- Netherlands

- /

- Entertainment

- /

- ENXTAM:BNJ

Do Delayed Revenues at Banijay Group (ENXTAM:BNJ) Reveal a Shift in Long-Term Growth Focus?

Reviewed by Sasha Jovanovic

- Banijay Group N.V. recently reported its earnings for the nine months ended September 30, 2025, showing sales of €3.22 billion and net income of €118.7 million, along with an update on annual guidance pointing to low-single digit growth in Entertainment & Live and around 10% growth at Banijay Gaming following a temporary hit from adverse sports results.

- An important detail emerging from these announcements is the company's decision to postpone some content deliveries to early 2026, paired with the impact of higher French taxes, which contributed to a more cautious outlook for the rest of the year despite year-to-date growth.

- We'll examine how Banijay’s mix of solid earnings growth and guidance reflecting postponed revenues could influence its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Banijay Group Investment Narrative Recap

To be a shareholder in Banijay Group, you need conviction in the company's ability to execute amid the unpredictable timing of content releases and shifting regulatory challenges, while still benefiting from its growing exposure to live events and gaming. The latest results reinforce this view: although Banijay posted solid growth and improving margins, the short-term catalyst of accelerating entertainment revenues now faces headwinds from postponed deliveries and higher French taxes, while the most significant risk remains the company’s exposure to content cycle volatility. Importantly, this news does not materially alter the long-term case but may dampen near-term expectations linked to big content launches.

Among recent announcements, Banijay's confirmation of low-single digit organic growth in Entertainment & Live for 2025, driven by delayed content deliveries, stands out as central to this earnings event. This guidance update ties directly to the near-term volatility in revenues and underscores why ongoing unpredictability in show release timing is a core risk for the business, especially since much of Banijay's earnings depend on a steady pipeline of major formats and international deals.

Yet, for those monitoring Banijay's progress, it’s critical not to overlook the impact that format delays could have on quarterly results and investor sentiment...

Read the full narrative on Banijay Group (it's free!)

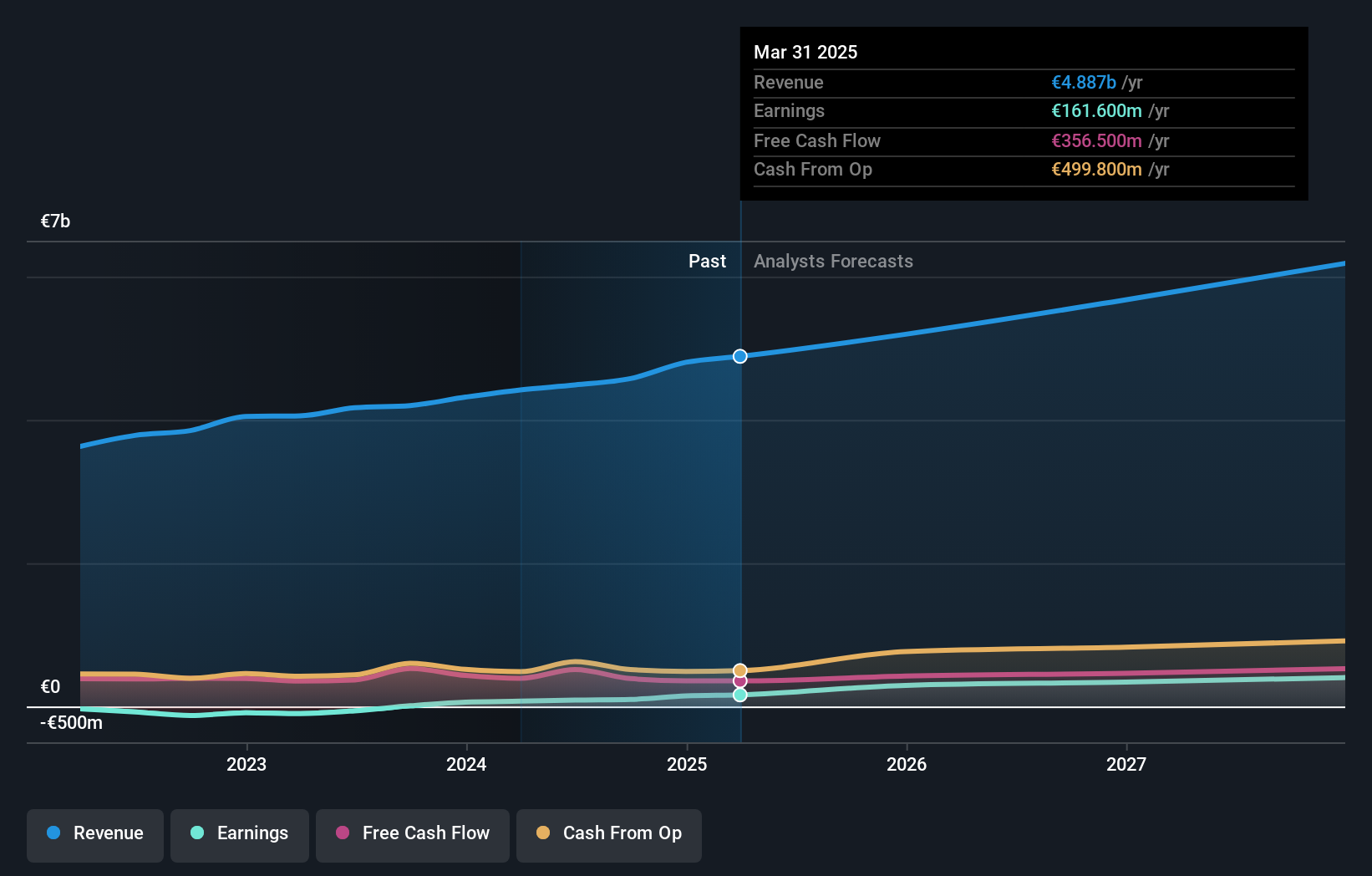

Banijay Group's narrative projects €6.5 billion revenue and €408.4 million earnings by 2028. This requires 9.6% yearly revenue growth and a €196.6 million earnings increase from €211.8 million today.

Uncover how Banijay Group's forecasts yield a €12.28 fair value, a 30% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community currently estimates Banijay’s fair value at €18.57, well above the latest market prices. Since content cycle volatility can drive surprise swings in results, looking at multiple Community viewpoints can help you see how different assumptions affect perceived value.

Explore another fair value estimate on Banijay Group - why the stock might be worth as much as 96% more than the current price!

Build Your Own Banijay Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banijay Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Banijay Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banijay Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banijay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BNJ

Banijay Group

Engages in the content production, distribution, online sports betting, and gaming businesses in the United States, Europe, and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives