- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Exploring Undervalued Opportunities: 3 Stocks On Euronext Amsterdam With Intrinsic Discounts Ranging From 19% To 47%

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and ongoing trade tensions, the Euronext Amsterdam presents intriguing opportunities for investors seeking value. In this environment, identifying undervalued stocks that have potential for appreciation becomes particularly compelling.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

| Alfen (ENXTAM:ALFEN) | €16.695 | €24.81 | 32.7% |

| Ctac (ENXTAM:CTAC) | €3.08 | €3.83 | 19.7% |

| Arcadis (ENXTAM:ARCAD) | €63.25 | €119.30 | 47% |

| Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

| Envipco Holding (ENXTAM:ENVI) | €5.50 | €6.79 | 19% |

Let's dive into some prime choices out of from the screener.

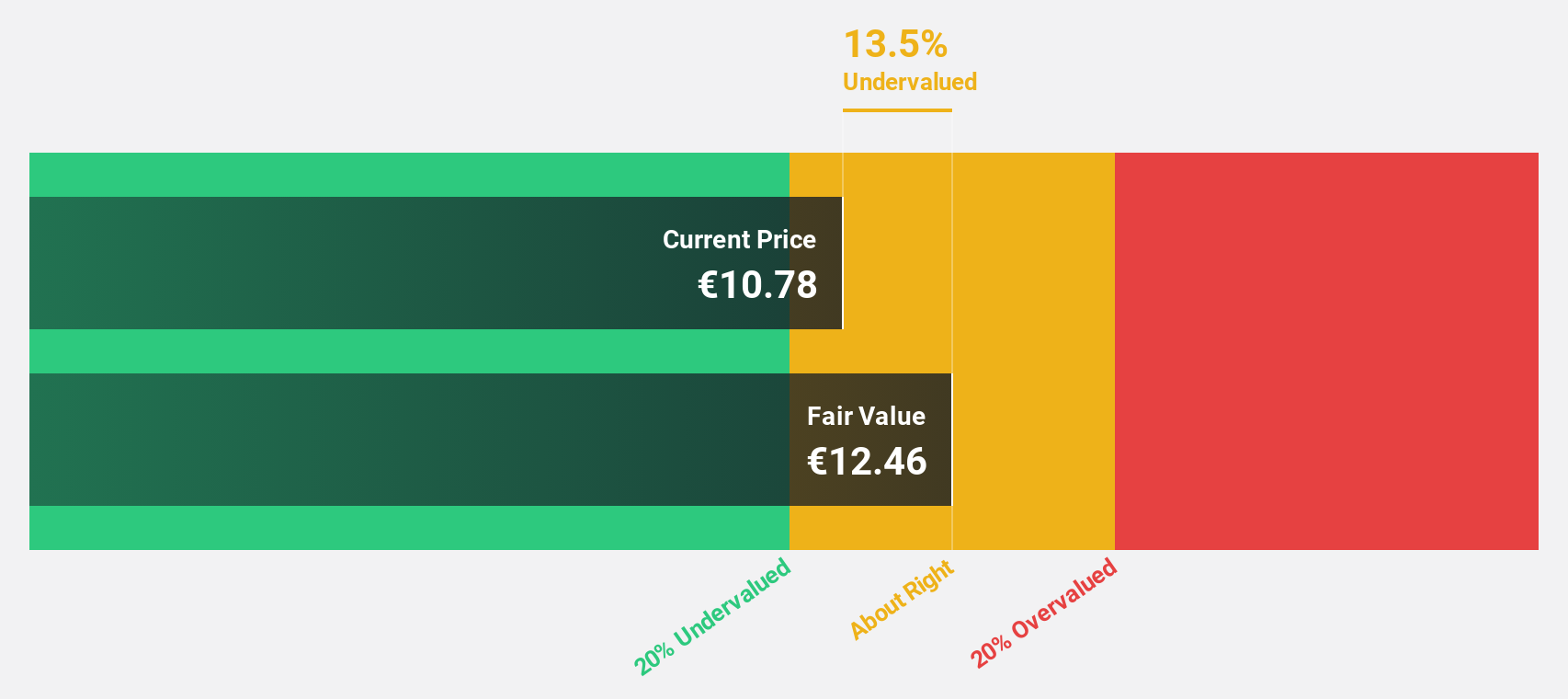

Alfen (ENXTAM:ALFEN)

Overview: Alfen N.V. specializes in smart grids, energy storage systems, and electric vehicle charging equipment, with a market capitalization of approximately €0.36 billion.

Operations: The company generates revenue through three primary segments: Smart Grid Solutions (€188.38 million), EV Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

Estimated Discount To Fair Value: 32.7%

Alfen, priced at €16.7, trades significantly below its estimated fair value of €24.81, marking a 32.7% undervaluation based on discounted cash flows. Despite recent lowered revenue guidance for 2024—from €590 million to between €485 million and €500 million—Alfen's earnings are expected to outpace the Dutch market with a forecasted growth rate of 20.1% annually. However, its profit margins have dipped from last year’s 12.1% to 5.9%. This blend of high forecasted earnings growth and current undervaluation positions Alfen intriguingly in the realm of cash flow-based investment opportunities in the Netherlands.

- The analysis detailed in our Alfen growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Alfen's balance sheet health report.

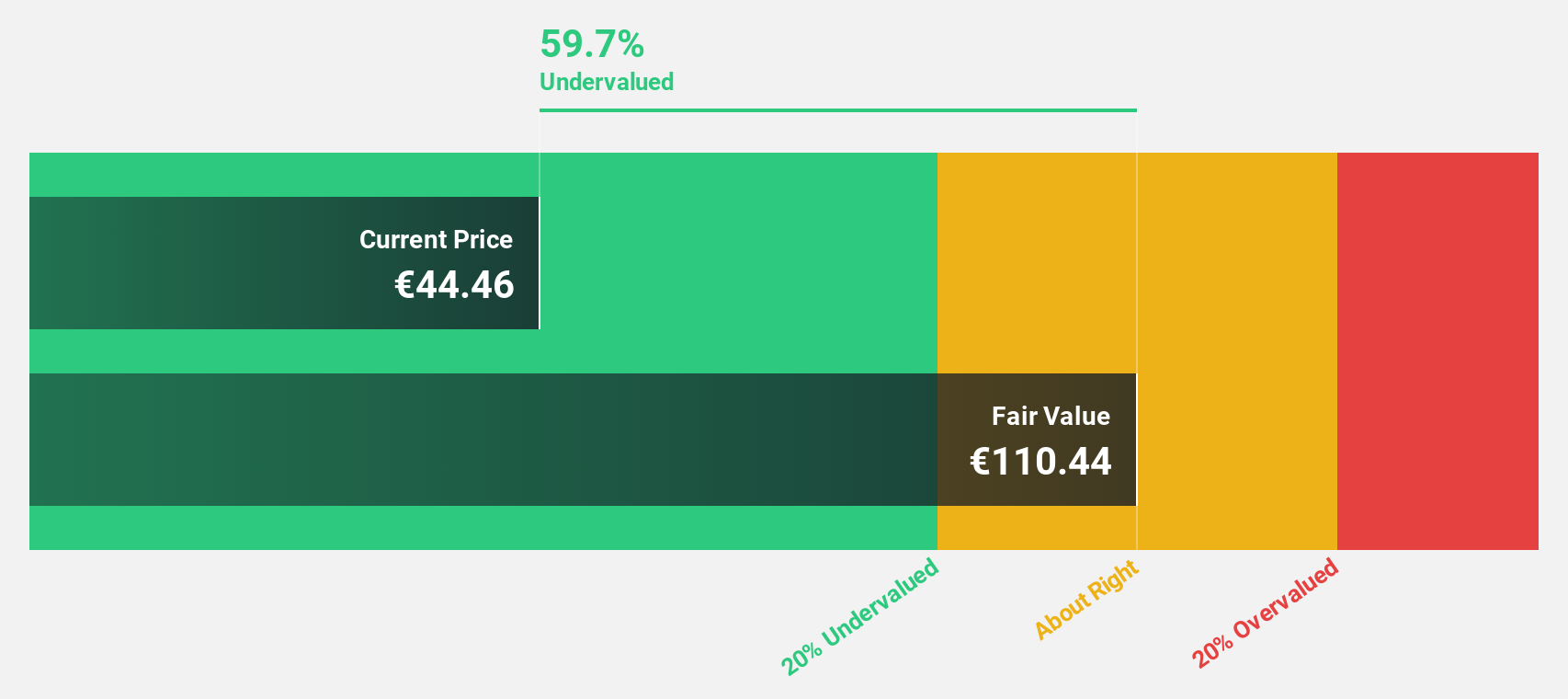

Arcadis (ENXTAM:ARCAD)

Overview: Arcadis NV is a global company providing design, engineering, and consultancy services for natural and built assets with a market capitalization of approximately €5.69 billion.

Operations: Arcadis generates revenue through various segments, with €1.94 billion from Places, €978.80 million from Mobility, €1.96 billion from Resilience, and €122.50 million from Intelligence.

Estimated Discount To Fair Value: 47%

Arcadis, trading at €63.25, is perceived as undervalued with a fair value estimate of €119.3 based on discounted cash flows, indicating substantial underpricing by 47%. Recent contracts like leading digital asset management for the City of Henderson underscore its strategic growth in intelligent systems. While earnings are expected to grow 20.48% annually, surpassing the Dutch market's 18.4%, revenue growth projections remain modest at 1.5% per year, trailing the broader market forecast of 10.1%.

- Our comprehensive growth report raises the possibility that Arcadis is poised for substantial financial growth.

- Get an in-depth perspective on Arcadis' balance sheet by reading our health report here.

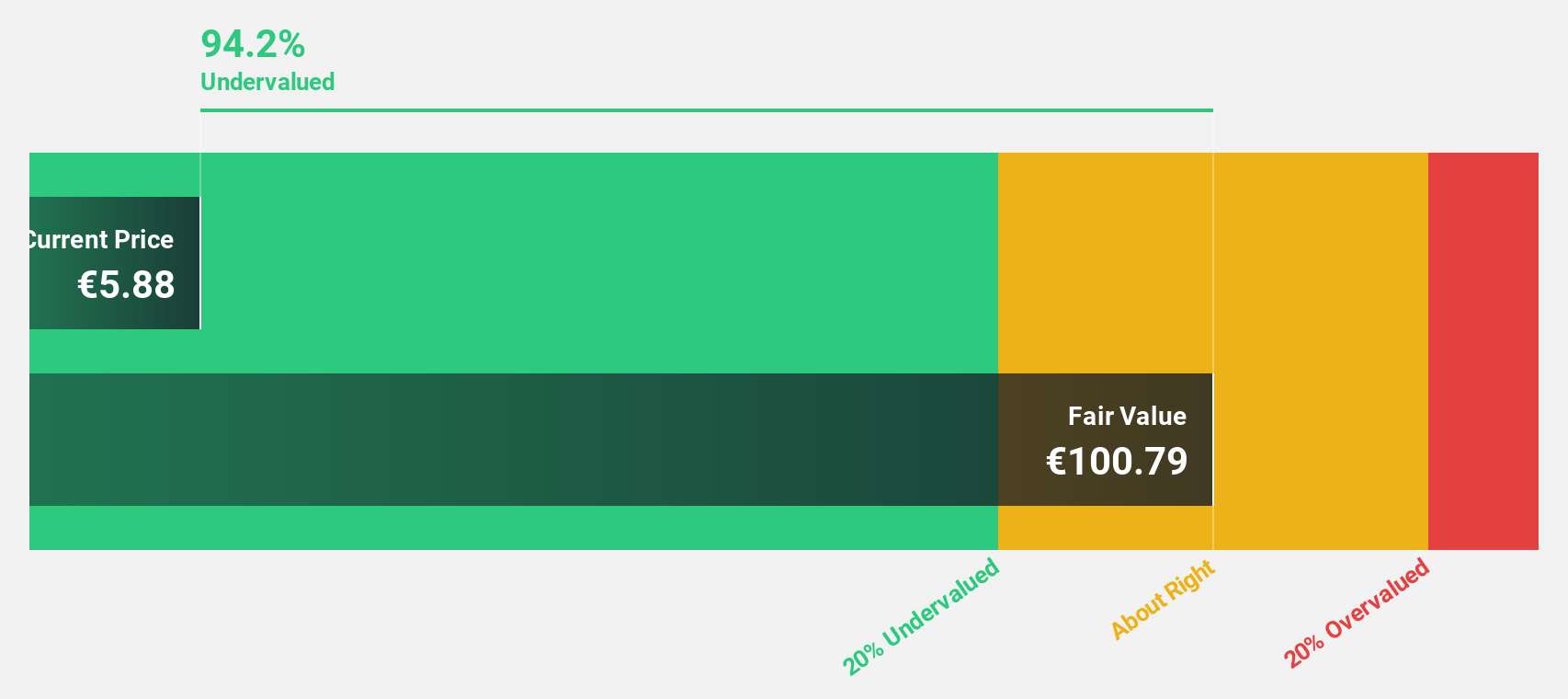

Envipco Holding (ENXTAM:ENVI)

Overview: Envipco Holding N.V. focuses on the design, development, manufacture, marketing, sale, leasing, and servicing of reverse vending machines for recycling used beverage containers in the Netherlands, North America, and other parts of Europe with a market capitalization of approximately €317.30 million.

Operations: The company generates revenue primarily from the design, development, marketing, and servicing of reverse vending machines in the Netherlands, North America, and other parts of Europe.

Estimated Discount To Fair Value: 19%

Envipco Holding N.V., with a current price of €5.5, is valued below its estimated fair value of €6.79, reflecting a potential undervaluation in the market. Recent financials show a significant turnaround with Q1 sales jumping to €27.44 million from €10.41 million year-over-year and shifting from a net loss to a profit of €0.147 million. Forecasted earnings growth is robust at 68.9% annually over the next three years, outpacing the Dutch market's 18.4%, coupled with expected revenue growth at 33.3% annually, significantly above the market average of 10.1%. However, share price volatility remains high and shareholder dilution has occurred over the past year.

- In light of our recent growth report, it seems possible that Envipco Holding's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Envipco Holding.

Seize The Opportunity

- Discover the full array of 6 Undervalued Euronext Amsterdam Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

High growth potential with adequate balance sheet.