- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

The Bull Case For Philips (ENXTAM:PHIA) Could Change Following AI-Driven, Radiation-Free Imaging Launches

Reviewed by Sasha Jovanovic

- In recent weeks, Royal Philips reiterated its 2026 earnings guidance and unveiled two major RSNA 2025 innovations: LumiGuide, an AI-enabled, radiation-free 3D navigation solution now commercially available across Europe and the US, and BlueSeal Horizon, a helium-free 3.0T MRI platform aimed at simplifying installation and reducing lifecycle risk.

- Together, these advances highlight Philips’ push to pair intelligent imaging with sustainability, potentially reshaping how hospitals approach radiation exposure, workflow efficiency, and long-term system ownership.

- We’ll now examine how Philips’ push into AI-enabled, radiation-free image-guided therapy could influence the company’s broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Koninklijke Philips' Investment Narrative?

For Philips to make sense in a portfolio, you need to believe the company can turn a recently restored profit base into something more durable, while rebuilding trust after a difficult few years. The reiterated 2026 guidance, combined with the LumiGuide rollout and the BlueSeal Horizon reveal, feeds into that story by showing management is still leaning into AI and radiation-free imaging as key differentiators rather than pulling back. In the near term, catalysts remain fairly practical: executing on modest comparable sales growth, improving cash conversion to better support the dividend, and managing down debt, as reflected in the recent bond tender offer. The RSNA announcements mostly reinforce, rather than redefine, that path, while the biggest risk is that high expectations embedded in a rich earnings multiple are not met if adoption or margins disappoint.

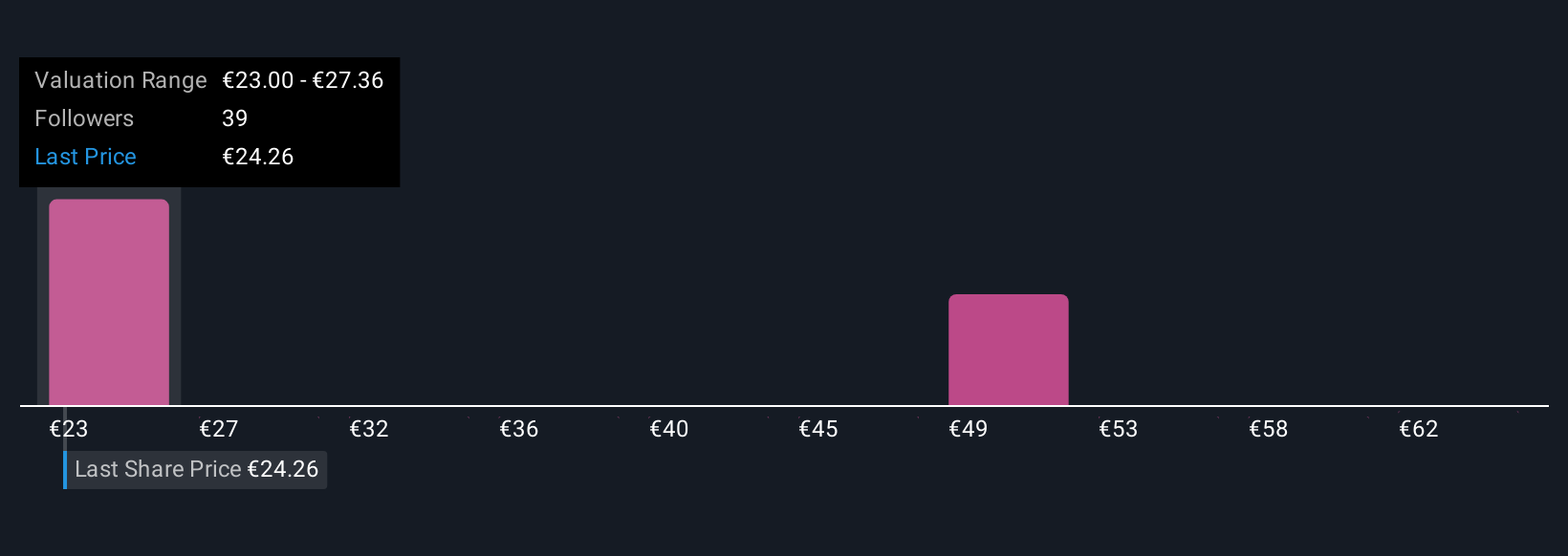

However, there is a key execution risk around turning innovation headlines into consistent earnings and cash flow. Despite retreating, Koninklijke Philips' shares might still be trading 38% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on Koninklijke Philips - why the stock might be worth over 2x more than the current price!

Build Your Own Koninklijke Philips Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Koninklijke Philips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Koninklijke Philips' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026