- South Korea

- /

- Telecom Services and Carriers

- /

- KOSDAQ:A036630

Sejong Telecom, Inc. (KOSDAQ:036630) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

Sejong Telecom, Inc. (KOSDAQ:036630) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 12% in that time.

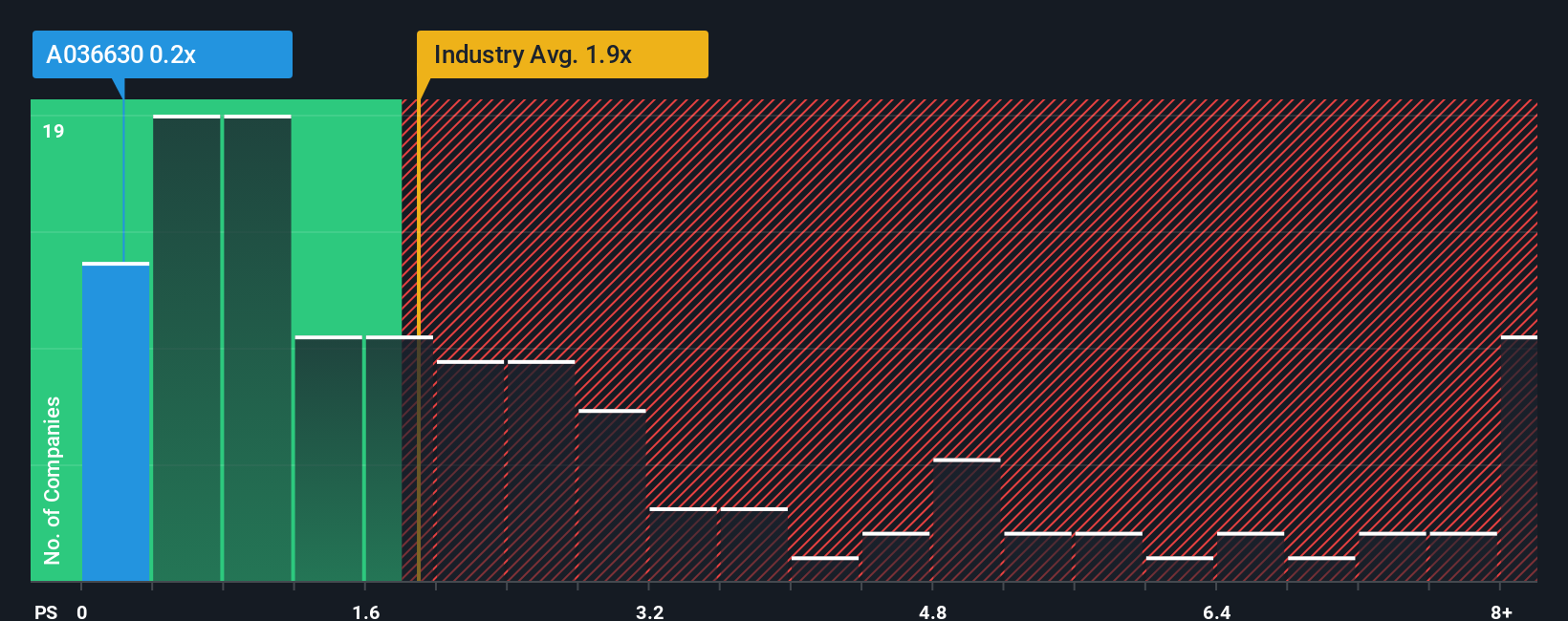

In spite of the heavy fall in price, it's still not a stretch to say that Sejong Telecom's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Telecom industry in Korea, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Sejong Telecom

What Does Sejong Telecom's Recent Performance Look Like?

For example, consider that Sejong Telecom's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sejong Telecom's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Sejong Telecom's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.2% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Sejong Telecom's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

Sejong Telecom's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Sejong Telecom currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Sejong Telecom is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Sejong Telecom's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036630

Sejong Telecom

Operates as a telecommunications carrier in South Korea and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives