- Malaysia

- /

- Interactive Media and Services

- /

- KLSE:CATCHA

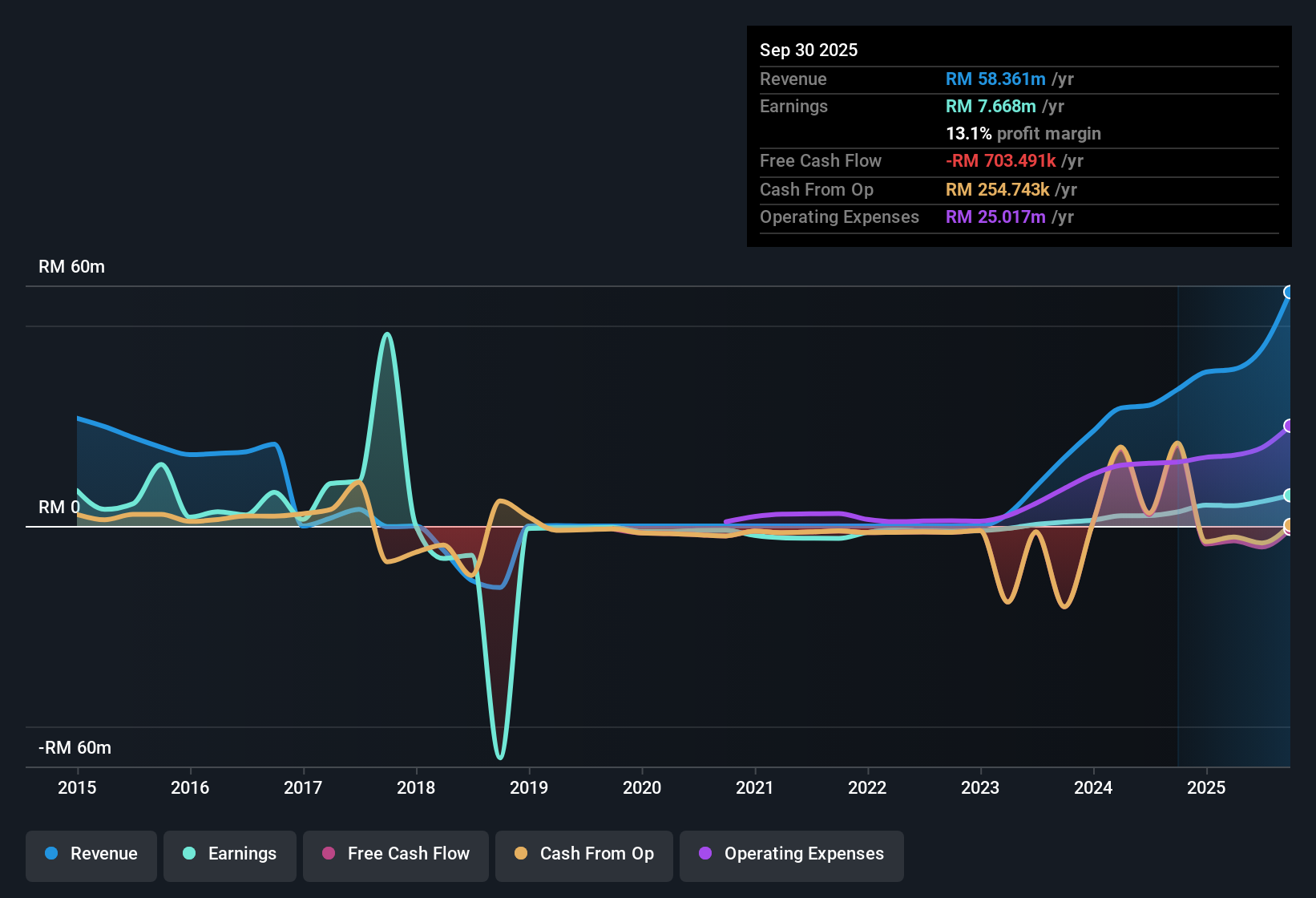

We Think That There Are Issues Underlying Catcha Digital Berhad's (KLSE:CATCHA) Earnings

Despite announcing strong earnings, Catcha Digital Berhad's (KLSE:CATCHA) stock was sluggish. We did some digging and found some worrying underlying problems.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Catcha Digital Berhad issued 28% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Catcha Digital Berhad's historical EPS growth by clicking on this link.

A Look At The Impact Of Catcha Digital Berhad's Dilution On Its Earnings Per Share (EPS)

Catcha Digital Berhad was losing money three years ago. On the bright side, in the last twelve months it grew profit by 119%. But EPS was less impressive, up only 19% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Catcha Digital Berhad can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Catcha Digital Berhad.

Our Take On Catcha Digital Berhad's Profit Performance

Each Catcha Digital Berhad share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Catcha Digital Berhad's statutory profits are better than its underlying earnings power. The good news is that, its earnings per share increased by 19% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 3 warning signs for Catcha Digital Berhad you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Catcha Digital Berhad's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CATCHA

Catcha Digital Berhad

An investment holding company, provides digital media advertising services for brand owners and advertising agencies in Malaysia.

Solid track record with low risk.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026