- Netherlands

- /

- Construction

- /

- ENXTAM:FUR

What Fugro (ENXTAM:FUR)'s Removal from the Euronext 150 Index May Mean for Shareholders

Reviewed by Sasha Jovanovic

- On October 31, 2025, Fugro was removed from the Euronext 150 Index, coinciding with the release of its Q3 2025 sales and trading statement call.

- Index removals often impact trading volumes and stock demand, as index-tracking funds must adjust their portfolios to reflect constituent changes.

- Given the influence of index removals on institutional trading, we’ll explore how this development may shape Fugro’s broader investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fugro Investment Narrative Recap

To own Fugro stock, an investor needs to believe in the long-term opportunity tied to the global build-out of offshore wind and marine infrastructure, balanced against cyclical challenges. Fugro’s recent removal from the Euronext 150 Index may influence trading volumes, but does not materially alter the immediate company catalysts, namely, the pace of renewables backlog recovery, or change the biggest risk: continued weakness in the offshore wind market and uncertain project timing.

Of Fugro's recent announcements, the withdrawal of guidance for full-year 2025 stands out. This move followed difficult market conditions and signals that management does not expect to meet previous growth targets, reinforcing why project delays and regulatory shifts in renewables remain critical factors for the investment story.

Yet, in contrast, the real risk investors should focus on involves the visibility of future revenue from renewables, given...

Read the full narrative on Fugro (it's free!)

Fugro's narrative projects €2.3 billion revenue and €198.1 million earnings by 2028. This requires 2.8% yearly revenue growth and a €66.1 million earnings increase from the current €132.0 million.

Uncover how Fugro's forecasts yield a €10.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

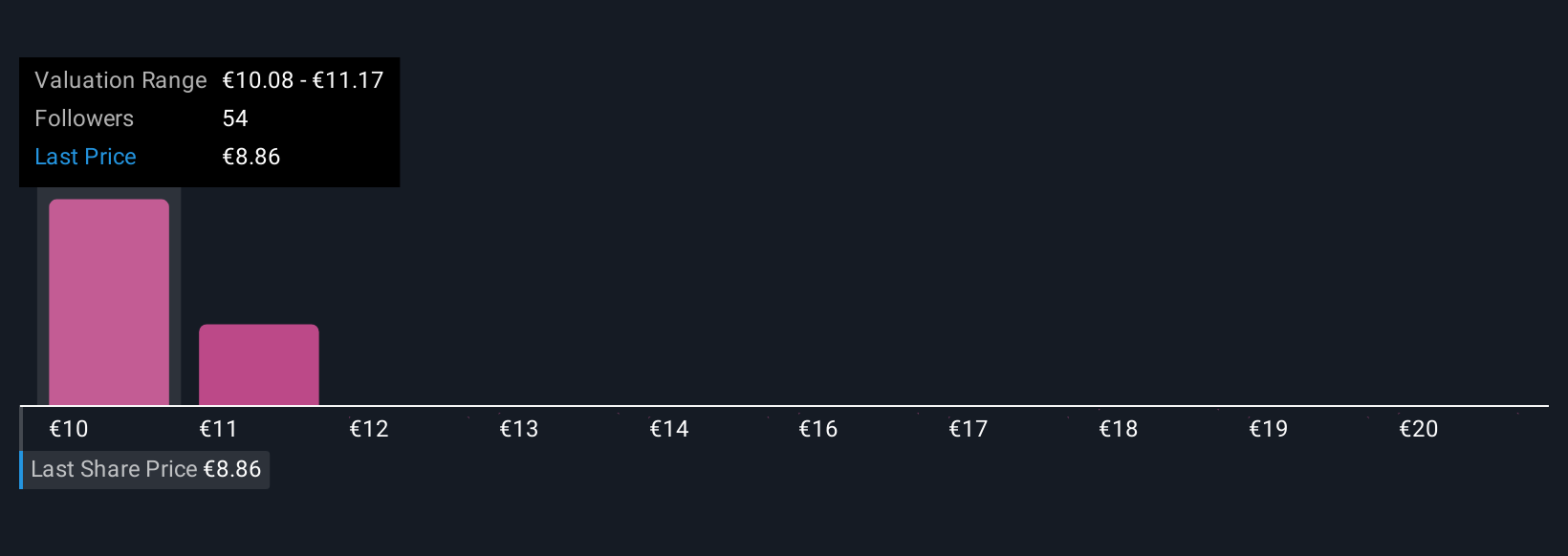

Retail investors in the Simply Wall St Community recently estimated Fugro’s fair value in a wide range from €10 to €21 (9 views). Some expect sharp recovery, but the company’s lowered guidance and project backlog volatility raise key questions for future earnings. Compare your view to these opinions for a broader picture.

Explore 9 other fair value estimates on Fugro - why the stock might be worth just €10.00!

Build Your Own Fugro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fugro research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fugro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fugro's overall financial health at a glance.

No Opportunity In Fugro?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FUR

Fugro

Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives