- South Korea

- /

- Biotech

- /

- KOSDAQ:A476060

Take Care Before Jumping Onto Onconic Therapeutics Inc. (KOSDAQ:476060) Even Though It's 29% Cheaper

Onconic Therapeutics Inc. (KOSDAQ:476060) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

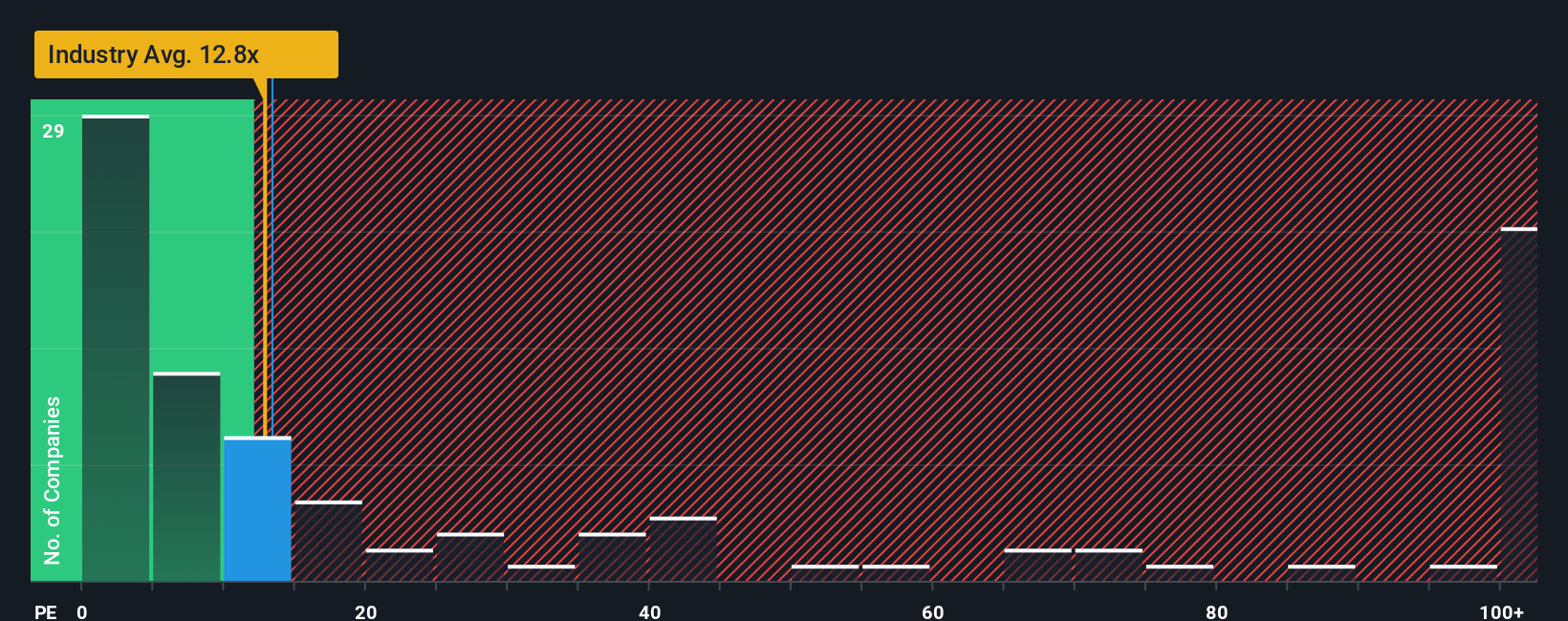

Even after such a large drop in price, there still wouldn't be many who think Onconic Therapeutics' price-to-sales (or "P/S") ratio of 13.3x is worth a mention when the median P/S in Korea's Biotechs industry is similar at about 12.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Onconic Therapeutics

How Onconic Therapeutics Has Been Performing

With revenue growth that's exceedingly strong of late, Onconic Therapeutics has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Onconic Therapeutics will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Onconic Therapeutics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Onconic Therapeutics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 75% shows it's noticeably more attractive.

In light of this, it's curious that Onconic Therapeutics' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Onconic Therapeutics' P/S

With its share price dropping off a cliff, the P/S for Onconic Therapeutics looks to be in line with the rest of the Biotechs industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision Onconic Therapeutics' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Onconic Therapeutics.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A476060

Onconic Therapeutics

Engages in the research and development of anti-cancer therapy in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives