- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

A Look at ABN AMRO (ENXTAM:ABN) Valuation Following Sweeping Strategic Overhaul and Major Job Cuts

Reviewed by Simply Wall St

ABN AMRO Bank (ENXTAM:ABN) has unveiled a sweeping plan to cut 5,200 jobs by 2028, streamline its operations, and accelerate investment in digital technology. The move also includes selling its personal loan arm, Alfam, to Rabobank.

See our latest analysis for ABN AMRO Bank.

Investor enthusiasm has rallied behind ABN AMRO Bank following the strategic shake-up, with the latest share price up at €29.34 after a remarkable 15.1% one-month share price return and a 96.2% surge year-to-date. This momentum has been building for some time, as long-term investors have seen an impressive 113.2% total shareholder return over the past year and 403.1% across five years. This makes the stock one of the notable standouts in the European banking sector.

If this kind of transformation has you looking for the next opportunity, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

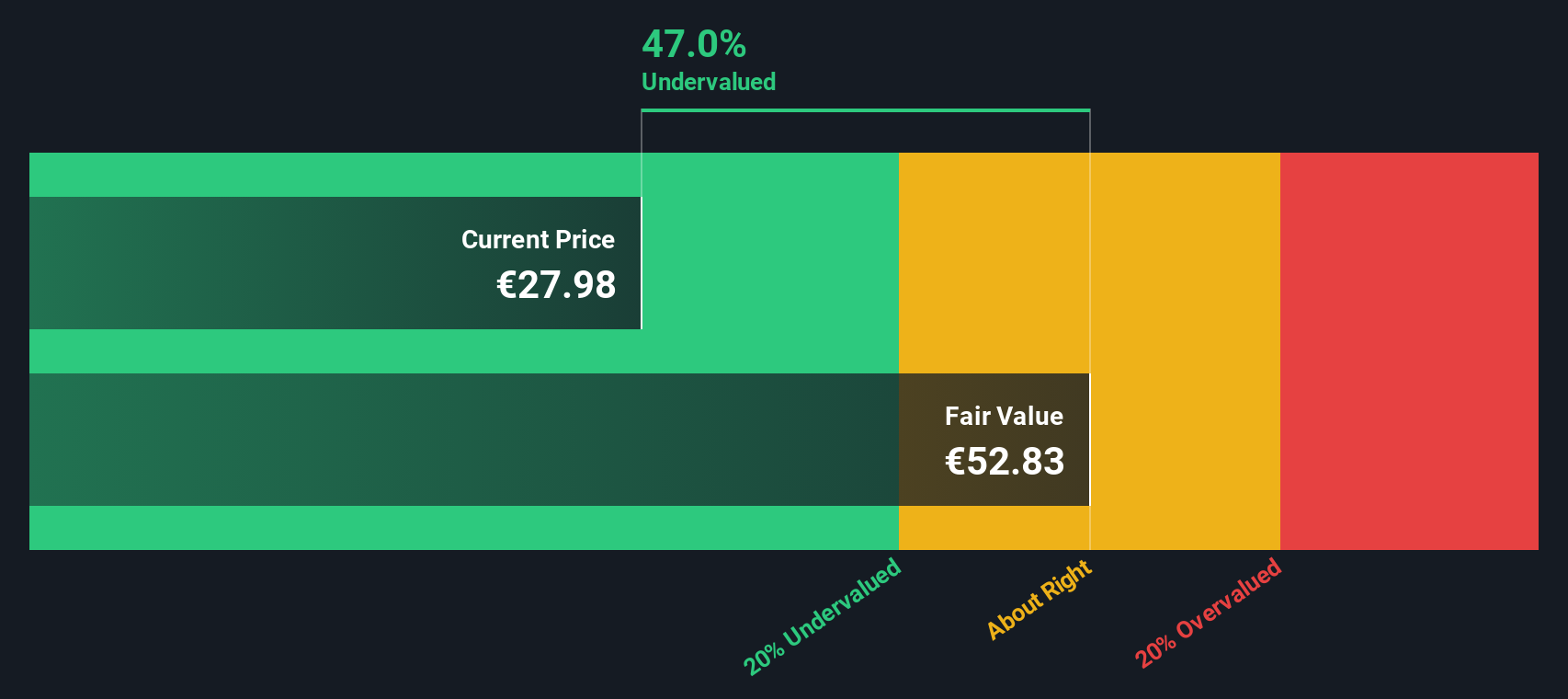

With such explosive gains already logged, the crucial question is whether ABN AMRO remains undervalued after its rally or if the market has now fully priced in the bank’s future transformation and growth potential.

Most Popular Narrative: 4.2% Overvalued

Compared to ABN AMRO Bank’s previous close at €29.34, the most widely followed narrative puts fair value at €28.15, indicating the stock now trades at a premium. The drivers behind this view center around elevated profit margins as well as a bullish revenue growth outlook.

Analysts highlight the bank’s ability to achieve better revenue momentum and point to its attractive valuation. They note that ABN AMRO trades below tangible book value compared to European peers.

What is pushing this valuation higher? The calculation relies on a sharp acceleration in core earnings and a profit margin profile that few established banks can match. Think you know which numbers are making this story stand out from the rest? Discover which assumptions make this valuation so surprising.

Result: Fair Value of €28.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and potential setbacks in digital transformation could quickly undermine the optimistic outlook that analysts have for ABN AMRO's future performance.

Find out about the key risks to this ABN AMRO Bank narrative.

Another View: Deep Value or Value Trap?

Looking at the SWS DCF model, a very different story emerges. This approach estimates ABN AMRO is trading at a steep 45.5% discount to its fair value of €53.83. This estimate is far more optimistic than the multiples-based view. Does this signal a rare bargain, or is there a reason for the gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ABN AMRO Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ABN AMRO Bank Narrative

Not convinced by the consensus or eager to dig into the details yourself? Dive into the numbers and craft your own view in just a few minutes. Do it your way

A great starting point for your ABN AMRO Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Smart Investment Move?

Confident decisions start with great ideas. Join other proactive investors and uncover unique stocks on the rise before the crowd catches on. You won’t want to miss opportunities hiding in plain sight.

- Capture strong passive income potential when you check out these 15 dividend stocks with yields > 3% featuring companies with reliable, above-average yields.

- Tap into the next wave of innovation and growth by reviewing these 25 AI penny stocks driving advancements in artificial intelligence and automation.

- Spot undervalued plays before markets catch up by browsing these 928 undervalued stocks based on cash flows and see which firms are trading below their true worth today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success