- Netherlands

- /

- Beverage

- /

- ENXTAM:CCEP

Coca-Cola Europacific Partners (ENXTAM:CCEP) Raises Dividend After Reaffirming 2025 Outlook—Has Confidence Peaked?

Reviewed by Sasha Jovanovic

- On November 5, 2025, Coca-Cola Europacific Partners reaffirmed its 2025 earnings guidance, posted year-to-date revenue of €15.68 billion, and declared an increased interim dividend, resulting in a full-year dividend payout ratio of approximately 50%.

- Management's confidence in delivering both revenue and profit growth, alongside an enhanced dividend, reflects ongoing operational strength and a continued focus on shareholder returns.

- We'll explore how the reaffirmed earnings outlook and higher dividend shape the current investment narrative for Coca-Cola Europacific Partners.

Find companies with promising cash flow potential yet trading below their fair value.

Coca-Cola Europacific Partners Investment Narrative Recap

Owning Coca-Cola Europacific Partners asks investors to believe in steady demand for branded beverages, disciplined cost control, and consistent shareholder returns, even as mature markets and changing consumer preferences bring challenges. The reaffirmed earnings guidance and increased dividend underscore management’s optimism, but the most important near-term catalyst remains execution in new growth markets, while a key risk continues to be regulatory and health-driven pressures. At this stage, the recent announcements support the current narrative, and the impact on those factors appears limited.

Of the recent developments, the decision to raise the interim dividend to €1.25 per share, bringing the full-year payout ratio to around 50%, stands out. This move is relevant given the company's emphasis on stable, attractive dividends as a core part of its value proposition, especially with revenue growth guidance reaffirmed. For investors watching short-term catalysts, such dividend resilience provides continuity but doesn't address underlying volume and margin pressure in mature markets.

But with all this positive news, investors should also be watching for signals that ongoing regulatory pressures might...

Read the full narrative on Coca-Cola Europacific Partners (it's free!)

Coca-Cola Europacific Partners' outlook anticipates €23.2 billion in revenue and €2.2 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 3.5% and an increase in earnings of €0.7 billion from the current €1.5 billion.

Uncover how Coca-Cola Europacific Partners' forecasts yield a €84.86 fair value, a 6% upside to its current price.

Exploring Other Perspectives

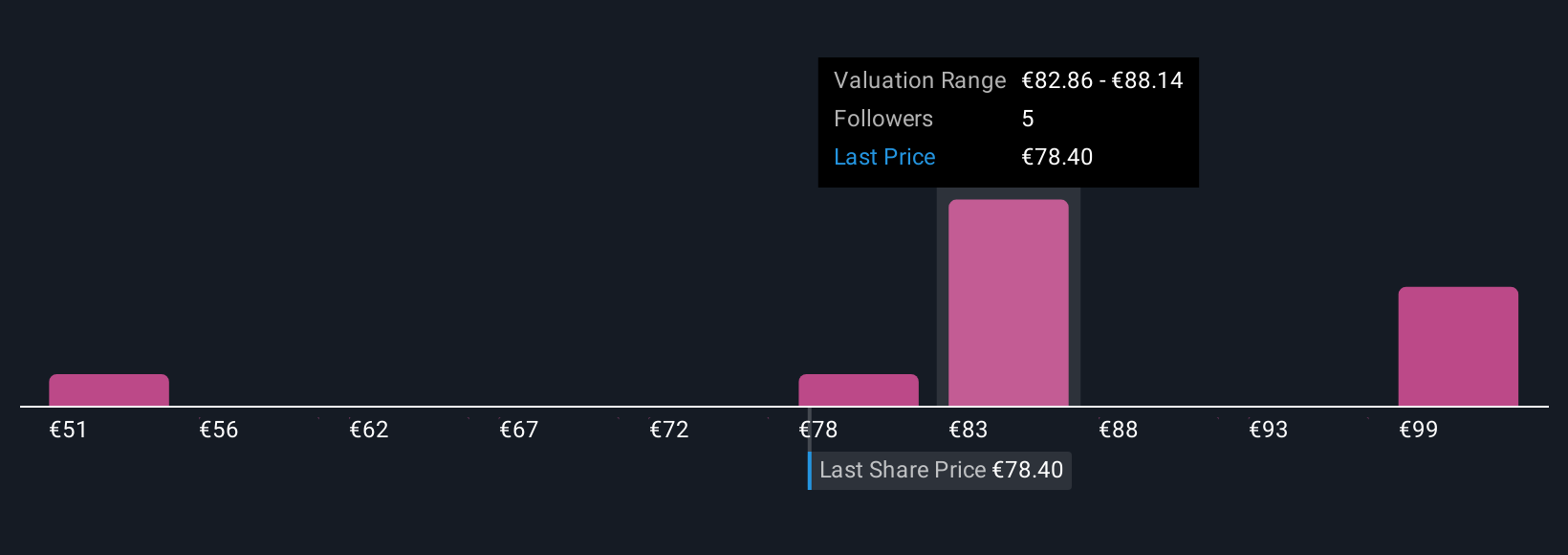

Four Simply Wall St Community members estimate fair value for Coca-Cola Europacific Partners from €51.14 to €101.13 per share. While many see higher growth potential, concerns about stricter regulation still shape differing expectations for long-term performance.

Explore 4 other fair value estimates on Coca-Cola Europacific Partners - why the stock might be worth as much as 26% more than the current price!

Build Your Own Coca-Cola Europacific Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Europacific Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coca-Cola Europacific Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Europacific Partners' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CCEP

Coca-Cola Europacific Partners

Produces, distributes, and sells a range of non-alcoholic ready to drink beverages.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives