- South Korea

- /

- Commercial Services

- /

- KOSDAQ:A365340

Top 3 Growth Companies With High Insider Ownership On KRX

Reviewed by Simply Wall St

The South Korean stock market has shown resilience, climbing higher in three consecutive sessions and positioning the KOSPI above the 2,580-point mark. With a positive global outlook and optimism surrounding interest rates, investors are keenly eyeing growth companies with high insider ownership as potential opportunities. In this article, we will explore three such promising stocks listed on the Korea Exchange (KRX) that demonstrate strong growth potential coupled with significant insider investment.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Here's a peek at a few of the choices from the screener.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of ₩1.33 trillion.

Operations: Medy-Tox generates revenue primarily from its biotechnology segment, amounting to ₩246.25 billion.

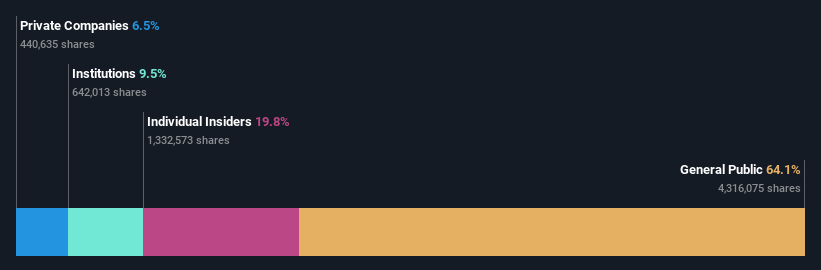

Insider Ownership: 19.8%

Revenue Growth Forecast: 12.2% p.a.

Medy-Tox, a growth company with high insider ownership in South Korea, reported second-quarter net income of KRW 11.41 billion despite negative sales. Although profit margins have declined from 12.9% to 1.9%, earnings are forecast to grow by 62% annually, outpacing the market's 29.1%. The company trades at a significant discount to its fair value and analysts agree on a potential price rise of 30.1%, despite recent share price volatility.

- Click here and access our complete growth analysis report to understand the dynamics of Medy-Tox.

- The valuation report we've compiled suggests that Medy-Tox's current price could be quite moderate.

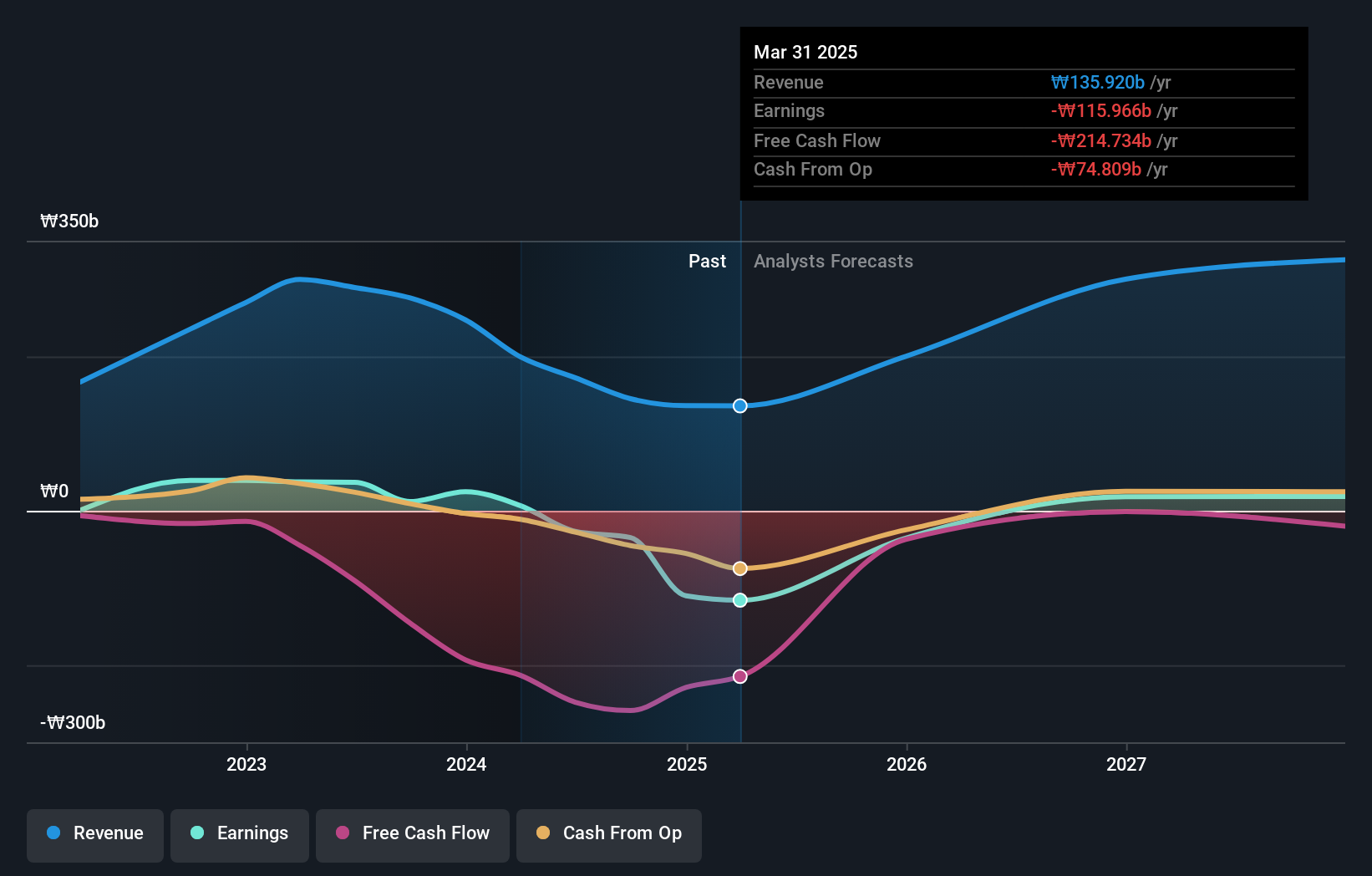

SungEel HiTech (KOSDAQ:A365340)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SungEel HiTech Co., Ltd. operates as a secondary battery recycling company in South Korea, with a market cap of ₩638.42 billion.

Operations: The company's revenue segments include ₩196.64 billion from Secondary Battery Raw Material Manufacturing.

Insider Ownership: 37.9%

Revenue Growth Forecast: 40% p.a.

SungEel HiTech, with significant insider ownership, is forecast to see revenue grow by 40% annually, outpacing the South Korean market's 10.4%. The company is expected to become profitable within three years and trades at a substantial discount of 72.8% below its estimated fair value. However, its return on equity is projected to be low at 9.5%, and debt coverage by operating cash flow remains inadequate. Earnings are anticipated to grow significantly at 101.73% per year.

- Click to explore a detailed breakdown of our findings in SungEel HiTech's earnings growth report.

- Our comprehensive valuation report raises the possibility that SungEel HiTech is priced lower than what may be justified by its financials.

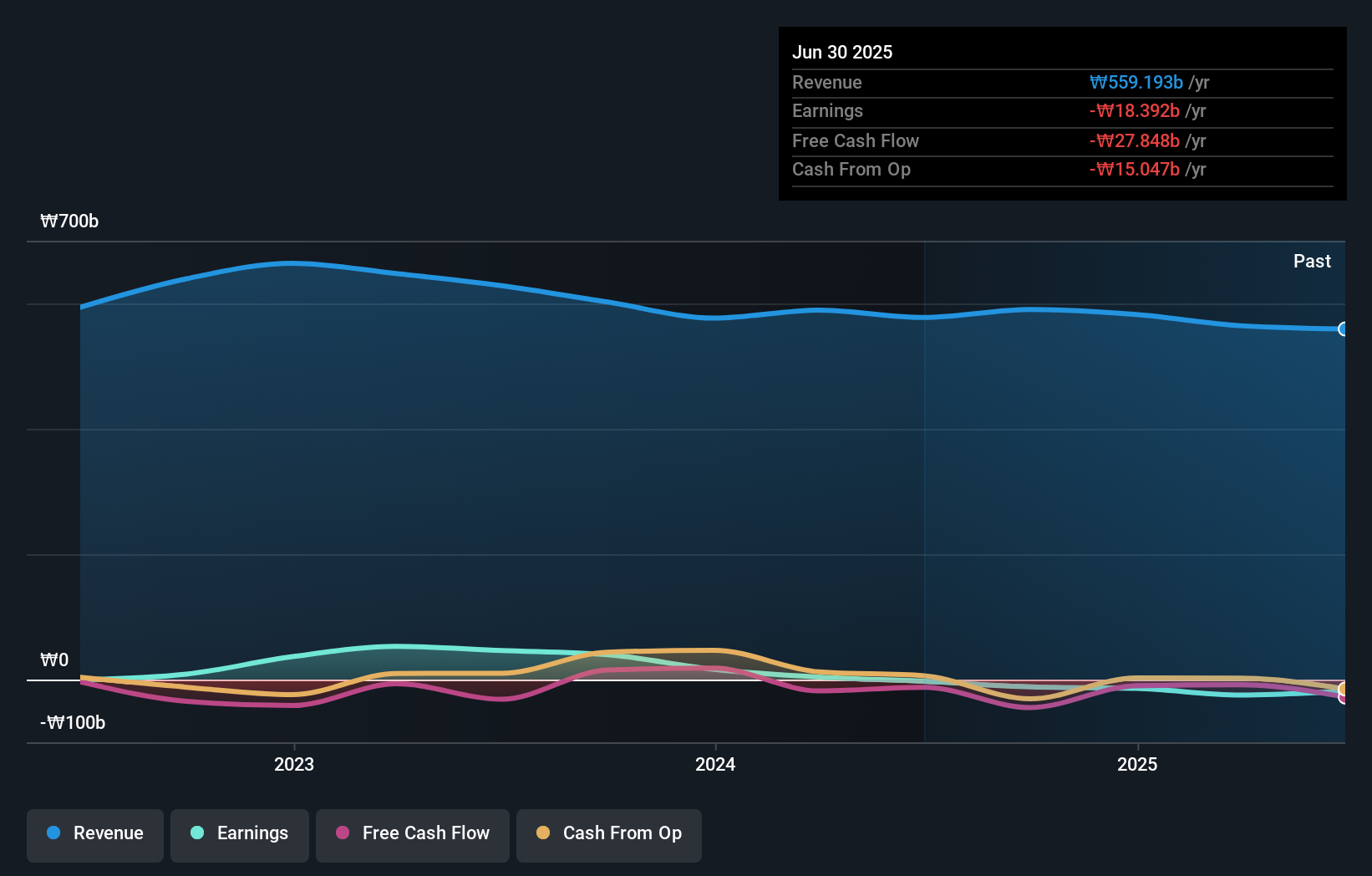

Shinsung E&GLtd (KOSE:A011930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shinsung E&G Co., Ltd. specializes in providing solar modules and solar systems both in Korea and internationally, with a market cap of ₩334.05 billion.

Operations: The company's revenue segments are comprised of ₩41.38 billion from the Renewable Energy Business Division and ₩532.80 billion from the Clean Environment Business Division.

Insider Ownership: 19.2%

Revenue Growth Forecast: 16.6% p.a.

Shinsung E&G Ltd., with high insider ownership, is forecast to grow its revenue by 16.6% annually, outpacing the South Korean market's 10.4%. The company is expected to become profitable within three years and trades at a 45% discount below estimated fair value. Earnings are projected to grow significantly at 108.51% per year, though interest payments are not well covered by earnings and return on equity is forecasted to be low at 14.4%.

- Unlock comprehensive insights into our analysis of Shinsung E&GLtd stock in this growth report.

- Our expertly prepared valuation report Shinsung E&GLtd implies its share price may be lower than expected.

Seize The Opportunity

- Unlock our comprehensive list of 88 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A365340

SungEel HiTech

Operates as a secondary battery recycling company in South Korea.

High growth potential and slightly overvalued.