There's Reason For Concern Over Kawan Renergy Berhad's (KLSE:KENERGY) Massive 31% Price Jump

Kawan Renergy Berhad (KLSE:KENERGY) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

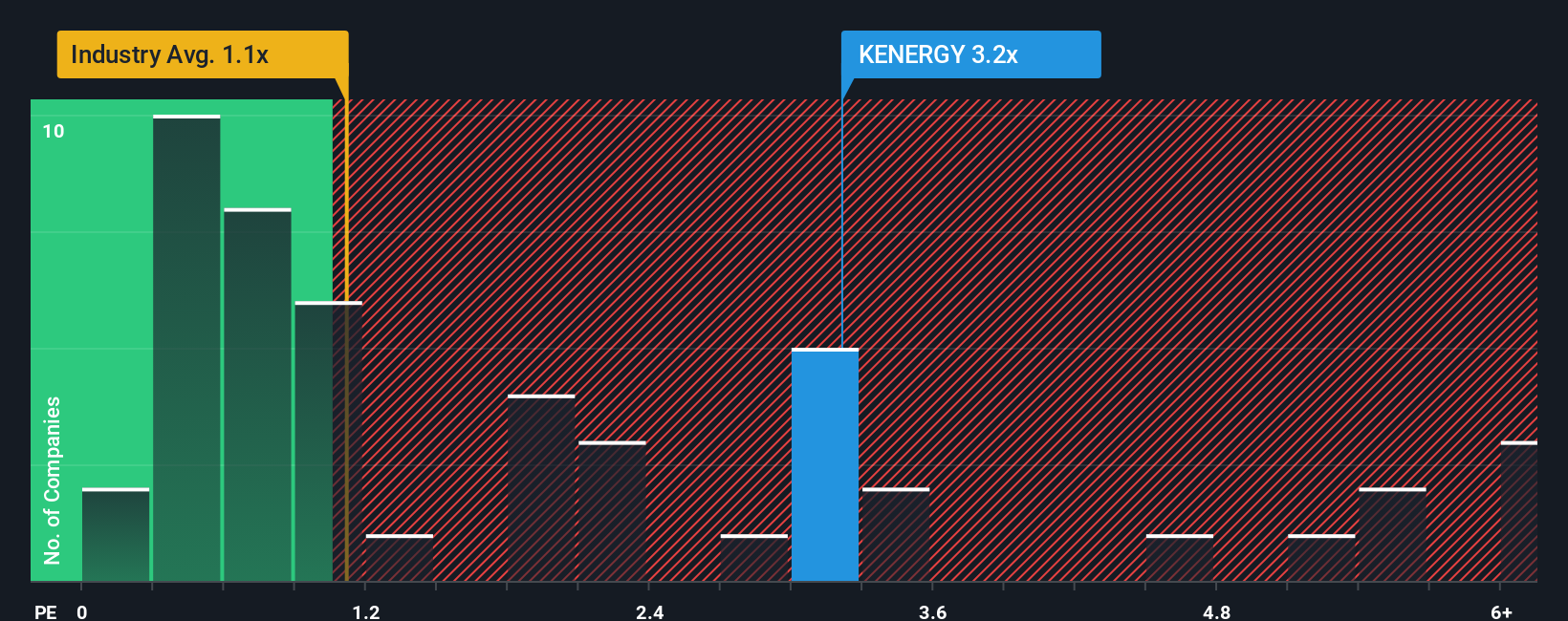

Since its price has surged higher, given around half the companies in Malaysia's Machinery industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Kawan Renergy Berhad as a stock to avoid entirely with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Kawan Renergy Berhad

How Kawan Renergy Berhad Has Been Performing

Kawan Renergy Berhad certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Kawan Renergy Berhad will help you uncover what's on the horizon.How Is Kawan Renergy Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kawan Renergy Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 3.4% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

With this information, we find it concerning that Kawan Renergy Berhad is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Kawan Renergy Berhad's P/S

Shares in Kawan Renergy Berhad have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Kawan Renergy Berhad trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for Kawan Renergy Berhad (1 is potentially serious!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kawan Renergy Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KENERGY

Kawan Renergy Berhad

An investment holding company, designs, fabricates, installs, and commissions industrial process equipment, process plants, and renewable energy and co-generation plants in Malaysia, Indonesia, Singapore, the United States, and internationally.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives