- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A036930

3 Global Stocks That May Be Priced Below Their Estimated Value In December 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape of dovish Federal Reserve signals, subdued inflation in Europe, and resilient economic indicators in Japan, investors are keenly assessing opportunities that may arise from these shifting dynamics. In this environment, identifying stocks that are potentially undervalued can be crucial for those looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN128.00 | PLN254.72 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.44 | €44.40 | 49.5% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.48 | €4.88 | 49.1% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.08 | CN¥26.02 | 49.7% |

| MNC SolutionLtd (KOSE:A484870) | ₩123500.00 | ₩243662.21 | 49.3% |

| HD Renewable Energy (TWSE:6873) | NT$104.50 | NT$207.35 | 49.6% |

| Esautomotion (BIT:ESAU) | €3.08 | €6.09 | 49.4% |

| China Beststudy Education Group (SEHK:3978) | HK$4.70 | HK$9.28 | 49.4% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN32.33 | PLN64.21 | 49.7% |

Here's a peek at a few of the choices from the screener.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment both in South Korea and internationally, with a market cap of ₩1.34 trillion.

Operations: The company's revenue segment includes Semiconductor Equipment and Services, generating ₩366.70 billion.

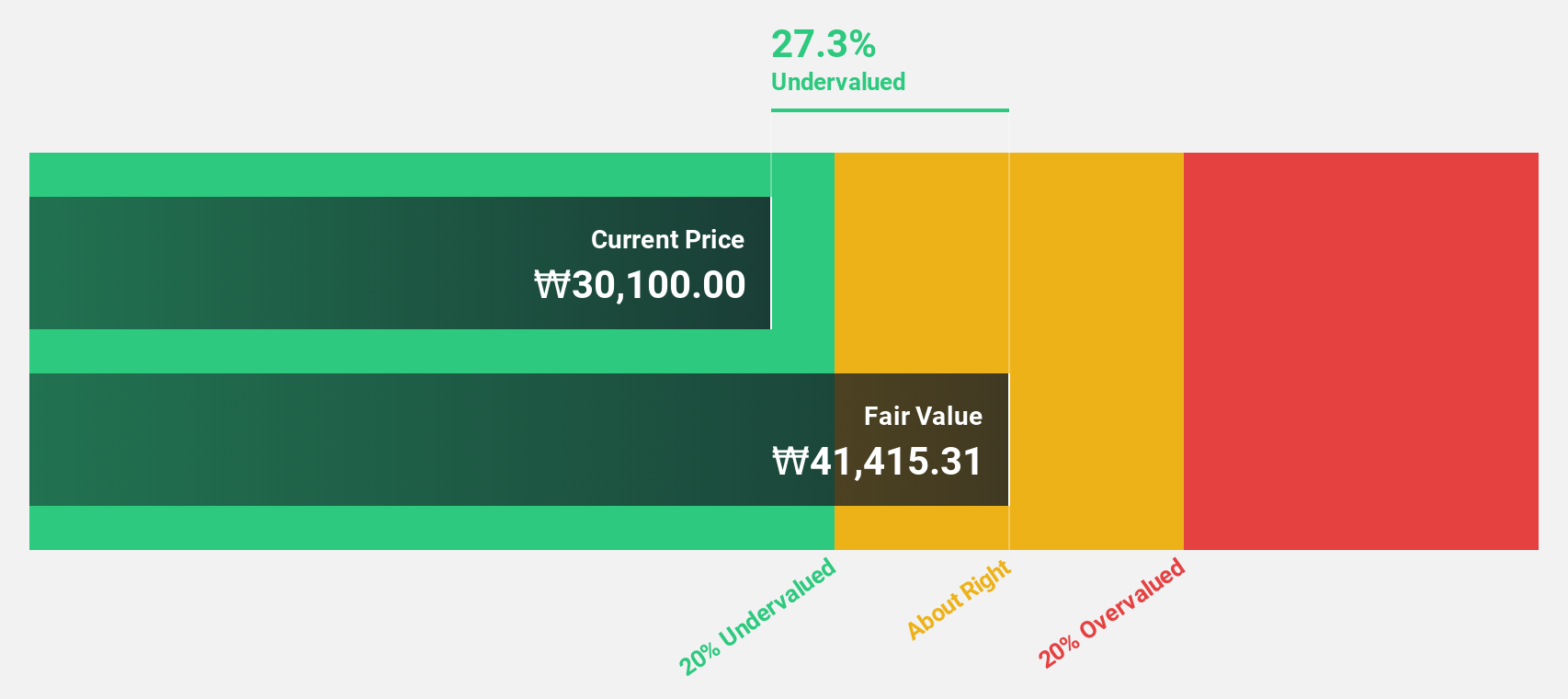

Estimated Discount To Fair Value: 46.9%

JUSUNG ENGINEERING Ltd. is trading at ₩30,350, significantly below its estimated fair value of ₩57,106.49, highlighting its undervaluation based on cash flows. The company's earnings are expected to grow at 38% annually, outpacing the KR market's growth rate of 28.6%. Despite a decline in profit margins from 28% to 17%, revenue growth forecasts remain above the market average. A recent dividend announcement further underscores financial stability amidst these promising growth prospects.

- Our growth report here indicates JUSUNG ENGINEERINGLtd may be poised for an improving outlook.

- Dive into the specifics of JUSUNG ENGINEERINGLtd here with our thorough financial health report.

Cafe24 (KOSDAQ:A042000)

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of approximately ₩828.10 billion.

Operations: The company's revenue is primarily derived from its Internet Business Solution segment, which generates ₩252.57 billion, followed by Transit at ₩40.35 billion and Clothes at ₩30.70 billion.

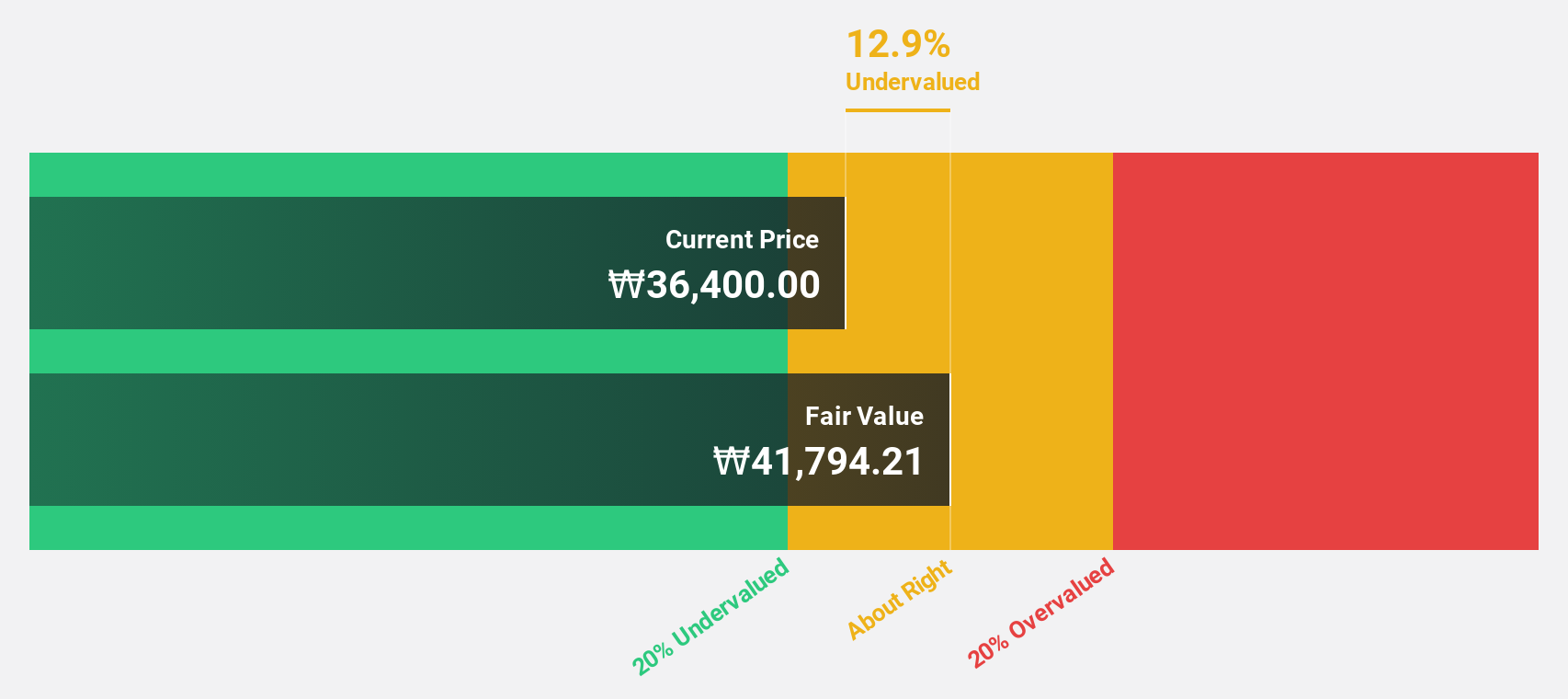

Estimated Discount To Fair Value: 12.9%

Cafe24 is trading at ₩36,400, slightly below its estimated fair value of ₩41,771.07, indicating some undervaluation based on cash flows. The company's earnings are projected to grow significantly at 34.2% annually over the next three years, surpassing the KR market's growth rate of 28.6%. Revenue is expected to increase by 12.2% per year, which is above the market average but not exceptionally high. These factors contribute to its attractiveness as an investment option.

- Upon reviewing our latest growth report, Cafe24's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Cafe24.

LianChuang Electronic TechnologyLtd (SZSE:002036)

Overview: LianChuang Electronic Technology Co., Ltd is involved in the research, development, production, and sale of optics and optoelectronics both in China and internationally, with a market cap of approximately CN¥10.98 billion.

Operations: LianChuang Electronic Technology Co., Ltd generates revenue from its optics and optoelectronics business, serving both domestic and international markets.

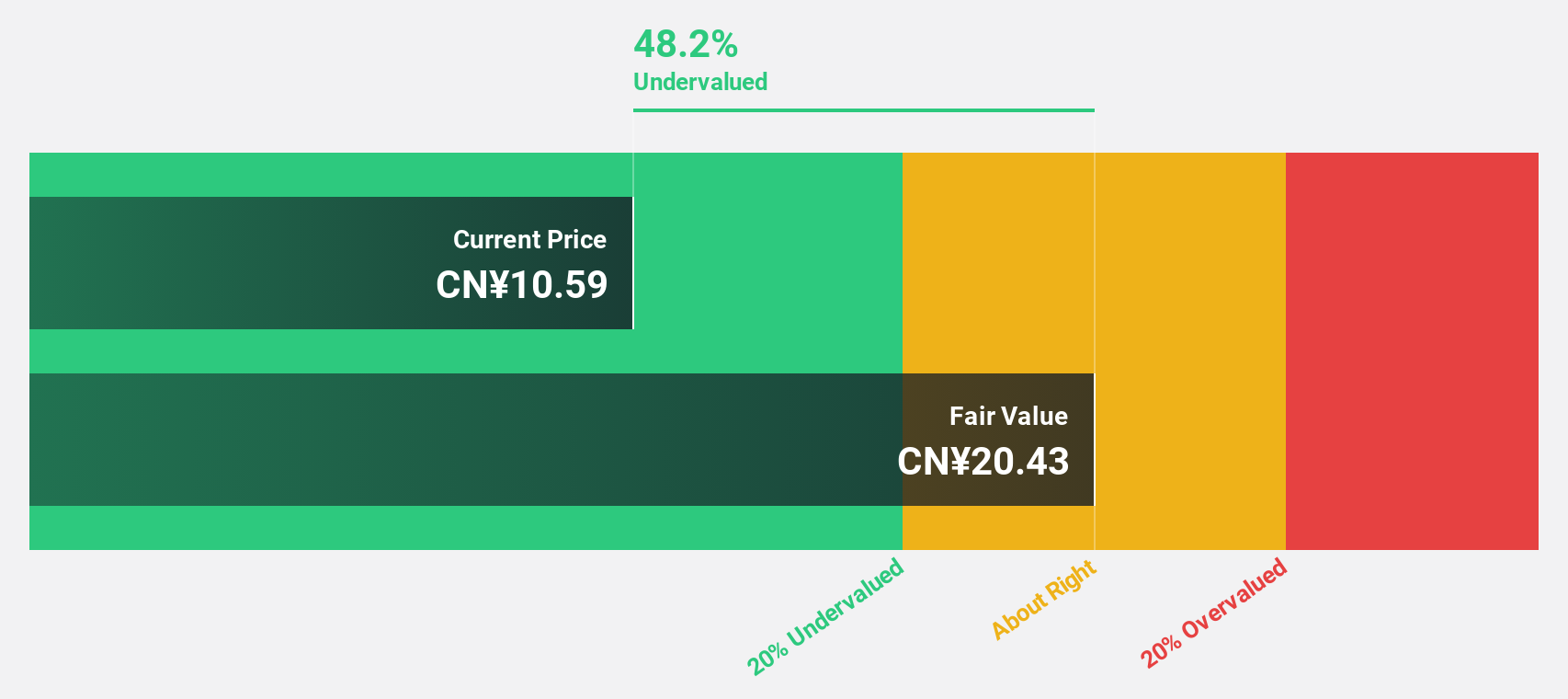

Estimated Discount To Fair Value: 48.1%

LianChuang Electronic Technology Ltd is trading at CNY 10.59, significantly below its estimated fair value of CNY 20.39, highlighting its undervaluation based on cash flows. Despite a decline in nine-month sales to CNY 6,488.63 million from the previous year's CNY 7,743.36 million, the company turned profitable with a net income of CNY 50.92 million compared to a net loss last year. Earnings are expected to grow annually by over 100%.

- According our earnings growth report, there's an indication that LianChuang Electronic TechnologyLtd might be ready to expand.

- Unlock comprehensive insights into our analysis of LianChuang Electronic TechnologyLtd stock in this financial health report.

Summing It All Up

- Click here to access our complete index of 514 Undervalued Global Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036930

JUSUNG ENGINEERINGLtd

Manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026