- Netherlands

- /

- Machinery

- /

- ENXTAM:AALB

3 Dividend Stocks Offering Yields Up To 5.2%

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have been buoyant, with major indices like the S&P 500 reaching record highs amid optimism for economic growth and tax reforms. As investors navigate these dynamic market conditions, dividend stocks offering attractive yields can provide a steady income stream and potential stability amidst fluctuating market sentiments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.32% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.32% | ★★★★★☆ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

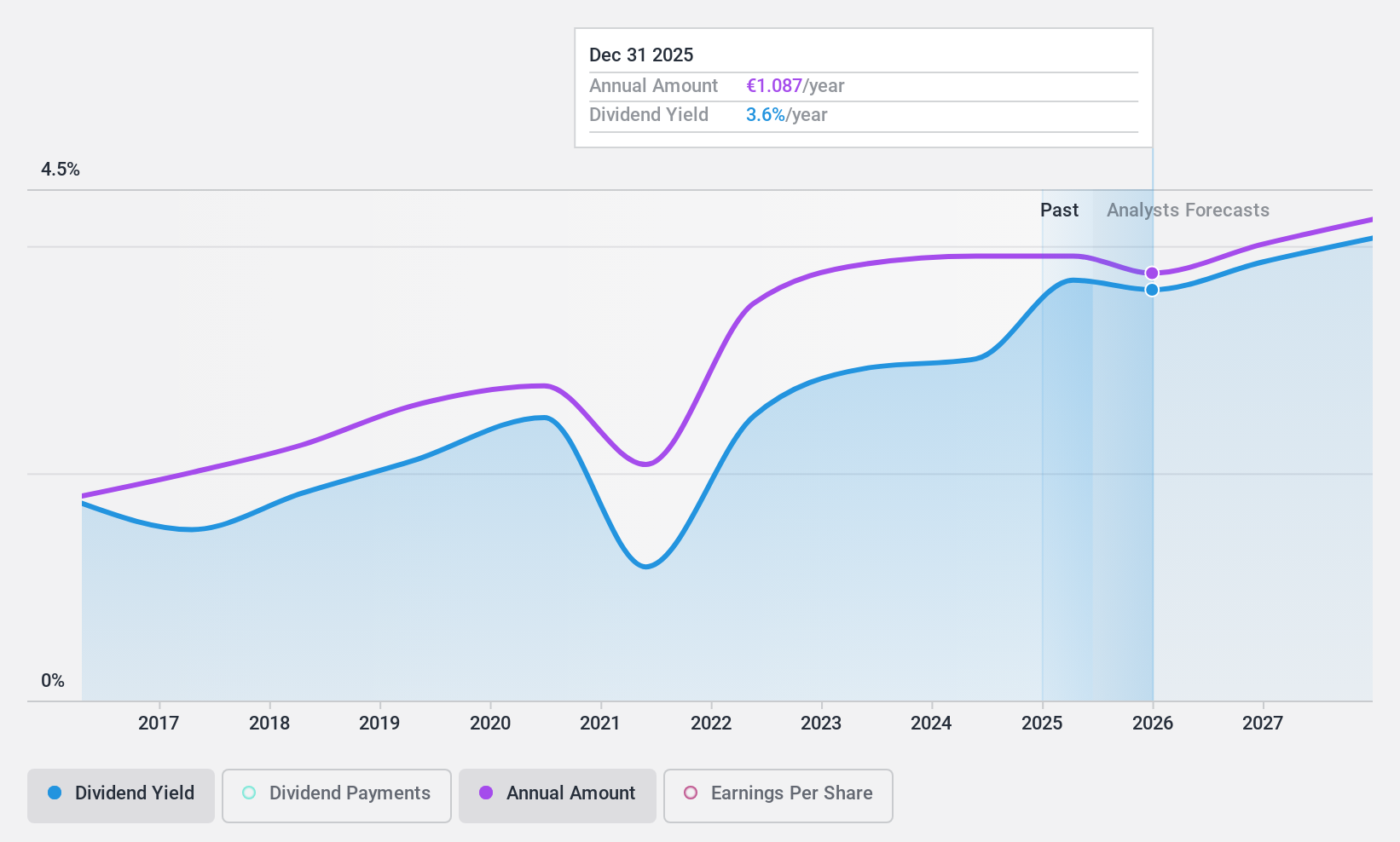

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the aerospace, automotive, building, and maritime sectors with a market cap of €3.96 billion.

Operations: Aalberts N.V. generates its revenue from two main segments: Building Technology, which accounts for €1.74 billion, and Industrial Technology, contributing €1.49 billion.

Dividend Yield: 3.2%

Aalberts' dividend sustainability is supported by a low payout ratio of 41%, indicating coverage by earnings, and a cash payout ratio of 60.4%, suggesting adequate cash flow support. However, its dividends have been volatile over the past decade, lacking reliability despite some growth. The recent executive change with CFO Arno Monincx's departure may impact future financial strategies but ensures continuity through his advisory role post-April 2025 for a smooth transition.

- Unlock comprehensive insights into our analysis of Aalberts stock in this dividend report.

- Our valuation report unveils the possibility Aalberts' shares may be trading at a discount.

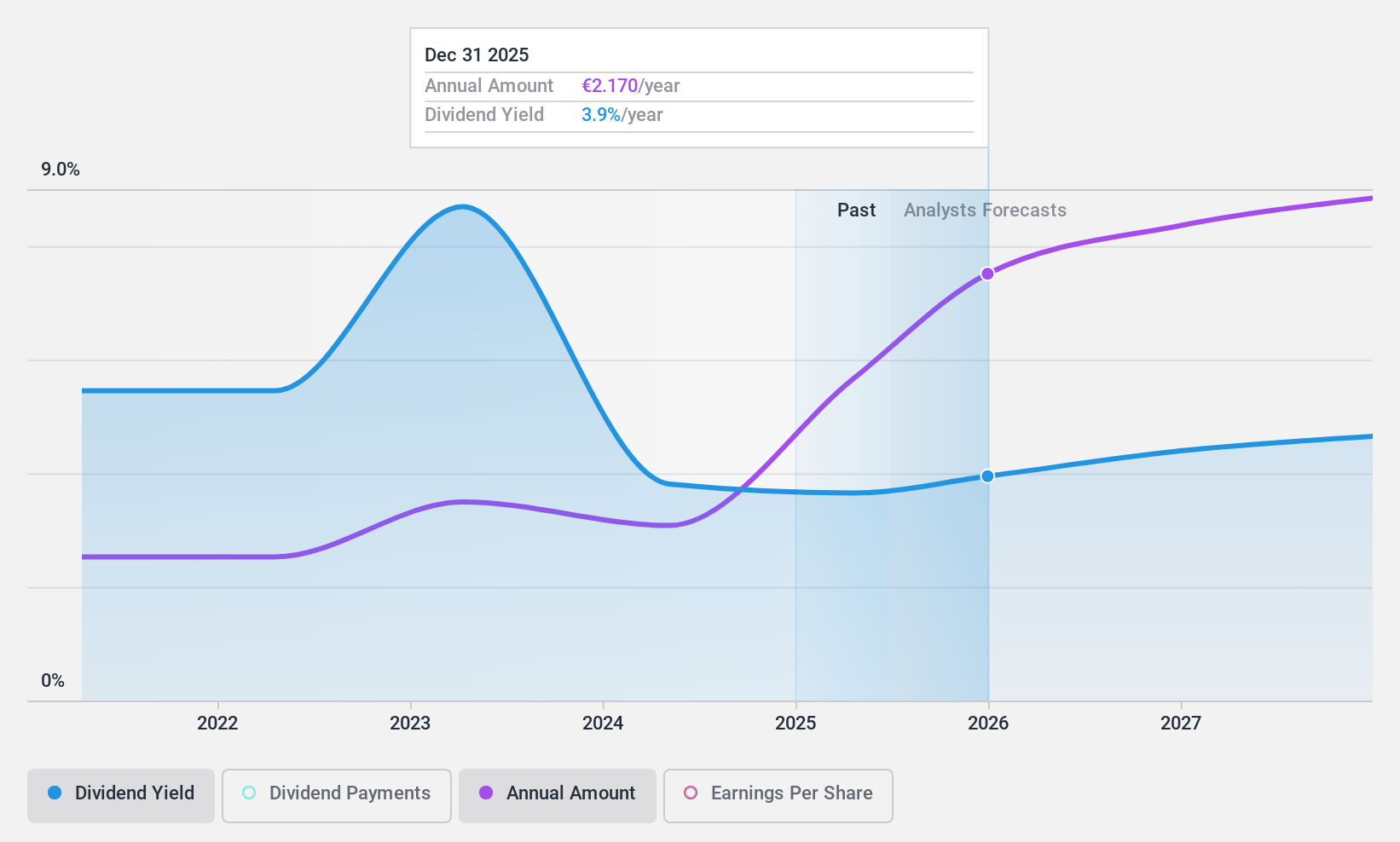

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €708.20 million.

Operations: Koninklijke Heijmans N.V. generates revenue from its Connecting segment, which amounts to €871.03 million.

Dividend Yield: 3.4%

Koninklijke Heijmans' dividend payments are covered by earnings with a low payout ratio of 30% and cash flows at 20.7%, indicating sustainability. However, its dividend track record is unstable, with volatility over the past decade despite growth. The current yield of 3.37% is below the top tier in the Dutch market. Recent earnings growth of 65.5% suggests potential for future stability, though past shareholder dilution remains a concern.

- Click to explore a detailed breakdown of our findings in Koninklijke Heijmans' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Koninklijke Heijmans shares in the market.

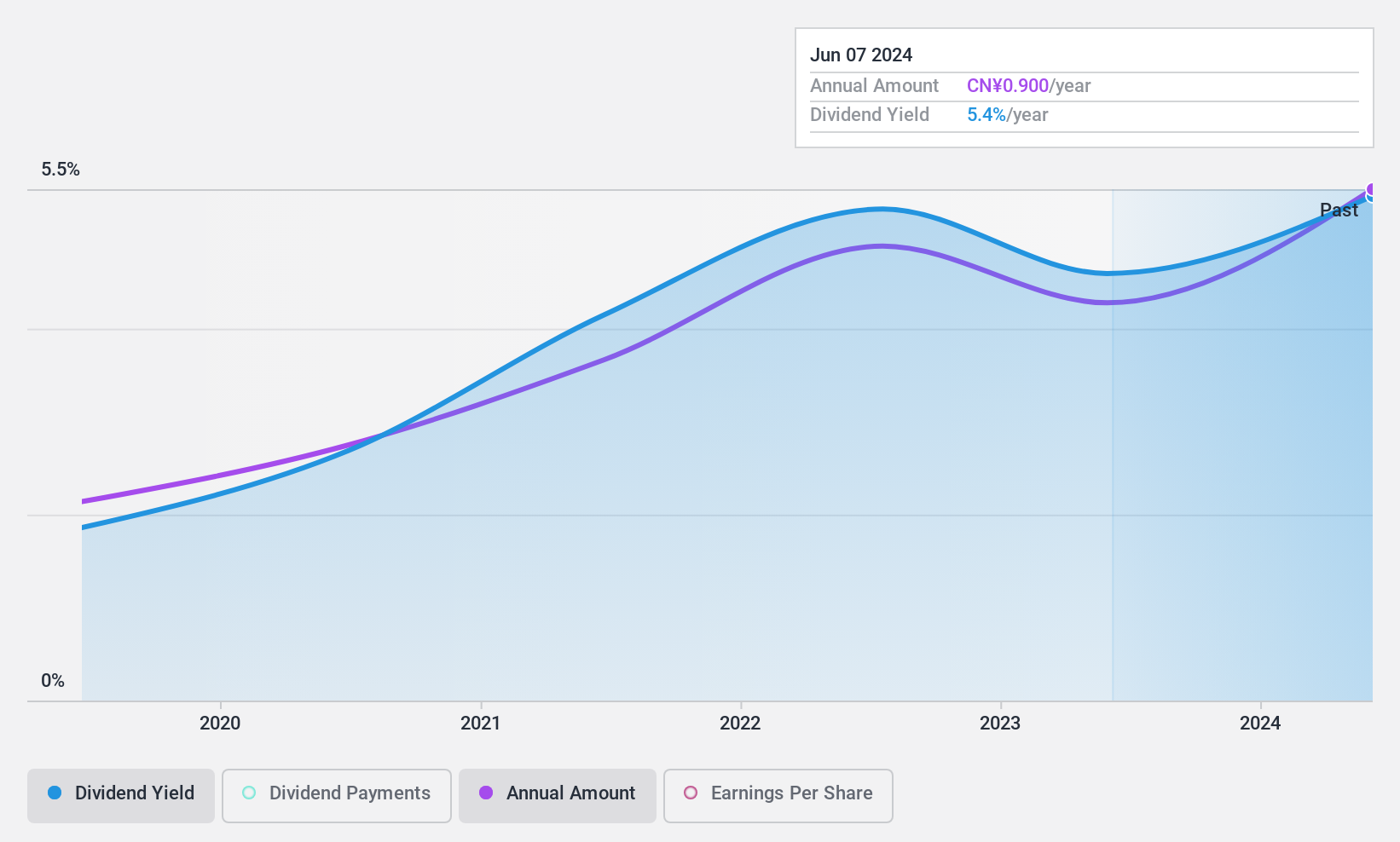

Xinjiang East Universe GasLtd (SHSE:603706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Co. Ltd. operates in the natural gas sector, focusing on sales, facility equipment installation, and heating services with a market cap of CN¥3.22 billion.

Operations: Xinjiang East Universe Gas Co. Ltd.'s revenue segments include natural gas sales, facility equipment installation, and heating services.

Dividend Yield: 5.3%

Xinjiang East Universe Gas Ltd. maintains a stable dividend with a payout ratio of 80.6% covered by earnings and 59.6% by cash flows, indicating sustainability despite its short five-year history of payments. Its dividend yield is competitive, ranking in the top 25% in China at 5.3%. Recent earnings growth supports this stability, with net income rising to CNY 121.69 million for the nine months ending September 2024, up from CNY 105.16 million previously.

- Click here to discover the nuances of Xinjiang East Universe GasLtd with our detailed analytical dividend report.

- Our valuation report here indicates Xinjiang East Universe GasLtd may be undervalued.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1936 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AALB

Aalberts

Offers mission-critical technologies for aerospace, automotive, building, and maritime sectors.

Flawless balance sheet, undervalued and pays a dividend.