Three Days Left Until Innoprise Plantations Berhad (KLSE:INNO) Trades Ex-Dividend

Readers hoping to buy Innoprise Plantations Berhad (KLSE:INNO) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Innoprise Plantations Berhad's shares on or after the 11th of December, you won't be eligible to receive the dividend, when it is paid on the 23rd of December.

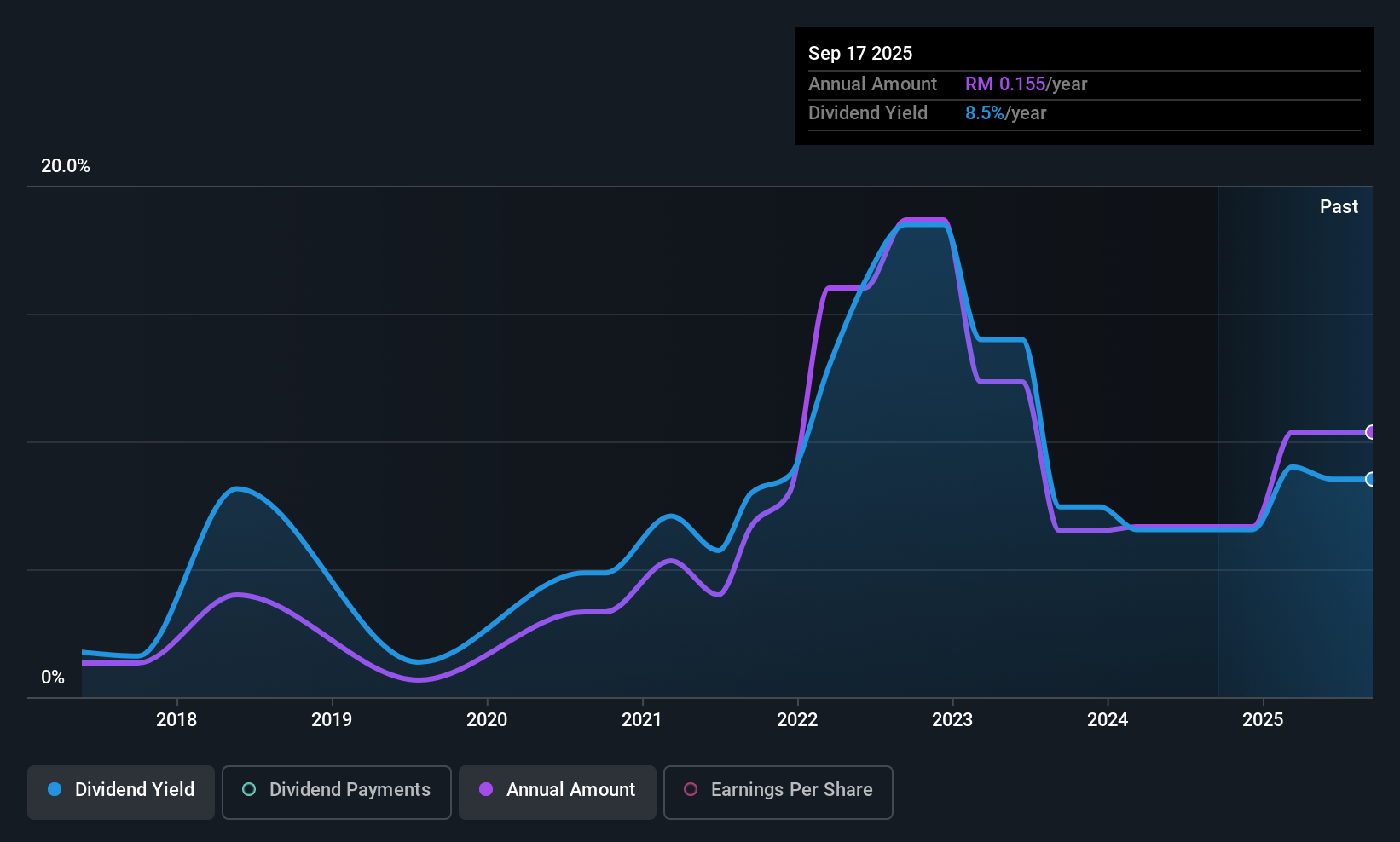

The company's next dividend payment will be RM00.035 per share, on the back of last year when the company paid a total of RM0.16 to shareholders. Calculating the last year's worth of payments shows that Innoprise Plantations Berhad has a trailing yield of 8.1% on the current share price of RM01.92. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Innoprise Plantations Berhad can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year Innoprise Plantations Berhad paid out 102% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. A useful secondary check can be to evaluate whether Innoprise Plantations Berhad generated enough free cash flow to afford its dividend. The company paid out 108% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

As Innoprise Plantations Berhad's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Check out our latest analysis for Innoprise Plantations Berhad

Click here to see how much of its profit Innoprise Plantations Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Innoprise Plantations Berhad's earnings have been skyrocketing, up 43% per annum for the past five years. Innoprise Plantations Berhad's dividend was not well covered by earnings, although at least its earnings per share are growing quickly. Generally, when a company is growing this quickly and paying out all of its earnings as dividends, it can suggest either that the company is borrowing heavily to fund its growth, or that earnings growth is likely to slow due to lack of reinvestment.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last nine years, Innoprise Plantations Berhad has lifted its dividend by approximately 26% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

From a dividend perspective, should investors buy or avoid Innoprise Plantations Berhad? Earnings per share have been growing, despite the company paying out a concerningly high percentage of its earnings and cashflow. We struggle to see how a company paying out so much of its earnings and cash flow will be able to sustain its dividend in a downturn, or reinvest enough into its business to continue growing earnings without borrowing heavily. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

So if you're still interested in Innoprise Plantations Berhad despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Our analysis shows 1 warning sign for Innoprise Plantations Berhad and you should be aware of this before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:INNO

Innoprise Plantations Berhad

An investment holding company, cultivates oil palms and plantation trees in Malaysia.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026