- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

Is It Too Late To Consider SK hynix After Its 218% AI Driven Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether SK hynix is still good value after its massive run up, you are not alone and this article will walk through what the current price is really baking in.

- The stock has cooled a little in the last month, slipping about 6.0%, but that comes after a stunning 217.8% gain year to date and roughly 229.0% over the last year, which completely changes how we need to think about upside and risk.

- Recent momentum has been driven by the global rush into AI related memory demand, with investors betting that SK hynix will remain a key supplier of high bandwidth memory chips used in leading edge data centers. In addition, optimism around a multi year upcycle in DRAM and NAND pricing has pushed sentiment from cautious to outright bullish, helping to justify, at least in the market's eyes, the rapid rerating in the share price.

- Even after that rally, our valuation framework gives SK hynix a 5/6 valuation score, suggesting it still screens as undervalued on most checks. Next, we will unpack what different valuation approaches say about the stock, before finishing with a more nuanced way to think about its true worth.

Approach 1: SK hynix Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in today’s ₩ terms.

For SK hynix, the latest twelve month free cash flow is around ₩20.9 Trillion. Analyst forecasts and subsequent extrapolations used in the 2 Stage Free Cash Flow to Equity model point to free cash flow rising to roughly ₩94.2 Trillion by 2035, with the steepest growth expected over the next few years as AI driven memory demand lifts earnings.

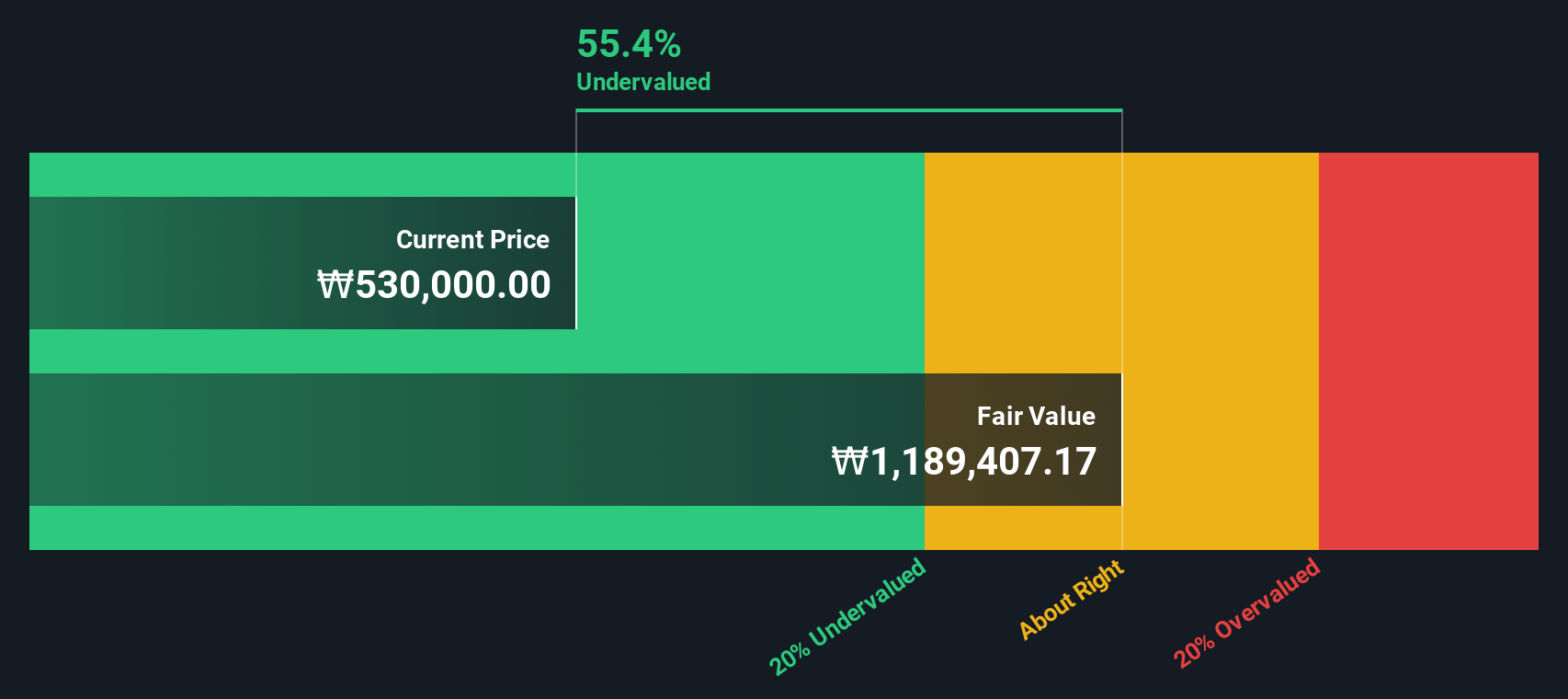

When all projected cash flows are discounted back, the model arrives at an intrinsic value of about ₩1,182,969 per share. That implies the shares trade at roughly a 54.0% discount to this estimate. This suggests the market is still cautious about how durable this cash flow upswing will be.

On balance, the DCF view is that investors are getting SK hynix growth at a material markdown relative to its modeled long term cash generating power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SK hynix is undervalued by 54.0%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: SK hynix Price vs Earnings

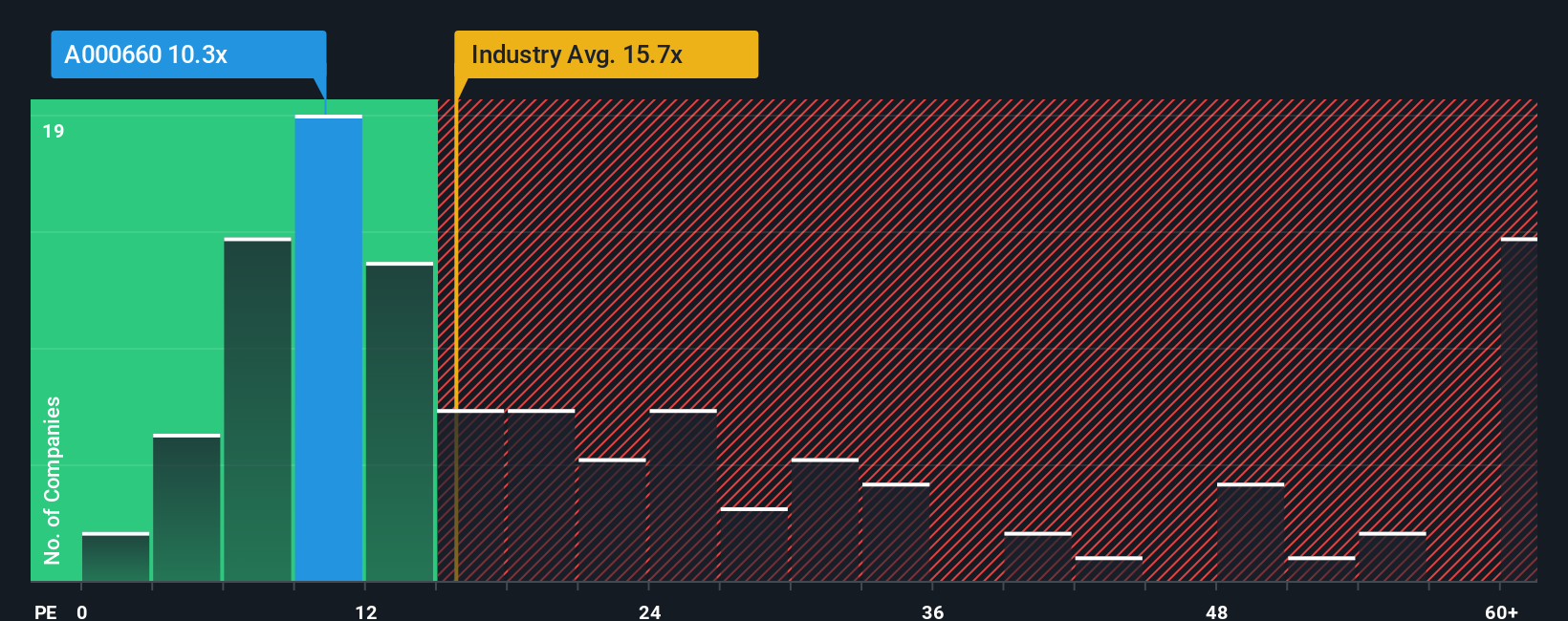

For profitable companies like SK hynix, the price to earnings, or PE, multiple is a useful shorthand for how much investors are willing to pay today for each unit of current earnings. A higher PE usually reflects stronger growth expectations or lower perceived risk, while a lower PE can signal slower growth, more uncertainty, or a market that is still skeptical about how sustainable profits will be.

SK hynix currently trades on a PE of about 10.52x, which is well below both the global Semiconductor industry average of around 16.52x and the peer average of roughly 33.10x. Simply Wall St also calculates a proprietary Fair Ratio of 30.03x for SK hynix, which is the PE that might be expected given its earnings growth outlook, profit margins, size, industry positioning and risk profile.

This Fair Ratio offers a more tailored benchmark than simple peer or industry comparisons, because it explicitly adjusts for how fast SK hynix is growing and how risky its earnings stream appears. With the current PE of 10.52x sitting far below the 30.03x Fair Ratio, the multiple based view points to SK hynix being materially undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SK hynix Narrative

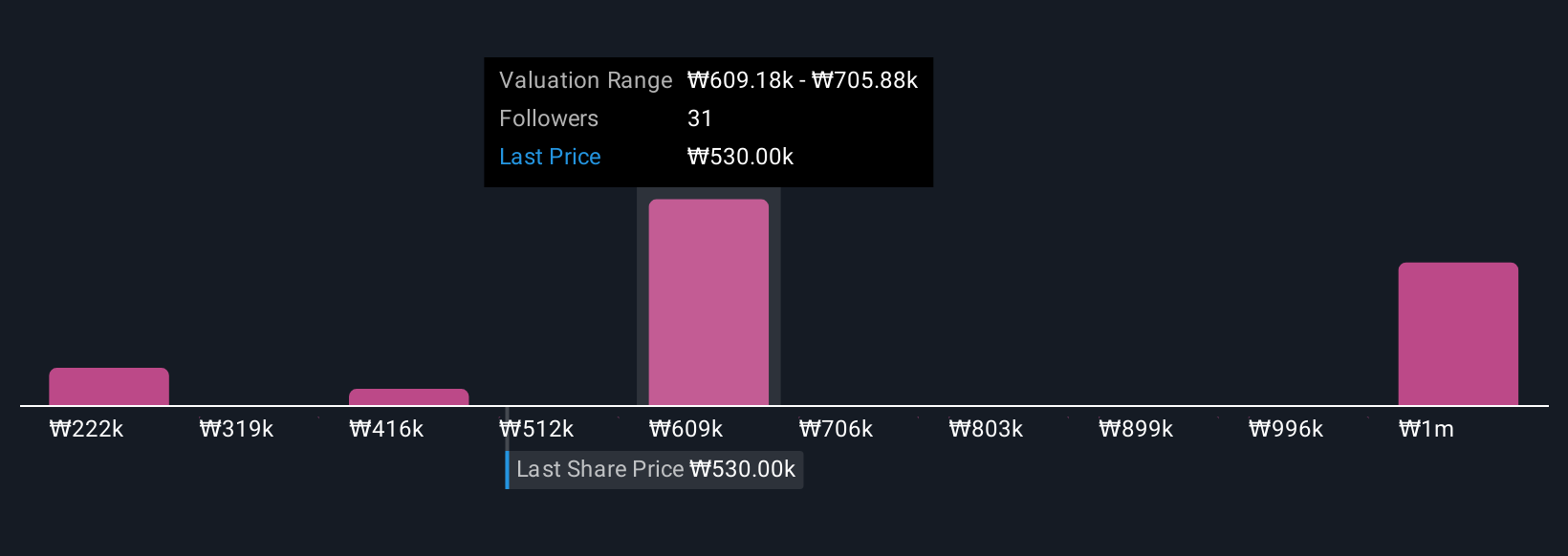

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about SK hynix linked directly to your numbers, like what you think its future revenue, earnings and margins will be, and what that implies for fair value.

A Narrative on Simply Wall St turns your view of the company, for example how durable you think AI memory demand will be or how serious you believe geopolitical risks are, into a concrete forecast and a resulting fair value that you can compare with today’s share price to decide whether SK hynix looks like a buy, hold or sell.

These Narratives live inside the Community page on Simply Wall St, used by millions of investors, and are updated dynamically as new information arrives, such as earnings results, product announcements, or big changes in analyst expectations.

For instance, one SK hynix investor might build a bullish Narrative that leans toward the higher analyst earnings and price targets, while another might base a more cautious Narrative on the lower estimates. By seeing how each story translates into a different fair value versus the current ₩262,500 price, they can each decide if the stock still fits their strategy.

Do you think there's more to the story for SK hynix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Manufactures, distributes, and sells semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026