- China

- /

- Real Estate

- /

- SHSE:600208

3 Global Growth Companies With High Insider Ownership And Up To 47% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic data, investors are keenly observing the potential for growth within various sectors. Amid these conditions, companies with strong insider ownership and robust revenue growth stand out as compelling opportunities, offering insights into their commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

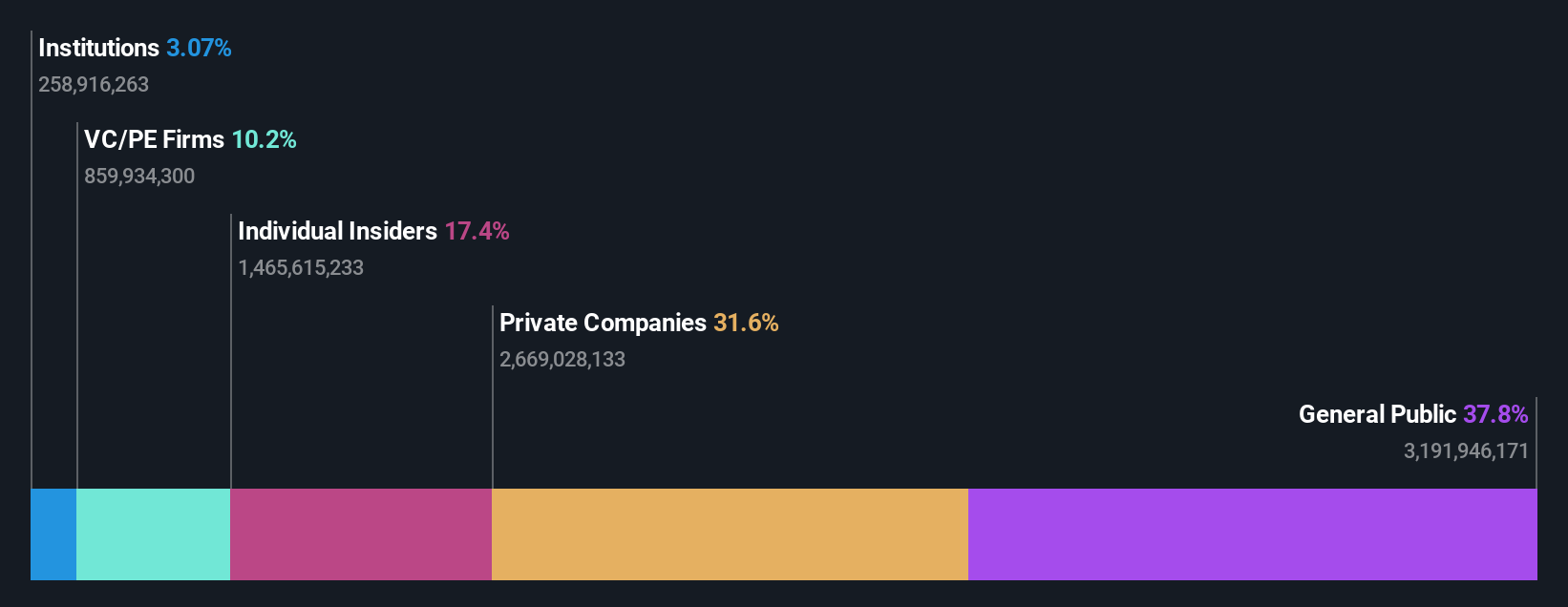

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. offers robotic solutions in South Korea and has a market capitalization of ₩3.02 trillion.

Operations: The company generates revenue of ₩34.11 billion from developing, manufacturing, and selling personal robots.

Insider Ownership: 26.7%

Revenue Growth Forecast: 43.1% p.a.

ROBOTIS has shown strong growth potential with a forecasted revenue increase of 43.1% annually, surpassing the KR market's 10.5%. The company recently became profitable, reporting a net income of KRW 810.98 million for Q3 2025, compared to a loss last year. Earnings are expected to grow significantly at 77.3% per year over the next three years, although its share price has been highly volatile and recent earnings were impacted by large one-off items.

- Take a closer look at ROBOTIS' potential here in our earnings growth report.

- The analysis detailed in our ROBOTIS valuation report hints at an inflated share price compared to its estimated value.

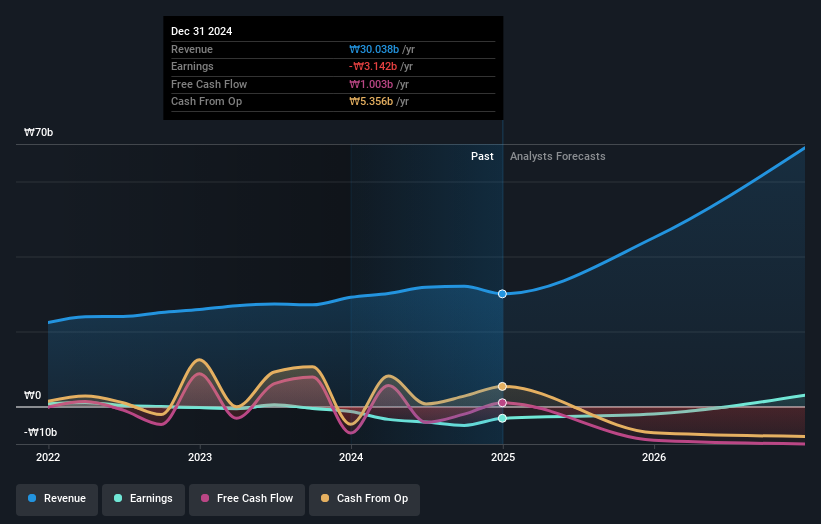

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development and financial services in China, with a market cap of CN¥35.39 billion.

Operations: The company's revenue segments include real estate development and financial services in China.

Insider Ownership: 17.2%

Revenue Growth Forecast: 47.6% p.a.

Quzhou Xin'an Development is poised for significant growth, with revenue expected to rise 47.6% annually, outpacing the CN market's 14.6%. Despite a challenging year-over-year sales decline from CNY 14.12 billion to CNY 1.05 billion, the company is forecasted to become profitable within three years, exceeding average market growth expectations. However, its return on equity remains low at a projected 4.7%, and debt coverage by operating cash flow needs improvement.

- Dive into the specifics of Quzhou Xin'an Development here with our thorough growth forecast report.

- Our valuation report here indicates Quzhou Xin'an Development may be overvalued.

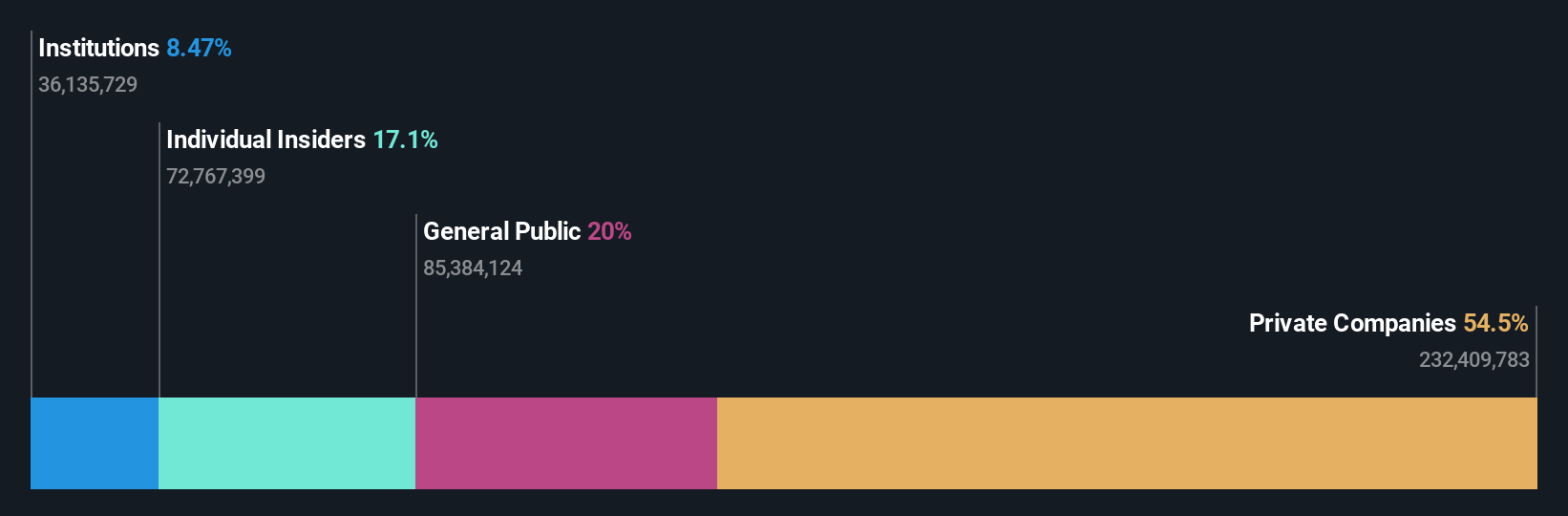

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanchip (Tianjin) Technology Co., Ltd. designs, manufactures, and sells radio frequency front end and high end analog chips in China, with a market cap of CN¥16.26 billion.

Operations: The company's revenue is primarily derived from its electronic components and parts segment, totaling CN¥2.17 billion.

Insider Ownership: 17.1%

Revenue Growth Forecast: 27.9% p.a.

Vanchip (Tianjin) Technology is positioned for robust growth, with revenue anticipated to increase by 27.9% annually, surpassing the CN market's 14.6%. The company turned a net income of CNY 8.6 million from a previous loss, reflecting improved financial health despite profit margins narrowing to 0.8%. Earnings are projected to grow significantly at 94.2% per year; however, return on equity is expected to remain modest at 6.9%, with no recent insider trading activity noted.

- Click here and access our complete growth analysis report to understand the dynamics of Vanchip (Tianjin) Technology.

- In light of our recent valuation report, it seems possible that Vanchip (Tianjin) Technology is trading beyond its estimated value.

Where To Now?

- Click this link to deep-dive into the 857 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Seeking Other Investments? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quzhou Xin'an Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600208

Quzhou Xin'an Development

Engages in the real estate development, and financial service businesses in China.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026