- Netherlands

- /

- Chemicals

- /

- ENXTAM:OCI

Unpleasant Surprises Could Be In Store For OCI N.V.'s (AMS:OCI) Shares

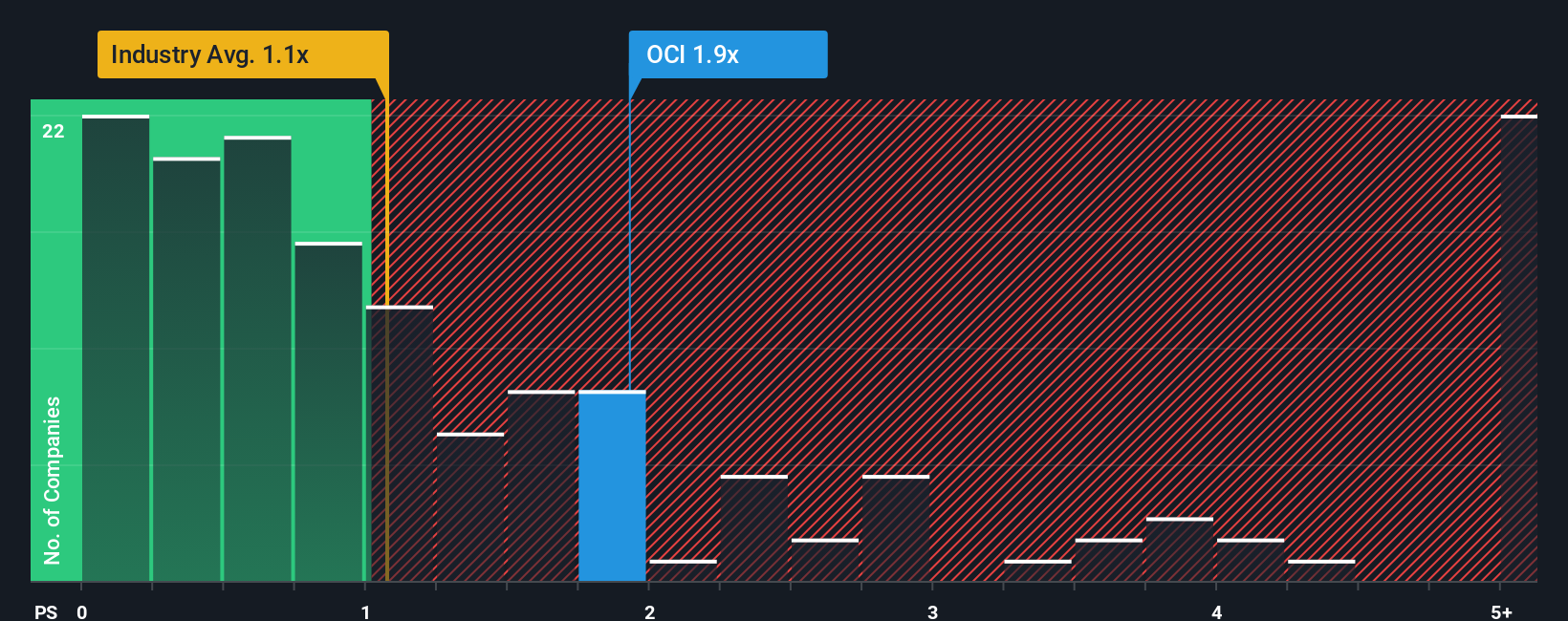

When you see that almost half of the companies in the Chemicals industry in the Netherlands have price-to-sales ratios (or "P/S") below 0.9x, OCI N.V. (AMS:OCI) looks to be giving off some sell signals with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for OCI

What Does OCI's Recent Performance Look Like?

Recent times haven't been great for OCI as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OCI.How Is OCI's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like OCI's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 85% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 3.5% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.8% per year, which is noticeably more attractive.

In light of this, it's alarming that OCI's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for OCI, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for OCI with six simple checks.

If these risks are making you reconsider your opinion on OCI, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:OCI

OCI

Produces and distributes hydrogen-based and natural gas-based products to agricultural, transportation, and industrial customers in Europe, the Americas, the Middle East, Africa, Asia, and Oceania.

Excellent balance sheet and fair value.

Market Insights

Community Narratives