- South Korea

- /

- Machinery

- /

- KOSDAQ:A137400

Discovering PSK HOLDINGS And 2 Other Hidden Small Cap Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.2%, although it has been flat overall in the past year. With earnings forecast to grow by 29% annually, identifying promising small-cap stocks like PSK HOLDINGS can be a strategic move for investors looking to capitalize on future growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| SELVAS Healthcare | 13.50% | 9.36% | 71.59% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

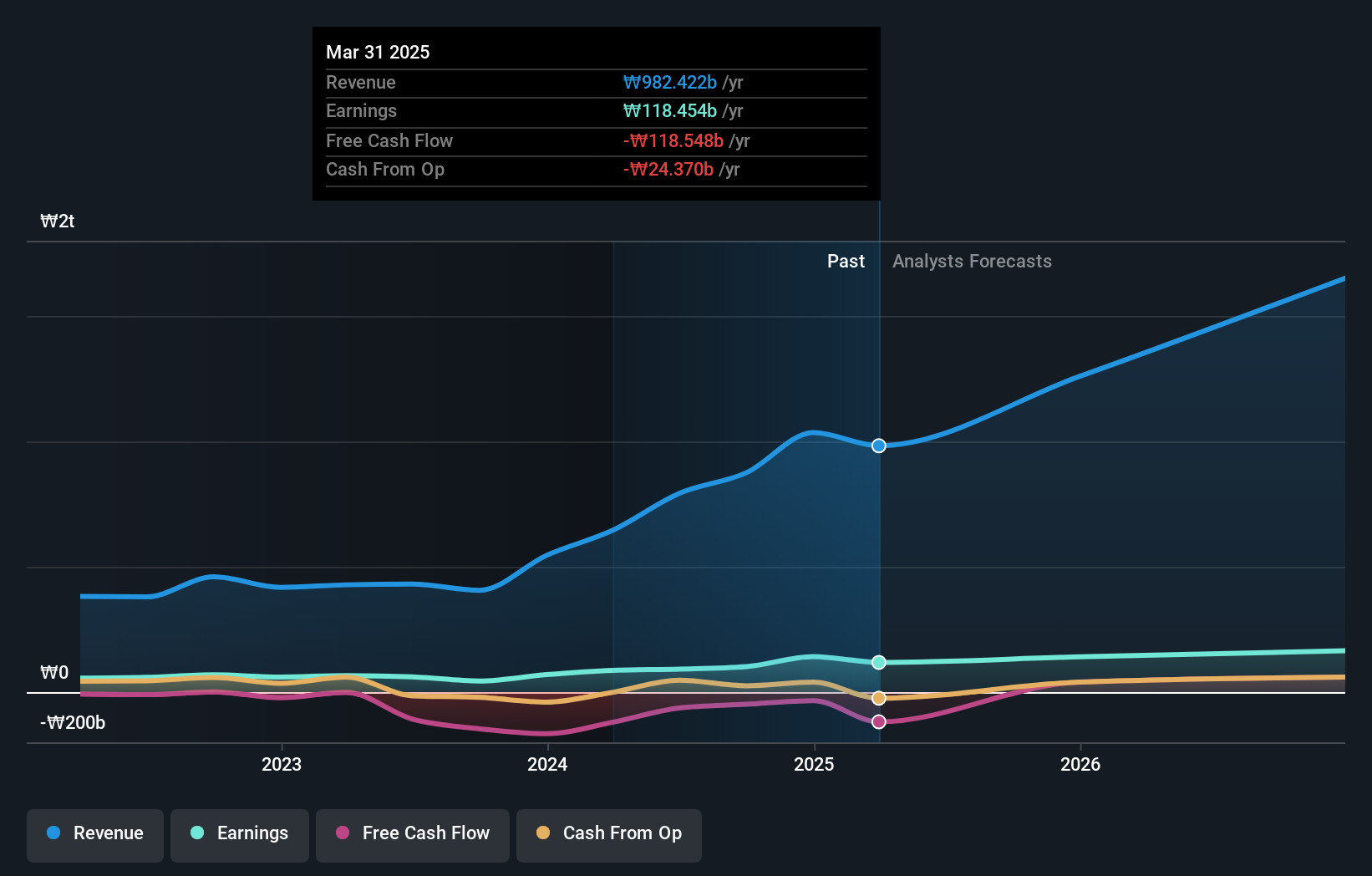

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide, with a market cap of ₩984.32 billion.

Operations: Revenue from semiconductor manufacturing equipment amounts to ₩132.98 billion.

PSK Holdings has shown impressive earnings growth of 40.8% over the past year, significantly outpacing the semiconductor industry’s -10%. Despite a volatile share price in recent months, the company remains profitable with a notable one-off gain of ₩26.4B impacting its latest financial results to June 30, 2024. The debt-to-equity ratio has increased from 0% to 4.4% over five years, but PSK still holds more cash than total debt and was recently added to the S&P Global BMI Index on September 23rd.

- Take a closer look at PSK HOLDINGS' potential here in our health report.

Evaluate PSK HOLDINGS' historical performance by accessing our past performance report.

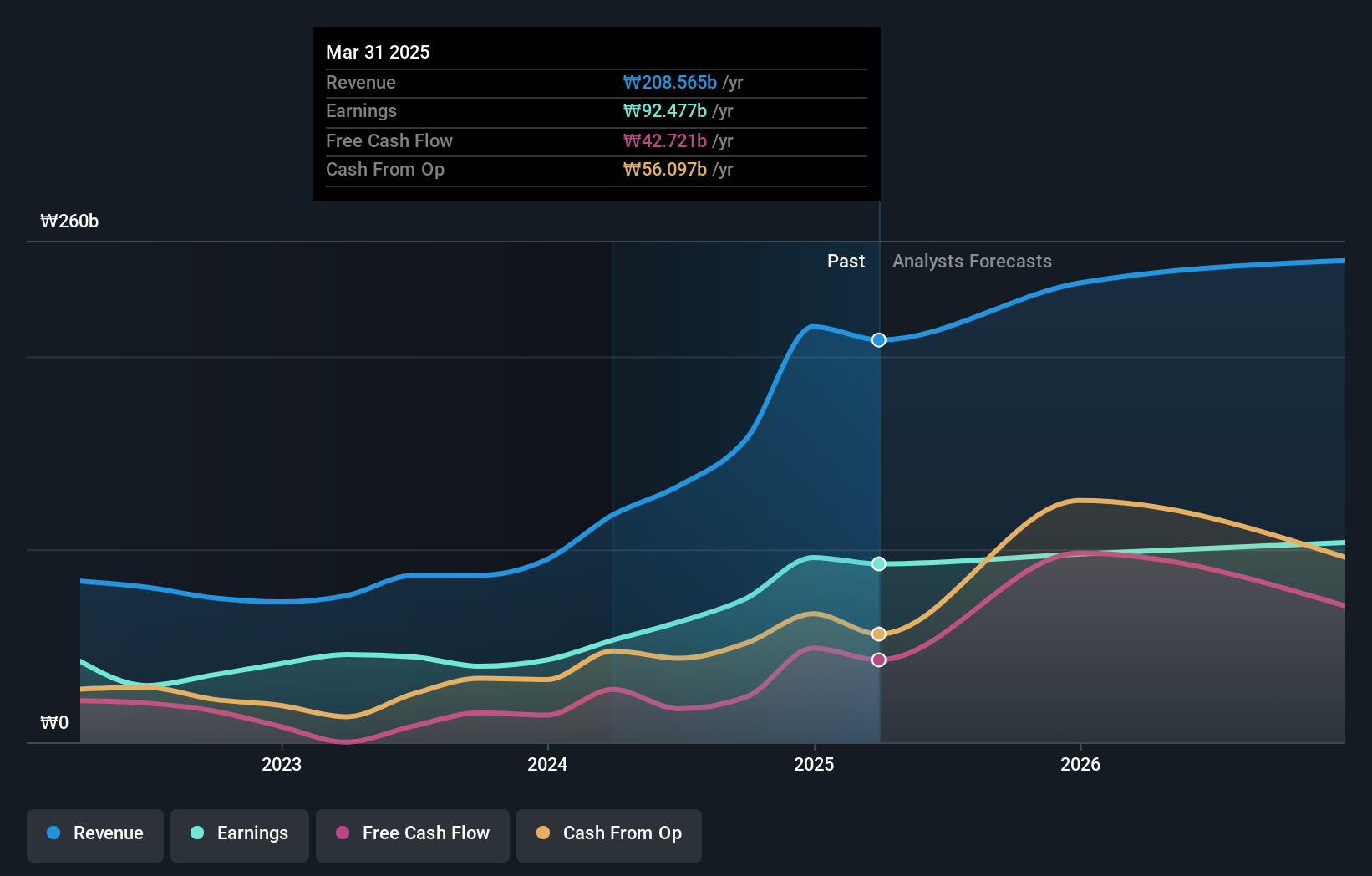

People & Technology (KOSDAQ:A137400)

Simply Wall St Value Rating: ★★★★★★

Overview: People & Technology Inc. specializes in providing coating, calendaring, slitting, automation, and other machinery solutions with a market cap of ₩1.34 billion.

Operations: People & Technology Inc. generates revenue primarily from its Machinery & Industrial Equipment segment, which reported ₩792.60 million.

People & Technology has shown impressive earnings growth of 50.9% over the past year, significantly outpacing the Machinery industry's 5.4%. The company's interest payments are well covered by EBIT, with a coverage ratio of 30.3x, indicating strong financial health. Additionally, its net debt to equity ratio stands at a satisfactory 19.4%, down from 78% five years ago. Trading at 55.5% below its estimated fair value, People & Technology appears undervalued with promising future prospects.

- Click here and access our complete health analysis report to understand the dynamics of People & Technology.

Assess People & Technology's past performance with our detailed historical performance reports.

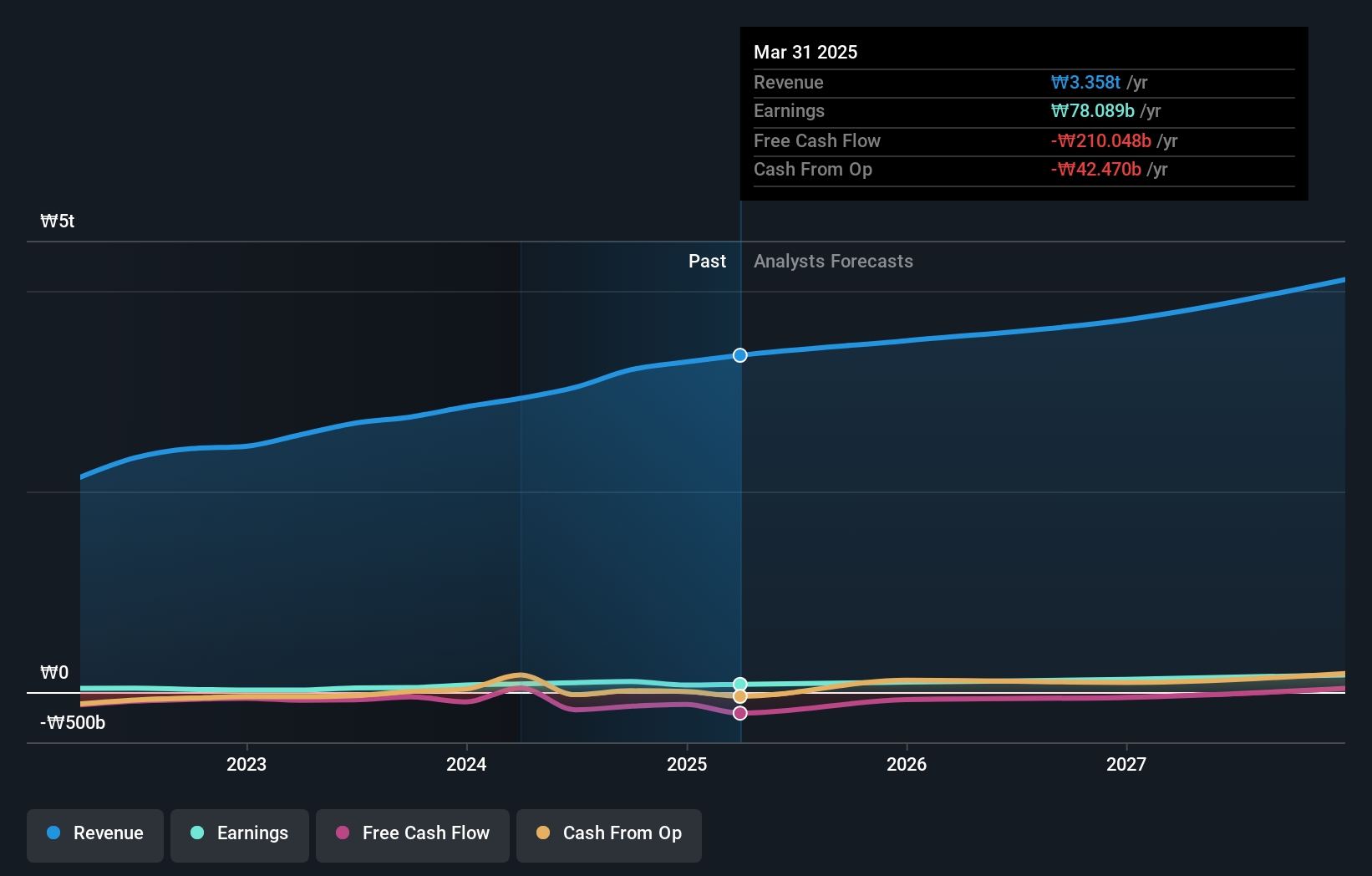

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.30 trillion.

Operations: Taihan Cable & Solution generates revenue primarily from its wire segment, amounting to ₩3.42 billion. The company also reports inter-division sales of -₩0.38 billion.

Taihan Cable & Solution, a notable player in South Korea's electrical industry, has shown impressive financial metrics. The company's net income for Q2 2024 was KRW 24.88 million, up from KRW 12.82 million the previous year, with basic EPS rising to KRW 134 from KRW 104. Over the past five years, its debt-to-equity ratio improved significantly from 203.6% to 30.2%. Despite a dip in sales to KRW 8.82 million this quarter compared to last year's KRW 9.75 million, earnings growth of 127% outpaced the industry's average of 18.5%.

- Click to explore a detailed breakdown of our findings in Taihan Cable & Solution's health report.

Understand Taihan Cable & Solution's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 191 KRX Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A137400

People & Technology

Offers coating, calendaring, slitting, automation, and other machineries.

Exceptional growth potential with flawless balance sheet.