PCCS Group Berhad's (KLSE:PCCS) Low P/E No Reason For Excitement

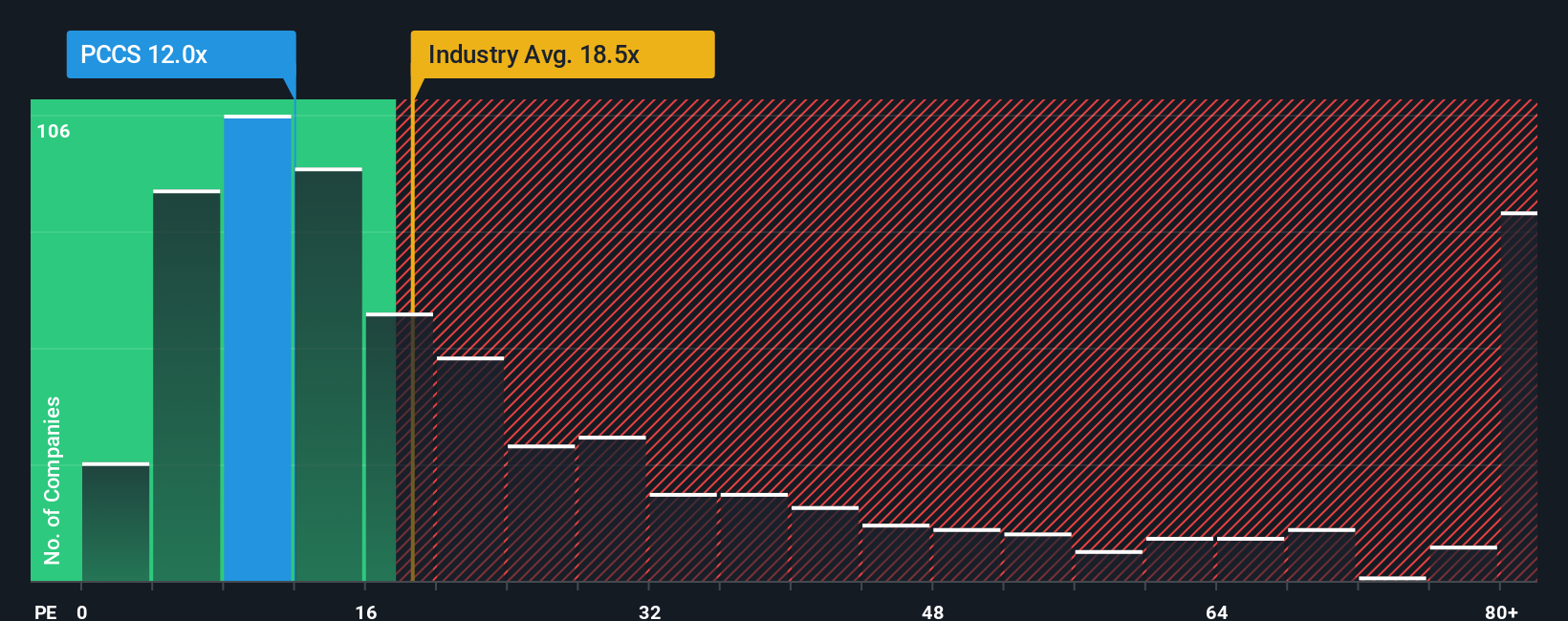

With a price-to-earnings (or "P/E") ratio of 12x PCCS Group Berhad (KLSE:PCCS) may be sending bullish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios greater than 15x and even P/E's higher than 25x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that PCCS Group Berhad's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for PCCS Group Berhad

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as PCCS Group Berhad's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 76% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 17% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that PCCS Group Berhad's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On PCCS Group Berhad's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that PCCS Group Berhad maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for PCCS Group Berhad you should be aware of, and 1 of them is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PCCS

PCCS Group Berhad

An investment holding company, primarily manufactures, markets, and sells apparel in Malaysia, Cambodia, Hong Kong, Singapore, and the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026