- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A141080

While LigaChem Biosciences (KOSDAQ:141080) shareholders have made 380% in 5 years, increasing losses might now be front of mind as stock sheds 3.6% this week

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the LigaChem Biosciences Inc. (KOSDAQ:141080) share price. It's 380% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 18% over the last quarter.

Although LigaChem Biosciences has shed ₩152b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for LigaChem Biosciences

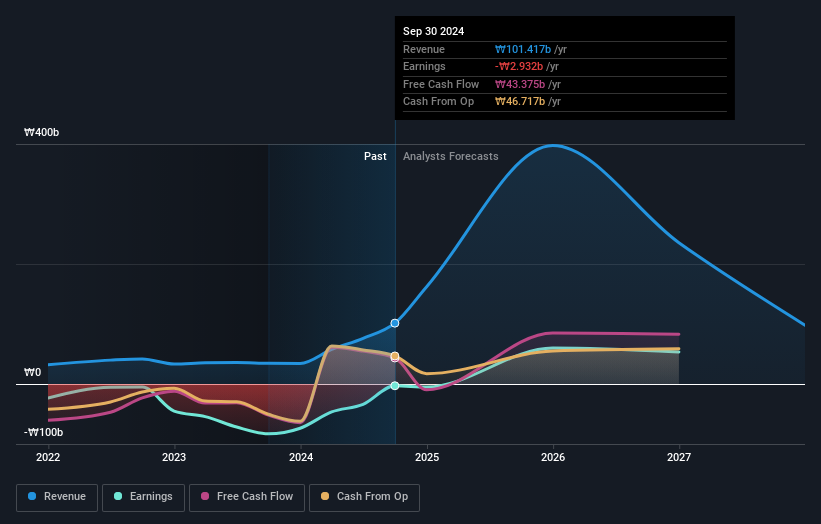

Given that LigaChem Biosciences didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years LigaChem Biosciences saw its revenue grow at 6.8% per year. That's a pretty good long term growth rate. Arguably it's more than reflected in the very strong share price gain of 37% a year over a half a decade. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling LigaChem Biosciences stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that LigaChem Biosciences shareholders have received a total shareholder return of 106% over one year. That's better than the annualised return of 37% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand LigaChem Biosciences better, we need to consider many other factors. Even so, be aware that LigaChem Biosciences is showing 1 warning sign in our investment analysis , you should know about...

Of course LigaChem Biosciences may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A141080

LigaChem Biosciences

A clinical stage biopharmaceutical company, engages in the discovery and development of medicines for unmet medical needs.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives