- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

High Growth Tech Stocks In Asia Featuring Samsung Electronics And Two Others

Reviewed by Simply Wall St

The Asian tech market is currently experiencing a dynamic phase, with investor enthusiasm particularly strong in sectors like technology and artificial intelligence, as evidenced by recent gains in key indices such as the CSI 300 and Hang Seng. In this context, identifying high-growth stocks involves looking for companies that are well-positioned to leverage technological advancements and maintain resilience amid economic fluctuations; Samsung Electronics serves as a prime example alongside two other notable contenders in the region.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.88% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Fositek | 37.49% | 49.53% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Samsung Electronics (KOSE:A005930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, IT and mobile communications, and device solutions with a market cap of ₩661.24 trillion.

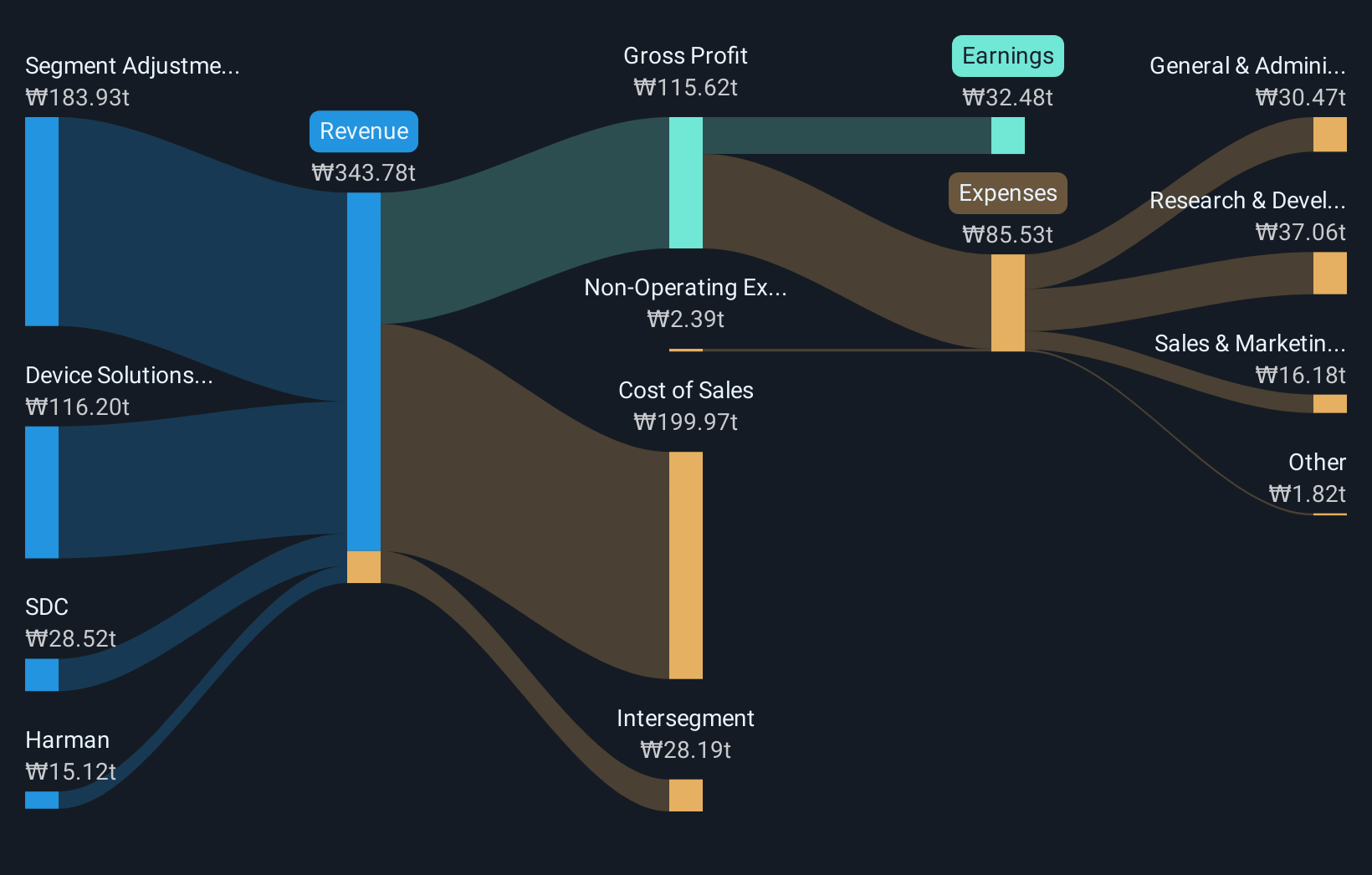

Operations: Samsung Electronics generates revenue primarily from its Device Experience (DX) segment, contributing ₩184.19 trillion, and Device Solutions (DS), adding ₩116.22 trillion. The company also earns from SDC and Harman segments, with revenues of ₩28.47 billion and ₩15.13 billion, respectively.

Samsung Electronics, a major player in the tech sector, is navigating through a transformative phase with significant leadership changes and strategic alliances aimed at enhancing its technological prowess. Recently appointed CEO Tae-moon Roh's experience in mobile R&D and product strategy is poised to invigorate Samsung's innovation trajectory, particularly in AI and mobile technologies. The company has also entered into a groundbreaking partnership with NVIDIA to establish an AI-driven semiconductor factory, which underscores its commitment to integrating cutting-edge AI into manufacturing processes. Financially, Samsung anticipates robust earnings growth with projections indicating a 29.4% annual increase, outpacing the broader Korean market's 28.6% growth rate. This financial optimism is further bolstered by Samsung’s solid track record of R&D investment, crucial for sustaining long-term technological leadership.

- Unlock comprehensive insights into our analysis of Samsung Electronics stock in this health report.

Assess Samsung Electronics' past performance with our detailed historical performance reports.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector and has a market capitalization of CN¥8.46 billion.

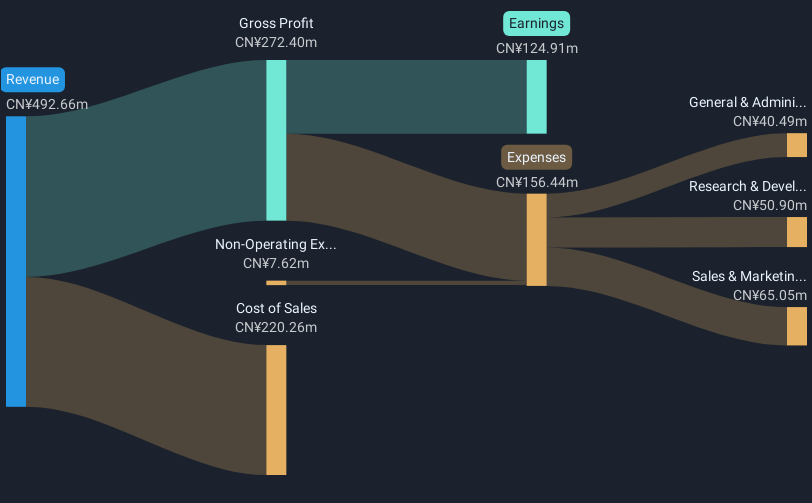

Operations: Top Cloud-agri Technology focuses on the agricultural technology sector, leveraging advanced solutions to enhance farming productivity. The company generates revenue through its innovative products and services aimed at improving agricultural efficiency.

Zhejiang Top Cloud-agri Technology Co., Ltd. is carving a niche in the high-growth tech landscape of Asia, with its recent financial performance underscoring robust growth prospects. Over the past year, the company has seen a revenue increase to CNY 391.25 million from CNY 335.51 million and net income growth to CNY 91.29 million from CNY 76.6 million, reflecting a solid trajectory in earnings with an annualized rate of 10.6%, outpacing the electronic industry's average of 9%. This fiscal enhancement is complemented by strategic dividends, evidenced by their recent interim dividend affirmation at CNY 2.35 per ten shares, aligning shareholder returns with ongoing financial health and future confidence.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

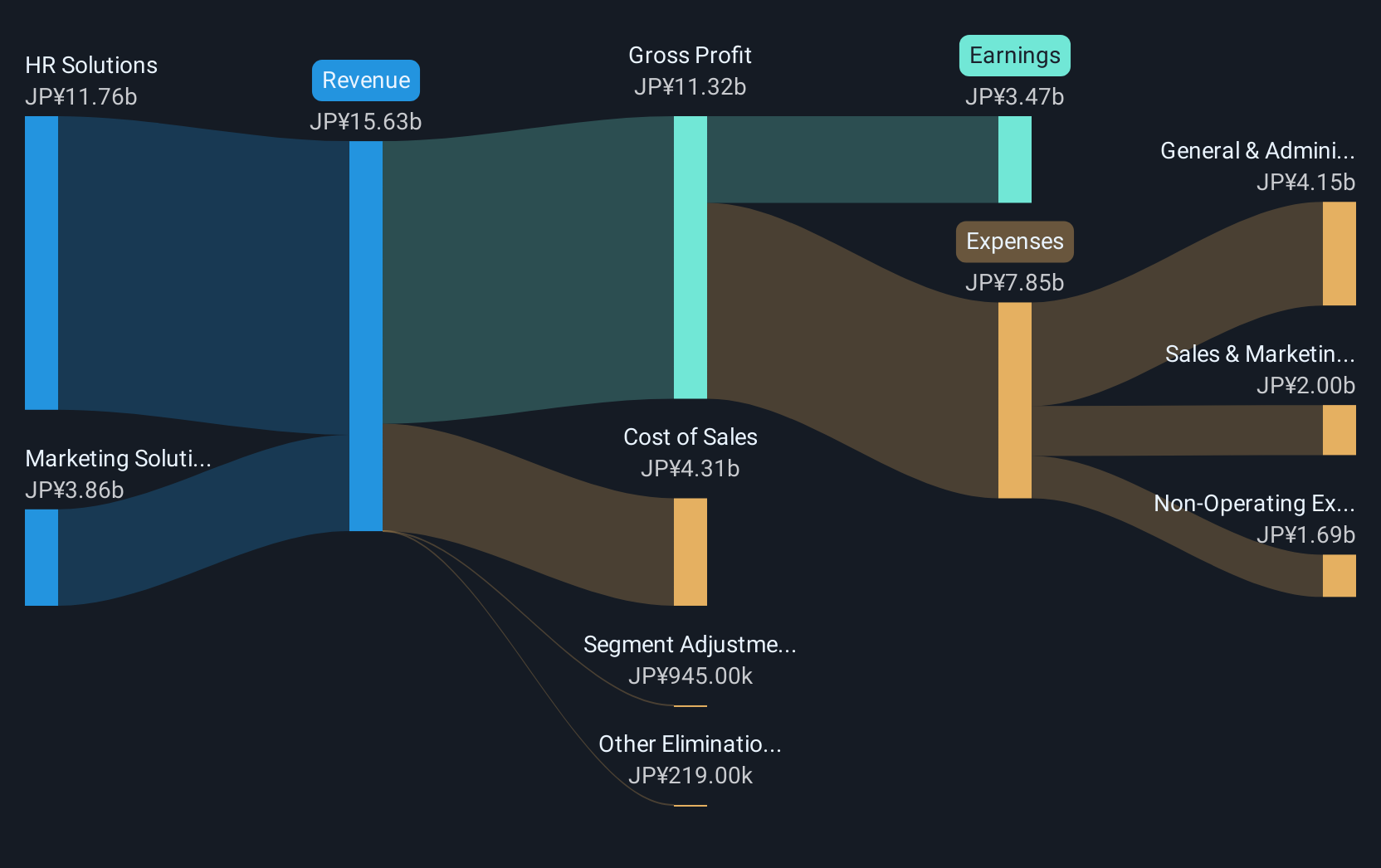

Overview: Plus Alpha Consulting Co., Ltd. offers marketing and HR solutions in Japan, with a market cap of ¥100.29 billion.

Operations: The company specializes in delivering marketing and HR solutions within Japan. It operates with a market capitalization of approximately ¥100.29 billion.

Plus Alpha ConsultingLtd. demonstrates a dynamic trajectory in the high-growth tech sector of Asia, with its recent performance reflecting strong financial health and strategic foresight. In the fiscal year ending September 2025, the company reported a significant increase in net income to JPY 3.26 billion from previous projections, alongside a robust annual revenue growth rate of 12.4%. This growth is supported by an aggressive R&D investment strategy that not only fuels innovation but also aligns with industry shifts towards digital transformation solutions. Recent corporate decisions, including enhanced dividend payouts and strategic alliances such as with RAKUS Co., Ltd., underscore its commitment to sustainable growth and shareholder value, positioning it well for future advancements in technology consulting services.

Seize The Opportunity

- Investigate our full lineup of 187 Asian High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026