- South Korea

- /

- Biotech

- /

- KOSDAQ:A127120

JS Link, Inc.'s (KOSDAQ:127120) 26% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, JS Link, Inc. (KOSDAQ:127120) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days were the cherry on top of the stock's 490% gain in the last year, which is nothing short of spectacular.

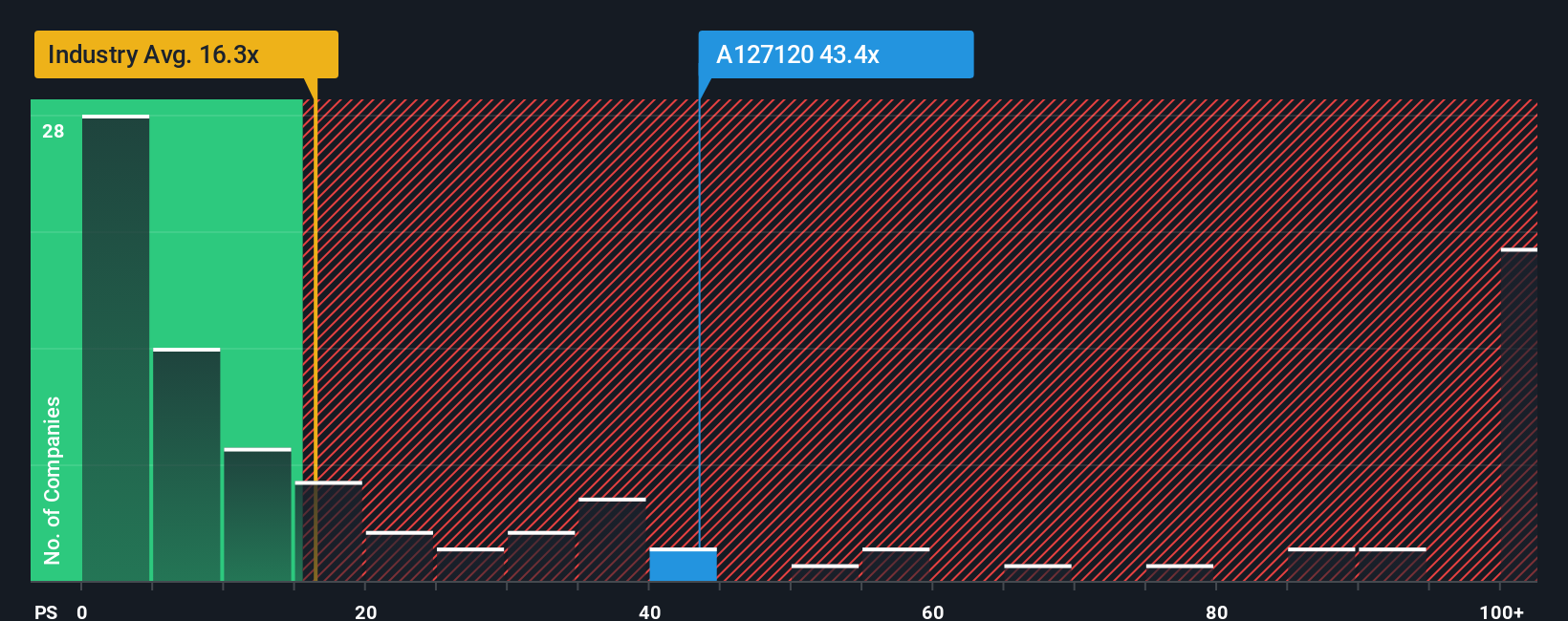

Since its price has surged higher, JS Link may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 43.4x, when you consider almost half of the companies in the Biotechs industry in Korea have P/S ratios under 16.3x and even P/S lower than 4x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for JS Link

How JS Link Has Been Performing

For instance, JS Link's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for JS Link, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is JS Link's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like JS Link's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. This means it has also seen a slide in revenue over the longer-term as revenue is down 32% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 69% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that JS Link is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in JS Link have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that JS Link currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 2 warning signs for JS Link (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on JS Link, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A127120

JS Link

A genome-based biotechnology company, focuses on the research and development of genome analysis services in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026