- Netherlands

- /

- Aerospace & Defense

- /

- ENXTAM:THEON

Assessing Theon International (ENXTAM:THEON) Valuation After a Year of Powerful Share Price Gains

Reviewed by Simply Wall St

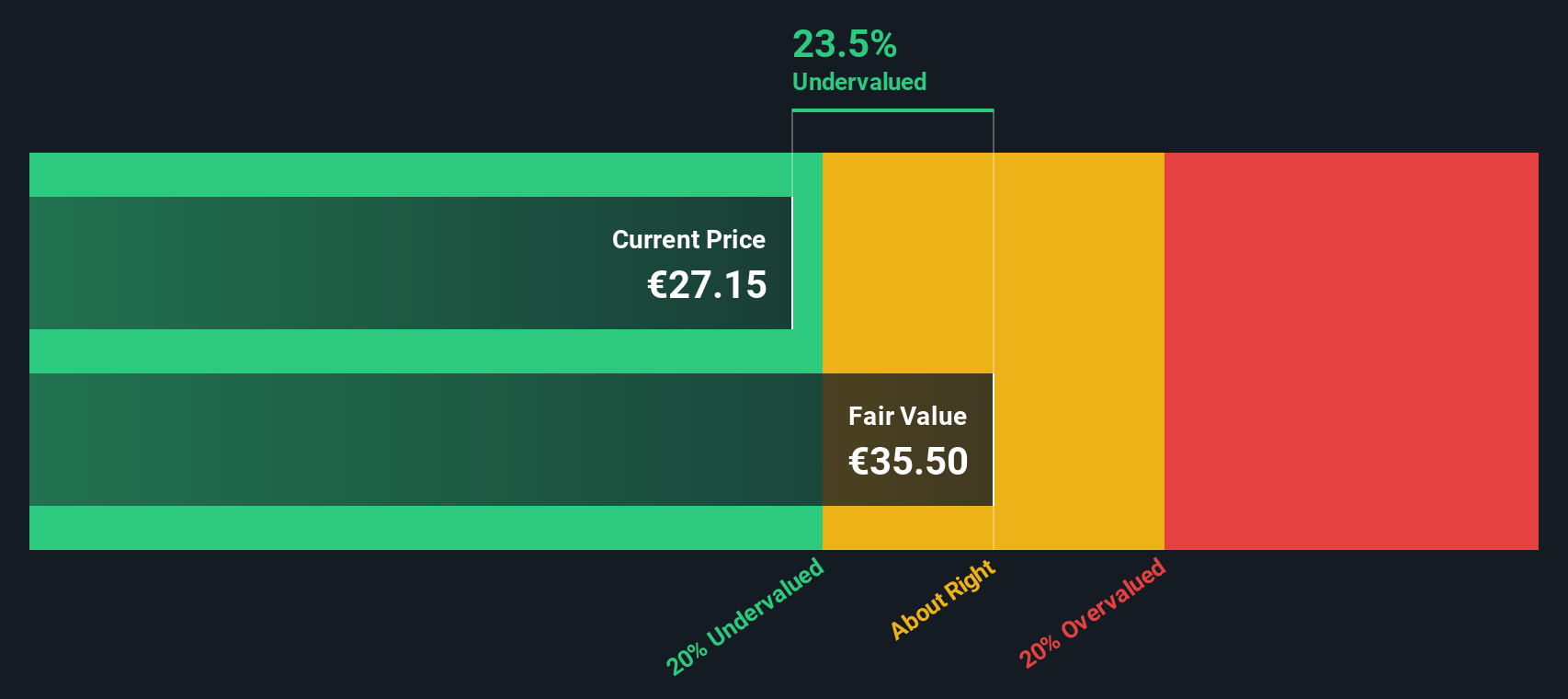

Theon International (ENXTAM:THEON) has quietly delivered a strong run this year, with the stock nearly doubling over the past 12 months, prompting investors to ask whether the current valuation still looks reasonable.

See our latest analysis for Theon International.

With the latest share price sitting at $32.0 and a powerful year to date share price return of 142.42 percent plus a one year total shareholder return of 197.36 percent, momentum clearly looks to be building as investors reassess Theon International’s growth prospects and risk profile.

If Theon’s surge has you thinking about what else could be gaining traction in defense and security hardware, it might be worth exploring aerospace and defense stocks as your next stop.

With earnings still growing solidly and the shares trading only modestly below analyst targets, the key question now is whether Theon International remains undervalued or if the market is already pricing in its future growth.

Price to Earnings of 30.8x: Is it justified?

On a price to earnings basis, Theon International’s last close at €32 implies a 30.8x multiple, putting the shares slightly on the expensive side versus peers and fair value estimates.

The price to earnings ratio compares the current share price to the company’s earnings per share. It is a core yardstick for valuing profitable defense and aerospace businesses, where earnings power and contract visibility matter.

At 30.8x, investors are paying a premium not only to the peer average of 17.1x and the European Aerospace and Defense industry at 30.7x, but also to the SWS estimated fair price to earnings ratio of 24.4x.

Result: Price to earnings of 30.8x (OVERVALUED)

Explore the SWS fair ratio for Theon International

However, risks remain, including potential delays or cancellations of defense contracts and any setback to its impressive double digit revenue and earnings growth trajectory.

Find out about the key risks to this Theon International narrative.

Another lens on value

While the current price to earnings ratio of 30.8x looks rich compared to peers and the fair ratio of 24.4x, our DCF model paints a calmer picture. It suggests Theon trades only about 1.6 percent below fair value, which appears more like fairly priced than clearly overvalued.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Theon International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Theon International Narrative

If you would rather challenge these conclusions and build your own evidence based view from the ground up, you can craft a personalized narrative in minutes with Do it your way.

A great starting point for your Theon International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you are not leaving other compelling opportunities on the table. The Simply Wall St screener surfaces ideas many investors overlook.

- Capitalize on mispriced quality by using these 902 undervalued stocks based on cash flows to spot businesses where cash flow strength is not yet fully reflected in the share price.

- Explore the next wave of innovation and growth by scanning these 27 AI penny stocks for companies involved with artificial intelligence.

- Review these 15 dividend stocks with yields > 3% for stocks that combine potential income with fundamentals that may support ongoing dividend payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Theon International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:THEON

Theon International

Develops and manufactures customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications in Europe and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026