- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:EXO

Exor (ENXTAM:EXO): Exploring Valuation After Joining the Euronext 100 Index

Reviewed by Simply Wall St

Exor (ENXTAM:EXO) has just joined the Euronext 100 Index, a key European equity benchmark. This inclusion puts the company in the spotlight and could attract broader investor attention, influencing trading dynamics in the coming weeks.

See our latest analysis for Exor.

Exor's inclusion in the Euronext 100 comes just after it settled a €600 million note issuance, reinforcing its profile among investors. While recent momentum has been mixed, with a 1-year total shareholder return of -19.7% and modest gains in the past month, the company's multi-year performance suggests it is navigating a period of changing market sentiment.

If big index moves spark your curiosity, now could be the perfect time to expand your watchlist and discover fast growing stocks with high insider ownership

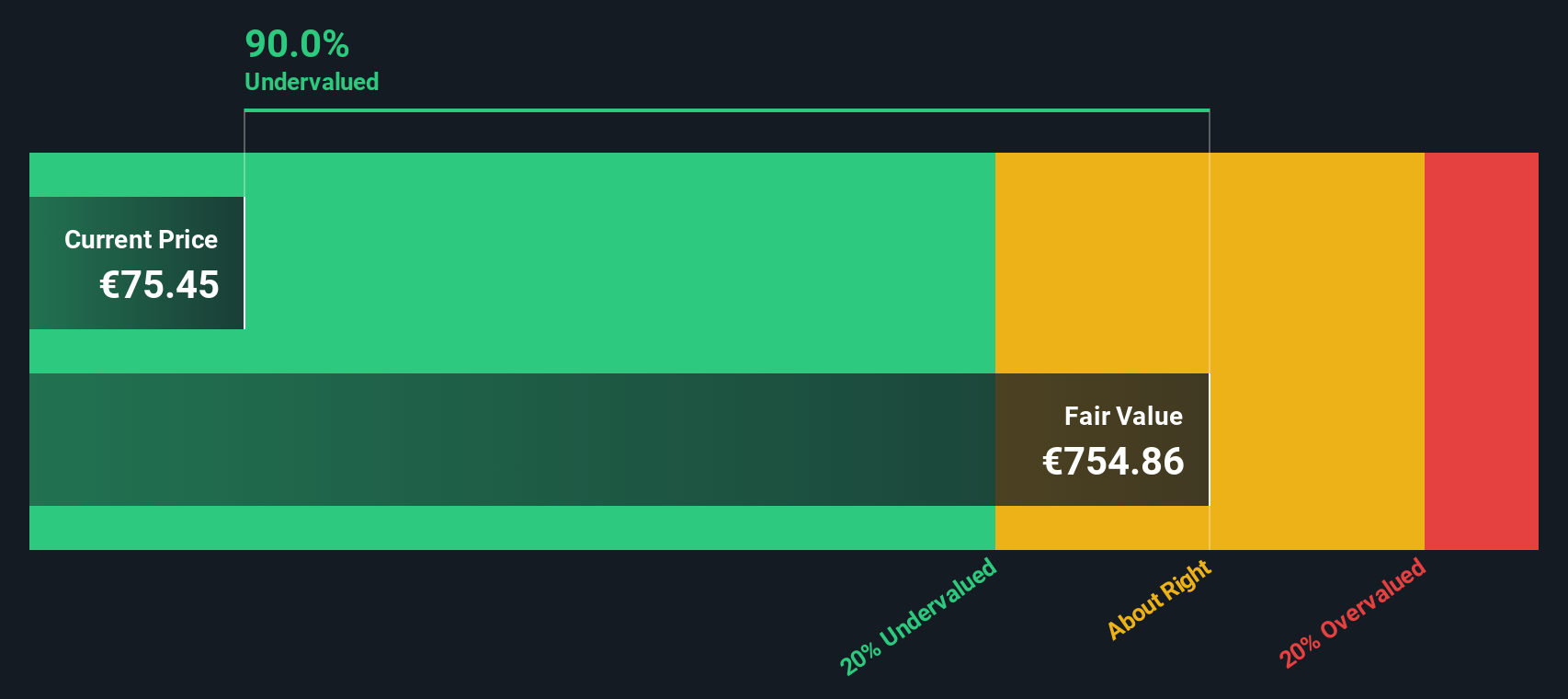

With Exor now in the Euronext 100 and trading at a notable discount to analyst targets, the question is whether investors are looking at an undervalued opportunity or if future growth is already reflected in the price.

Price-to-Book of 0.4x: Is it justified?

Exor's shares last closed at €75.7, reflecting a price-to-book (P/B) ratio of 0.4x. This suggests the stock is trading significantly below its book value, an unusual discount among peers in the European diversified financial sector.

The price-to-book ratio measures a company's market value relative to its net asset (book) value. For diversified financials, a low P/B can indicate that the market is undervaluing the company’s underlying assets or is skeptical about its future profitability.

At 0.4x, Exor’s price-to-book ratio is not only far below the European sector average of 1x but also well beneath the peer group average of 6x. This level of discount is hard to ignore and could signal a valuation floor that the market may eventually move toward, especially as the company approaches expected profitability.

Explore the SWS fair ratio for Exor

Result: Price-to-Book of 0.4x (UNDERVALUED)

However, lingering net losses and ongoing market skepticism about Exor’s future growth remain key risks that could limit any recovery in valuation.

Find out about the key risks to this Exor narrative.

Another View: What About Fair Value?

While the price-to-book ratio suggests Exor is deeply undervalued, there is another way to look at things. Our SWS DCF model estimates the company's fair value at €458.97, much higher than its current share price of €75.7. That is a massive gap, but could it be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Exor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Exor Narrative

If this perspective does not align with yours or you would rather dive into the details yourself, it only takes a few minutes to put together your own view and shape the story. So why not Do it your way

A great starting point for your Exor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment angles?

Act now to find your next winning pick. These hand-picked lists make sure you never miss a standout opportunity or emerging trend that others overlook.

- Spot stable cash flow opportunities by checking out these 875 undervalued stocks based on cash flows with solid financials and attractive valuations before the crowd catches on.

- Capture the next big breakthrough when you research companies advancing AI-powered solutions, starting with these 27 AI penny stocks.

- Grab income potential with strong yields by reviewing these 15 dividend stocks with yields > 3% offering steady returns even in unpredictable markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:EXO

Exor

Engages in the automotive, agriculture and construction, sports car, commercial vehicle, and powertrain businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives