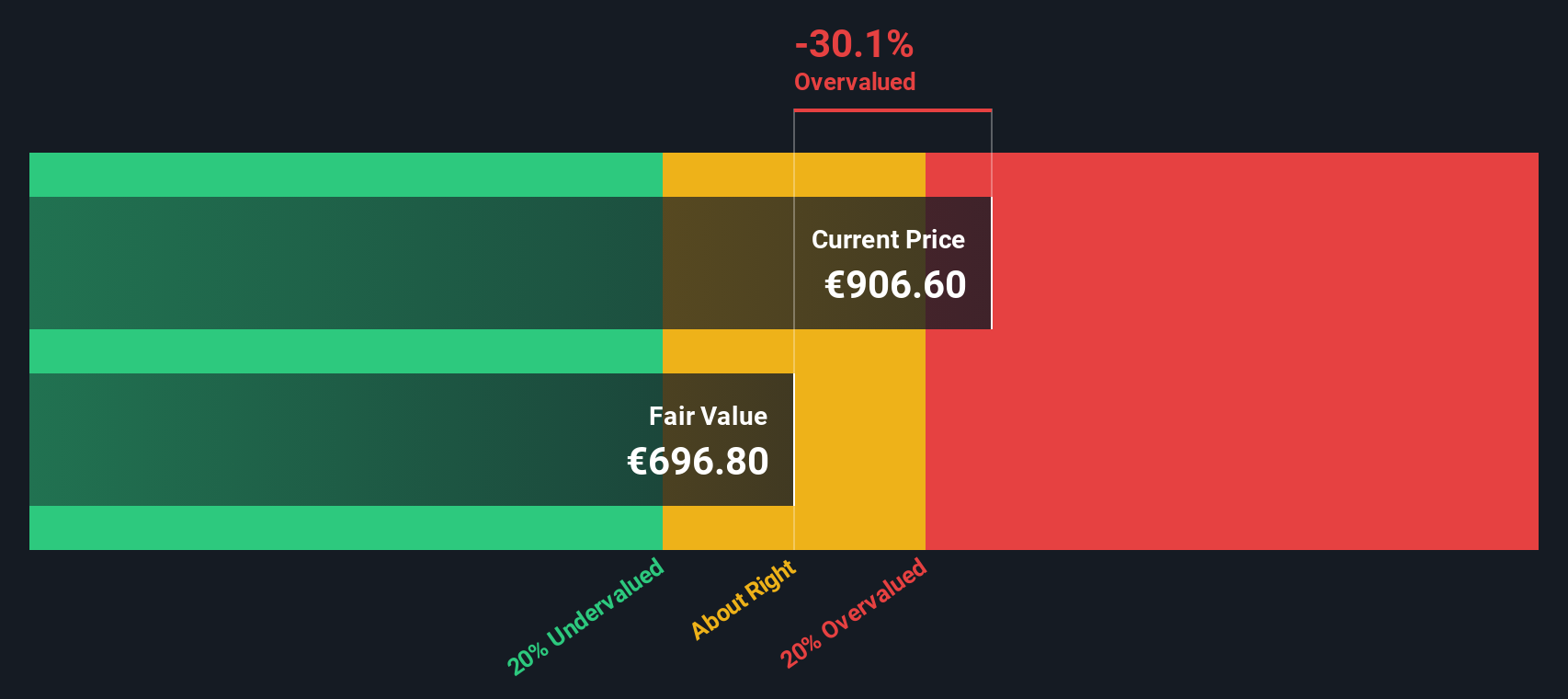

While some analysts see ASML as undervalued, our DCF model tells a different story. Based on projected future cash flows, the SWS DCF model estimates fair value at €697.60, which is below the current share price. This suggests the market may have already priced in much of the optimism. Does this more conservative outlook change your perspective?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASML Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASML Holding Narrative

If you’d like to interpret the figures differently or want a hands-on approach, you have the freedom to assemble your own view on ASML in just a few minutes, and Do it your way.

A great starting point for your ASML Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are constantly scanning for unique opportunities. Don’t let standout stocks pass you by. Simply Wall Street’s custom screeners provide a shortcut to your next investment idea.

- Supercharge your portfolio with reliable income streams by checking out these 15 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Capitalize on breakthroughs in artificial intelligence by evaluating these 25 AI penny stocks shaping tomorrow’s markets right now.

- Get ahead of Wall Street by sizing up these 921 undervalued stocks based on cash flows that the market may be overlooking today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.