Prosus (ENXTAM:PRX) Valuation Spotlight After Share Price Surge Linked to Tencent’s Rally and Chinese Market Shift

Reviewed by Simply Wall St

Prosus (ENXTAM:PRX) shares jumped almost 5% after Tencent’s rally, which followed improved market conditions in China. Because Prosus owns a large stake in Tencent, any shift in China’s sentiment can drive Prosus’ value.

See our latest analysis for Prosus.

Prosus has shown impressive momentum lately, with a 16.8% share price return over the past 90 days and a standout year-to-date gain of 59.2%. Over the last year, total shareholder return came in at 64%, underscoring building optimism after a period of volatility linked to both global tech trends and shifts in Chinese market sentiment.

If the recent surge in tech-linked stocks has you searching for fresh opportunities, consider broadening your lens and discover fast growing stocks with high insider ownership

With shares rallying and optimism building, the critical question is whether Prosus remains undervalued and primed for further upside, or if the recent surge means future growth is already reflected in the stock price.

Most Popular Narrative: 2.8% Undervalued

According to the most widely followed narrative, Prosus’s estimated fair value of €63.25 sits just above the recent close of €61.48. This suggests marginal upside that has caught investor attention through several rounds of analyst upgrades and downgrades.

"Bullish analysts have raised their price targets significantly in recent updates. This reflects renewed confidence in Prosus' ability to drive sustainable value for shareholders."

Think that jump in fair value is all about wishful thinking? There is a bold projection behind it. The narrative hangs on surprising shifts in revenue growth, margins, and a future profit multiple you might not expect for this business. Want to see what is really fueling these forecasts? Discover the drivers powering this sky-high estimate for Prosus.

Result: Fair Value of €63.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if operational improvements fall short or investments underperform, Prosus’s outlook could change quickly, reminding investors that expectations can shift just as swiftly.

Find out about the key risks to this Prosus narrative.

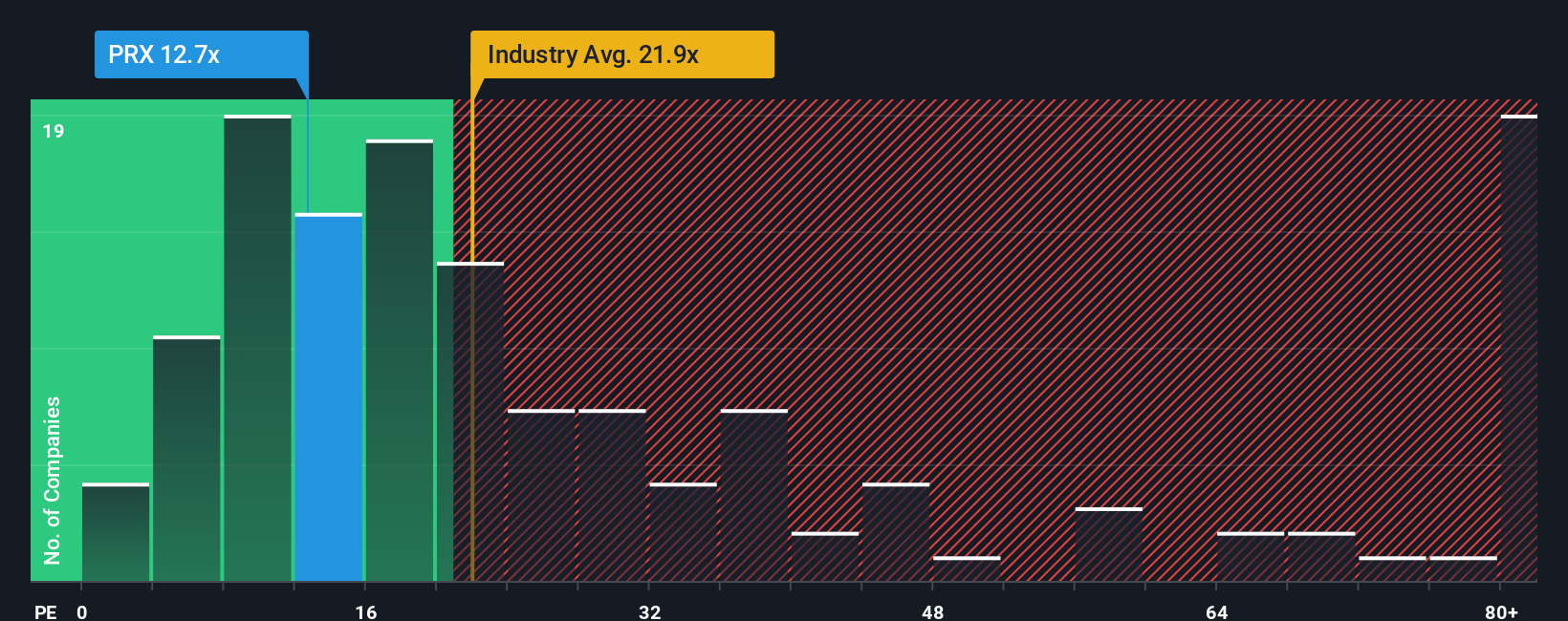

Another View: Multiple-Based Valuation

Looking at Prosus through the lens of its price-to-earnings ratio provides another angle. At 12.6x, it is trading well below both the Dutch market average of 16.9x and the global industry average of 19.9x. It is also under the fair ratio of 16.4x suggested by market regression. This sizable gap could signal value, but does it reflect real opportunity or hidden risks that the other models miss?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Prosus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Prosus Narrative

If you see things differently or want to explore your own perspective, it takes just a few minutes to shape your personal view: Do it your way

A great starting point for your Prosus research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are already tracking opportunities others miss. Spot momentum before the crowd, access untapped sectors, and get ahead of the next big trend with a few smart choices.

- Catch early-stage growth by scanning these 3572 penny stocks with strong financials showcasing robust financials and real potential for breakout performance.

- Capitalize on the AI revolution and see which companies are at the forefront with these 25 AI penny stocks offering tomorrow’s biggest breakthroughs today.

- Maximize your long-term returns by targeting value with these 855 undervalued stocks based on cash flows that stand out for quality and rapid upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PRX

Prosus

Engages in the e-commerce and internet businesses in Asia, Europe, Latin America, North America, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives