- Malaysia

- /

- Construction

- /

- KLSE:HSSEB

HSS Engineers Berhad (KLSE:HSSEB) Might Not Be As Mispriced As It Looks After Plunging 28%

To the annoyance of some shareholders, HSS Engineers Berhad (KLSE:HSSEB) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

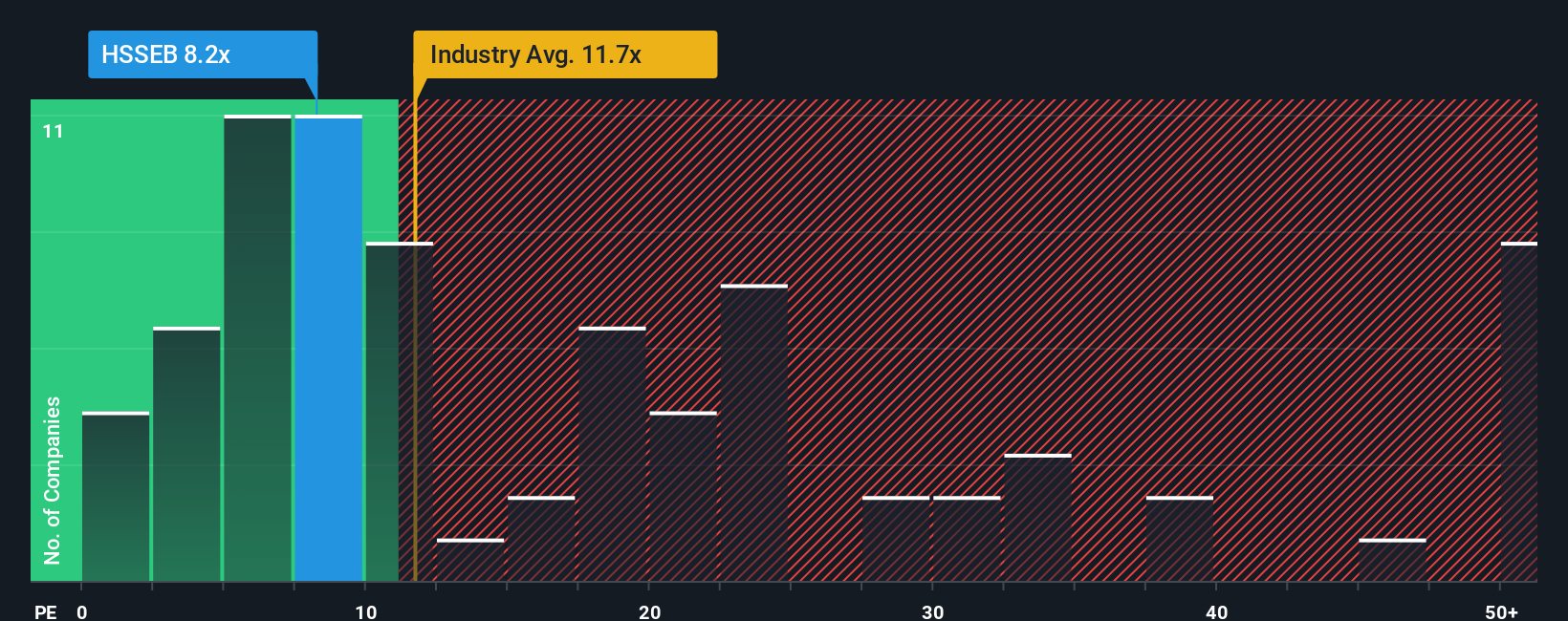

In spite of the heavy fall in price, HSS Engineers Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.2x, since almost half of all companies in Malaysia have P/E ratios greater than 14x and even P/E's higher than 25x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, HSS Engineers Berhad has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for HSS Engineers Berhad

Is There Any Growth For HSS Engineers Berhad?

There's an inherent assumption that a company should underperform the market for P/E ratios like HSS Engineers Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow EPS by 119% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 54% over the next year. Meanwhile, the rest of the market is forecast to only expand by 14%, which is noticeably less attractive.

With this information, we find it odd that HSS Engineers Berhad is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

HSS Engineers Berhad's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of HSS Engineers Berhad's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HSS Engineers Berhad, and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HSS Engineers Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HSSEB

HSS Engineers Berhad

An investment holding company, provides engineering and project management primarily in Malaysia, the Middle East, Cambodia, the Philippines, India, and Indonesia.

Undervalued with high growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026