- Malaysia

- /

- Medical Equipment

- /

- KLSE:SUPERMX

Supermax Corporation Berhad (KLSE:SUPERMX) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Supermax Corporation Berhad (KLSE:SUPERMX) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

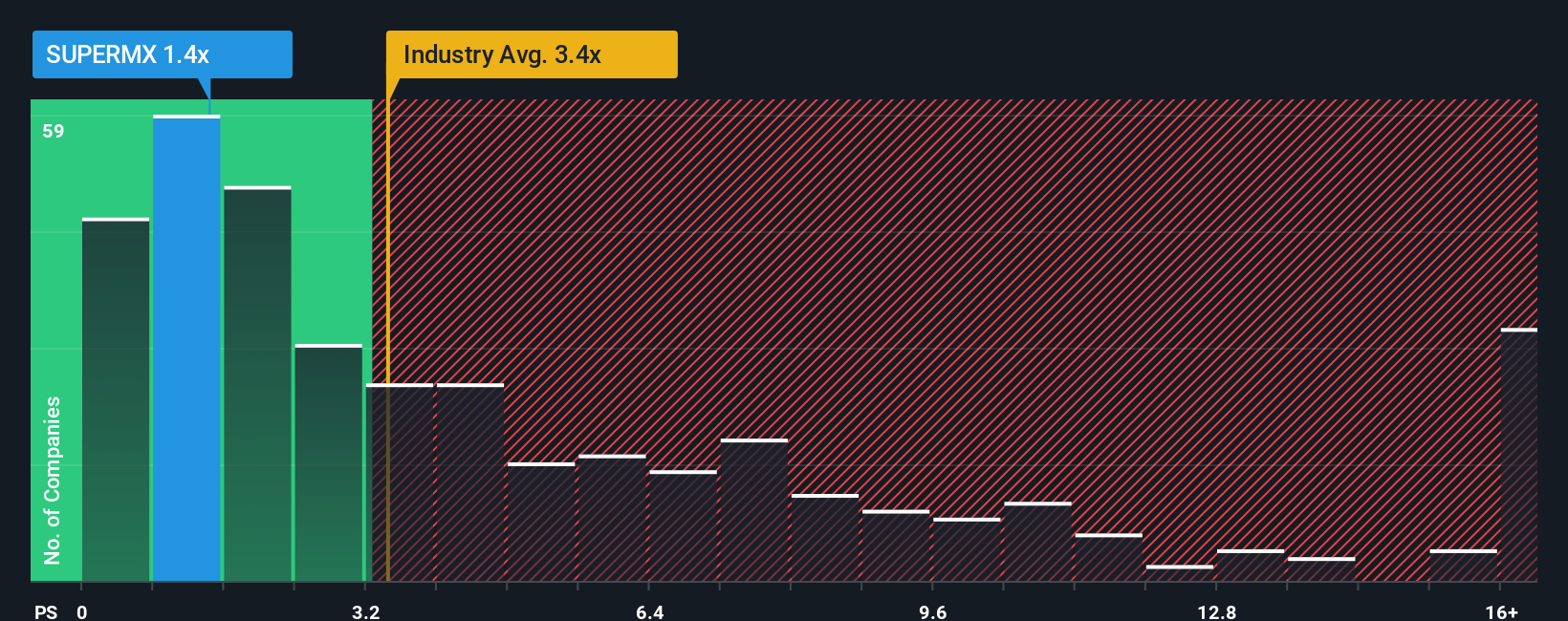

In spite of the heavy fall in price, it's still not a stretch to say that Supermax Corporation Berhad's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in Malaysia, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Supermax Corporation Berhad

How Has Supermax Corporation Berhad Performed Recently?

Supermax Corporation Berhad could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Supermax Corporation Berhad will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Supermax Corporation Berhad's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.8% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 49% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 23% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 21%, which is noticeably less attractive.

With this information, we find it interesting that Supermax Corporation Berhad is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Supermax Corporation Berhad looks to be in line with the rest of the Medical Equipment industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Supermax Corporation Berhad's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Supermax Corporation Berhad with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Supermax Corporation Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SUPERMX

Supermax Corporation Berhad

An investment holding company, manufactures, distributes, and markets medical gloves and contact lenses in Europe, North America, Central America, South America, Asia, Oceania, and Africa.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026