- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A080580

OKins Electronics Co.,Ltd.'s (KOSDAQ:080580) Shares Climb 42% But Its Business Is Yet to Catch Up

OKins Electronics Co.,Ltd. (KOSDAQ:080580) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 66%.

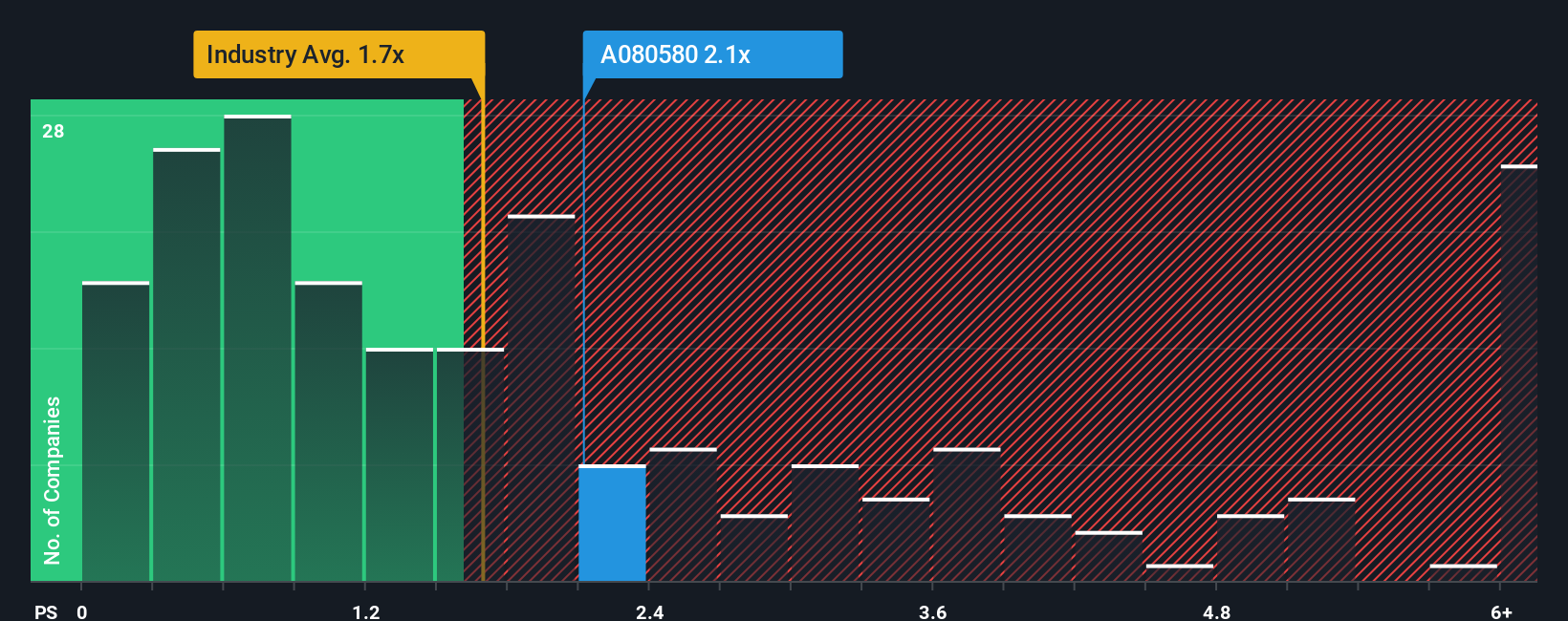

Even after such a large jump in price, there still wouldn't be many who think OKins ElectronicsLtd's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in Korea's Semiconductor industry is similar at about 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for OKins ElectronicsLtd

How OKins ElectronicsLtd Has Been Performing

OKins ElectronicsLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on OKins ElectronicsLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like OKins ElectronicsLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. As a result, it also grew revenue by 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this in mind, we find it intriguing that OKins ElectronicsLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

OKins ElectronicsLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of OKins ElectronicsLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You need to take note of risks, for example - OKins ElectronicsLtd has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A080580

OKins ElectronicsLtd

Okins Electronics Co.,Ltd. manufactures and sells semiconductor inspection sockets.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives