- Malaysia

- /

- Semiconductors

- /

- KLSE:VITROX

ViTrox Corporation Berhad's (KLSE:VITROX) one-year total shareholder returns outpace the underlying earnings growth

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the ViTrox Corporation Berhad (KLSE:VITROX) share price is up 25% in the last 1 year, clearly besting the market decline of around 1.5% (not including dividends). That's a solid performance by our standards! However, the stock hasn't done so well in the longer term, with the stock only up 8.8% in three years.

Although ViTrox Corporation Berhad has shed RM322m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

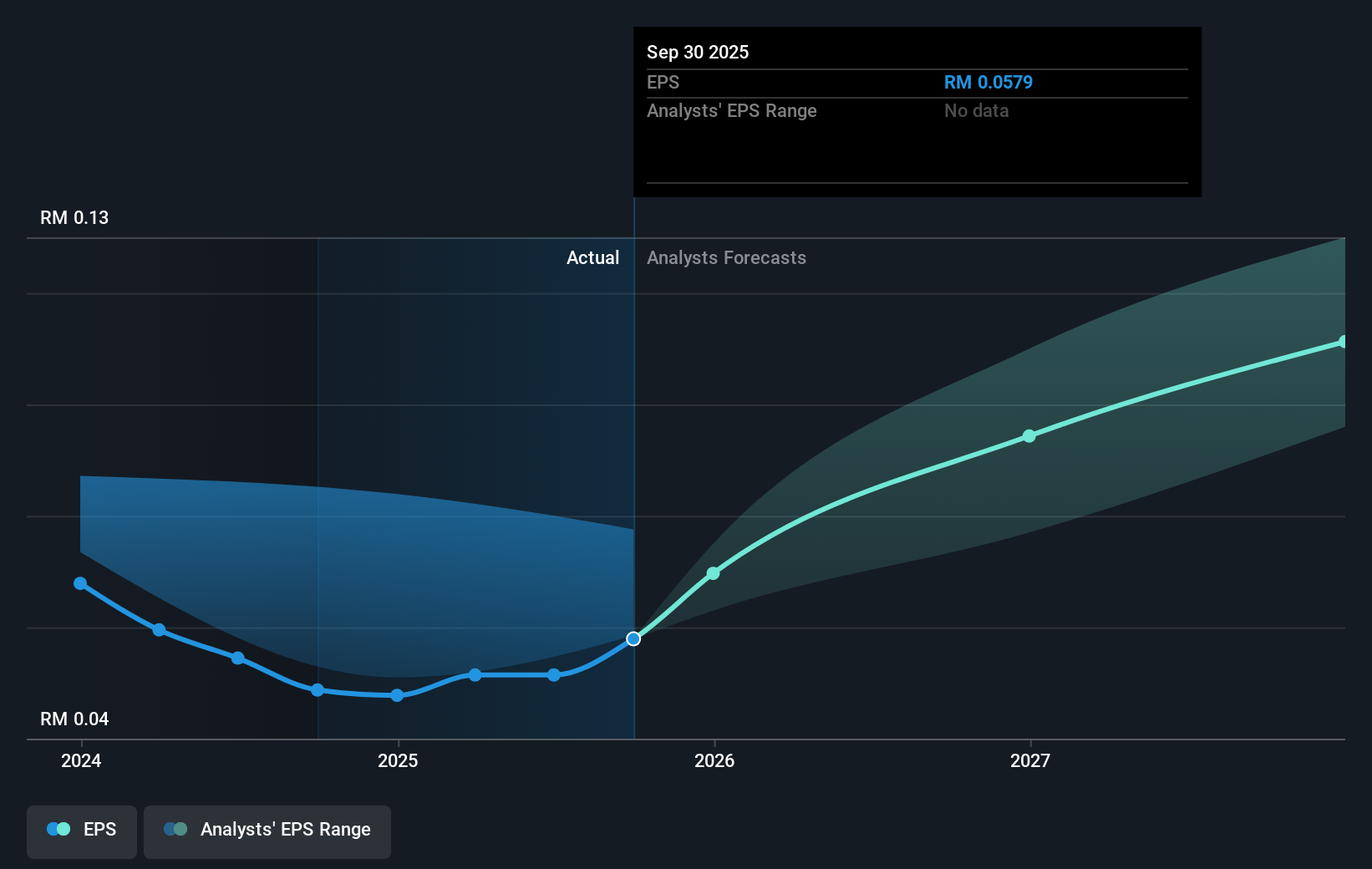

ViTrox Corporation Berhad was able to grow EPS by 19% in the last twelve months. The share price gain of 25% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago. The fairly generous P/E ratio of 71.70 also points to this optimism.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of ViTrox Corporation Berhad's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that ViTrox Corporation Berhad shareholders have received a total shareholder return of 25% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 2%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is ViTrox Corporation Berhad cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VITROX

ViTrox Corporation Berhad

An investment holding company, designs, manufactures, and sells automated vision inspection equipment and system-on-chip embedded electronics devices for the semiconductor and electronics packaging industries worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026