- South Korea

- /

- Chemicals

- /

- KOSE:A069260

KRX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.2%, while remaining flat over the past 12 months. With earnings forecast to grow by 29% annually, selecting strong dividend stocks can be a strategic way to enhance your portfolio's stability and income potential in this evolving market.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.34% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.47% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.47% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.28% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.17% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.82% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.33% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.03% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.69% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.49% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

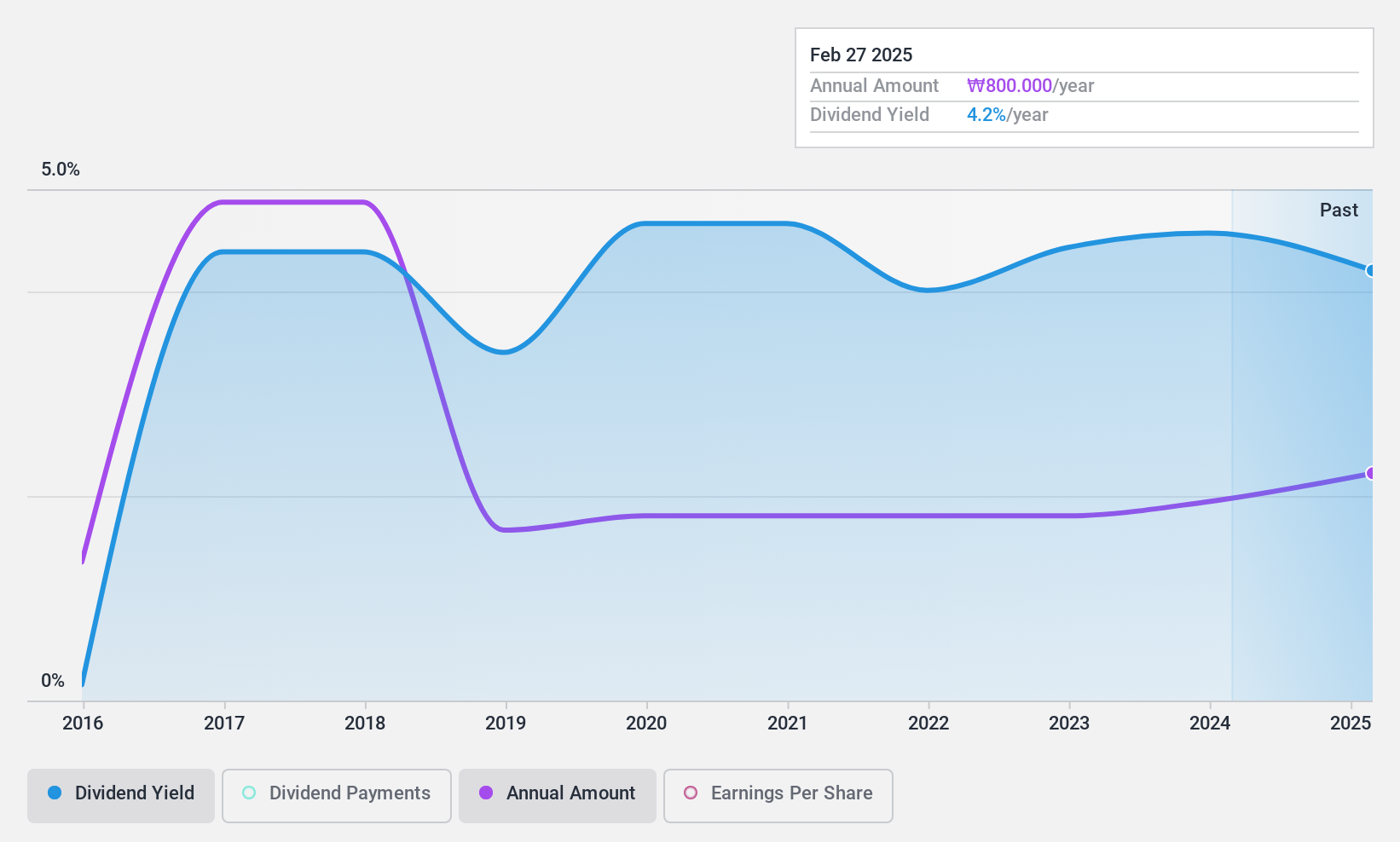

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ORION Holdings Corp. manufactures and sells confectioneries in South Korea, China, and internationally, with a market cap of ₩961.90 billion.

Operations: ORION Holdings Corp. generates revenue primarily from its confectionery segment (₩3.72 trillion), along with contributions from video (₩107.12 million) and landlord operations (₩38.70 million).

Dividend Yield: 4.7%

ORION Holdings' dividend payments are well-covered by earnings (41.2% payout ratio) and cash flows (10.7% cash payout ratio). Despite a volatile dividend history, the company has increased its dividends over the past decade. Recent earnings show strong performance with Q2 net income rising to ₩17.86 billion from ₩14.78 billion and six-month net income reaching ₩63.97 billion compared to ₩40.02 billion last year, indicating robust financial health supporting future dividends.

- Navigate through the intricacies of ORION Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report ORION Holdings implies its share price may be too high.

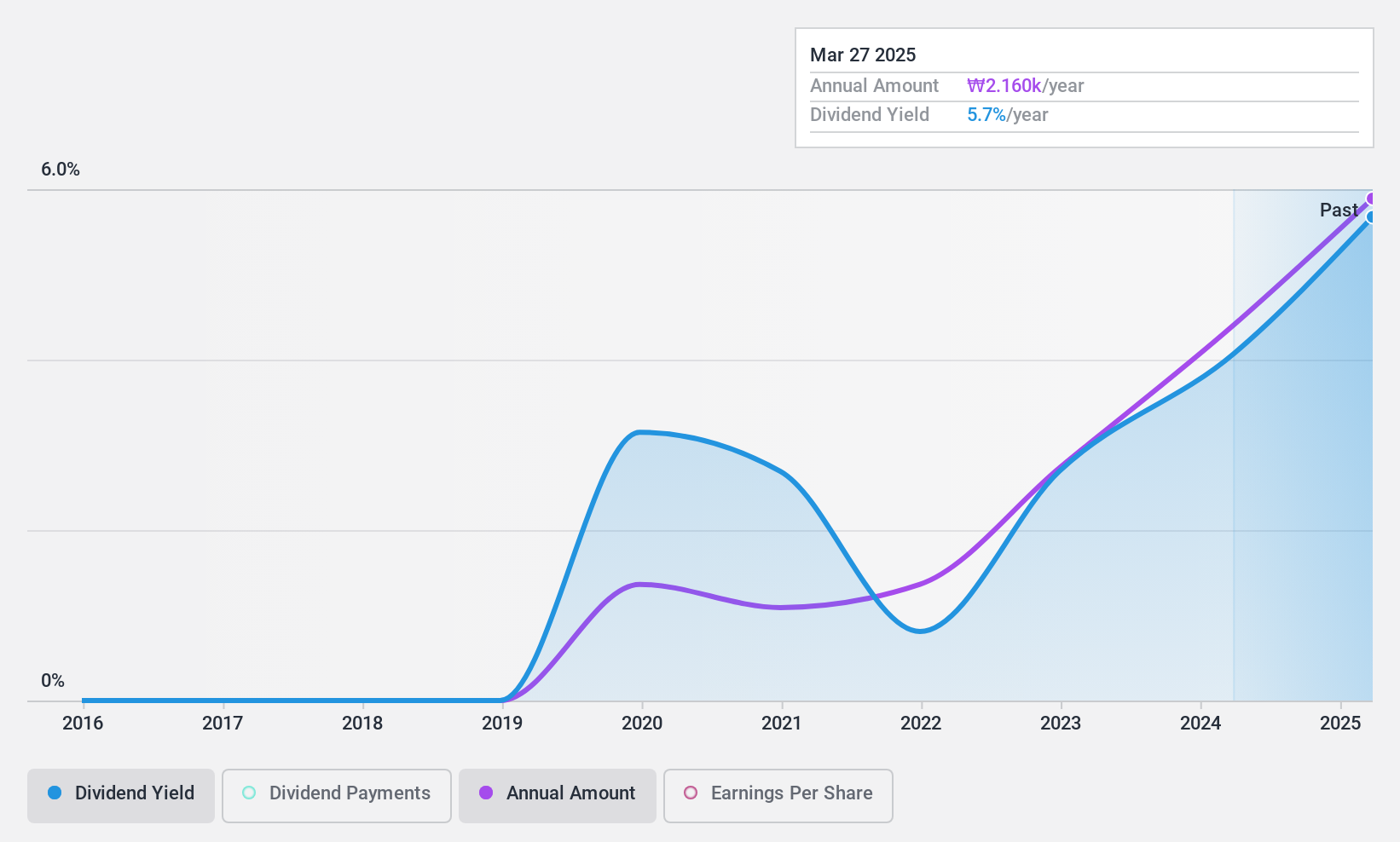

POSCO STEELEON (KOSE:A058430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POSCO STEELEON Co., Ltd. manufactures, processes, and sells steel products in South Korea and internationally, with a market cap of ₩248.61 billion.

Operations: POSCO STEELEON Co., Ltd. generates revenue primarily from its Metal Processors and Fabrication segment, which amounts to ₩1.21 trillion.

Dividend Yield: 3.9%

POSCO STEELEON's dividend yield (3.89%) ranks in the top 25% of South Korea's market, with a low payout ratio of 30.9%, ensuring dividends are well-covered by earnings. However, its dividend history is less reliable, having been paid for only five years with volatility. Despite this, the company's cash payout ratio is just 12.4%, indicating strong coverage by free cash flow. Recent earnings calls and reports show continued financial stability supporting future payouts.

- Take a closer look at POSCO STEELEON's potential here in our dividend report.

- According our valuation report, there's an indication that POSCO STEELEON's share price might be on the cheaper side.

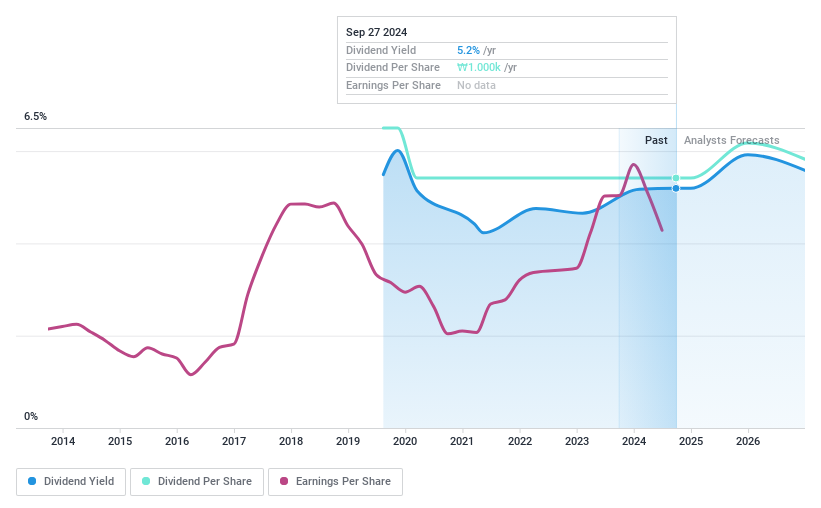

TKG Huchems (KOSE:A069260)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TKG Huchems Co., Ltd. manufactures and sells fine chemical products in South Korea and internationally, with a market cap of ₩740.56 billion.

Operations: TKG Huchems Co., Ltd. generates revenue primarily from its manufacturing segment, which amounts to ₩1.04 billion.

Dividend Yield: 5.2%

TKG Huchems' dividend yield of 5.18% places it in the top 25% of South Korea's market, supported by a low payout ratio of 37.9%, ensuring coverage by earnings. However, its five-year dividend history is unstable with payments having decreased and been volatile. Despite recent earnings declines—sales dropped to KRW 62.38 million in Q2 2024 from KRW 2,723.58 million last year—the cash payout ratio remains reasonable at 57.7%, indicating dividends are covered by cash flows.

- Dive into the specifics of TKG Huchems here with our thorough dividend report.

- Our valuation report unveils the possibility TKG Huchems' shares may be trading at a discount.

Seize The Opportunity

- Navigate through the entire inventory of 73 Top KRX Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKG Huchems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A069260

TKG Huchems

Manufactures and sells fine chemical products in South Korea and internationally.

Very undervalued with flawless balance sheet and pays a dividend.