- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A424960

Is Smart Radar System (KOSDAQ:424960) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Smart Radar System Inc. (KOSDAQ:424960) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Smart Radar System's Debt?

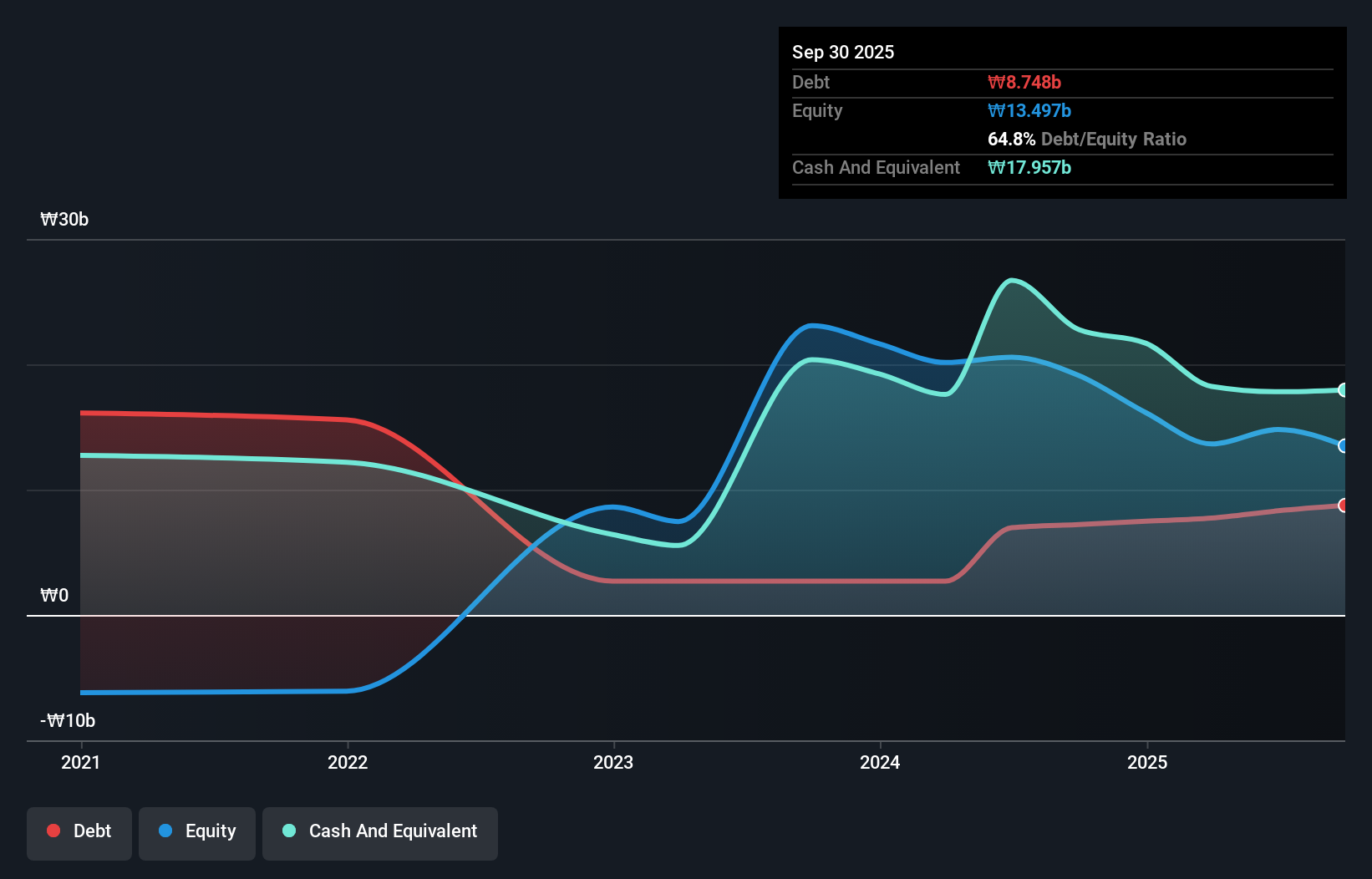

As you can see below, at the end of September 2025, Smart Radar System had ₩8.75b of debt, up from ₩7.22b a year ago. Click the image for more detail. But it also has ₩18.0b in cash to offset that, meaning it has ₩9.21b net cash.

How Strong Is Smart Radar System's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Smart Radar System had liabilities of ₩13.7b due within 12 months and liabilities of ₩1.41b due beyond that. Offsetting these obligations, it had cash of ₩18.0b as well as receivables valued at ₩1.79b due within 12 months. So it can boast ₩4.69b more liquid assets than total liabilities.

This surplus suggests that Smart Radar System has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Smart Radar System has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Smart Radar System's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Check out our latest analysis for Smart Radar System

Over 12 months, Smart Radar System reported revenue of ₩7.4b, which is a gain of 42%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Smart Radar System?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Smart Radar System had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of ₩4.5b and booked a ₩5.8b accounting loss. But the saving grace is the ₩9.21b on the balance sheet. That means it could keep spending at its current rate for more than two years. Smart Radar System's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Smart Radar System that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A424960

Smart Radar System

Provides RF antenna design, hardware module, radar signal processing algorithm, and software API in South Korea and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026