- Malaysia

- /

- Real Estate

- /

- KLSE:PARAMON

Interested In Paramount Corporation Berhad's (KLSE:PARAMON) Upcoming RM00.03 Dividend? You Have Four Days Left

Readers hoping to buy Paramount Corporation Berhad (KLSE:PARAMON) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Paramount Corporation Berhad investors that purchase the stock on or after the 10th of September will not receive the dividend, which will be paid on the 26th of September.

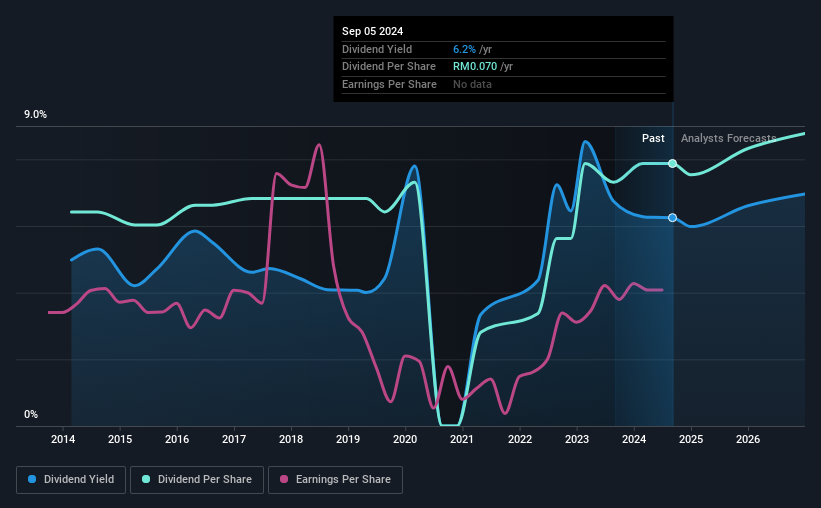

The company's next dividend payment will be RM00.03 per share. Last year, in total, the company distributed RM0.07 to shareholders. Calculating the last year's worth of payments shows that Paramount Corporation Berhad has a trailing yield of 6.3% on the current share price of RM01.12. If you buy this business for its dividend, you should have an idea of whether Paramount Corporation Berhad's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Paramount Corporation Berhad

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Paramount Corporation Berhad is paying out an acceptable 55% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. What's good is that dividends were well covered by free cash flow, with the company paying out 22% of its cash flow last year.

It's positive to see that Paramount Corporation Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're encouraged by the steady growth at Paramount Corporation Berhad, with earnings per share up 4.6% on average over the last five years. Earnings per share growth has been slim, and the company is already paying out a majority of its earnings. While there is some room to both increase the payout ratio and reinvest in the business, generally the higher a payout ratio goes, the lower a company's prospects for future growth.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Paramount Corporation Berhad has increased its dividend at approximately 2.1% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has Paramount Corporation Berhad got what it takes to maintain its dividend payments? While earnings per share growth has been modest, Paramount Corporation Berhad's dividend payouts are around an average level; without a sharp change in earnings we feel that the dividend is likely somewhat sustainable. Pleasingly the company paid out a conservatively low percentage of its free cash flow. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

On that note, you'll want to research what risks Paramount Corporation Berhad is facing. In terms of investment risks, we've identified 2 warning signs with Paramount Corporation Berhad and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PARAMON

Paramount Corporation Berhad

An investment holding company, engages in the property development business in Malaysia.

Undervalued with excellent balance sheet and pays a dividend.