- China

- /

- Entertainment

- /

- SZSE:300027

Insider Favorites Include OCI Holdings And Two Other Growth Leaders

Reviewed by Simply Wall St

In a week marked by lower finishes for major global indexes and cautious earnings reports from tech giants, growth stocks have generally lagged behind their value counterparts. Amid this backdrop, companies with high insider ownership often attract attention as they may signal confidence in the firm's future prospects, making them intriguing considerations for investors navigating today's complex market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

OCI Holdings (KOSE:A010060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd., along with its subsidiaries, offers a range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, Europe, and globally, with a market cap of ₩1.25 trillion.

Operations: The company generates revenue from its Basic Chemical Division, which accounts for ₩1.78 trillion, the Urban Development Business Sector with ₩606.66 billion, and the Energy Solution Division contributing ₩507.09 billion.

Insider Ownership: 29.2%

OCI Holdings demonstrates characteristics of a growth company with high insider ownership, trading at 73.5% below its estimated fair value. Despite recent shareholder dilution and lower profit margins compared to last year, the company's earnings are forecasted to grow significantly at 30.1% annually, outpacing the Korean market's average. The share repurchase program aims to enhance shareholder value and stabilize stock prices, having completed substantial buybacks totaling KRW 39.99 billion by September 2024.

- Dive into the specifics of OCI Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that OCI Holdings' current price could be quite moderate.

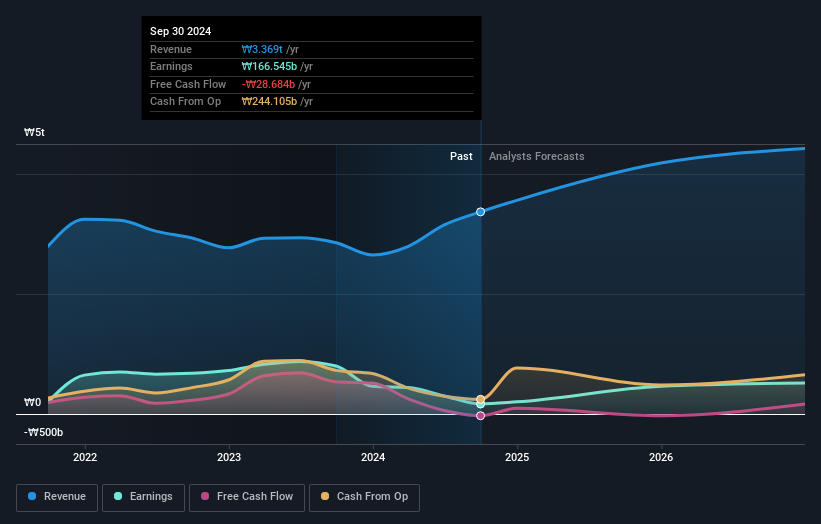

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company operating in China and internationally, with a market cap of CN¥7.55 billion.

Operations: Huayi Brothers Media Corporation generates revenue through various segments, including film and television production, talent management, and cinema operations.

Insider Ownership: 17.5%

Huayi Brothers Media shows potential for growth with insider ownership, despite recent volatility and being dropped from the FTSE All-World Index. The company reported a narrowed net loss of CNY 42.48 million for the nine months ending September 2024, compared to CNY 281.8 million a year ago. Revenue is forecasted to grow at 41.2% annually, surpassing market averages, and it is expected to become profitable within three years with high return on equity projections.

- Get an in-depth perspective on Huayi Brothers Media's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Huayi Brothers Media's shares may be trading at a premium.

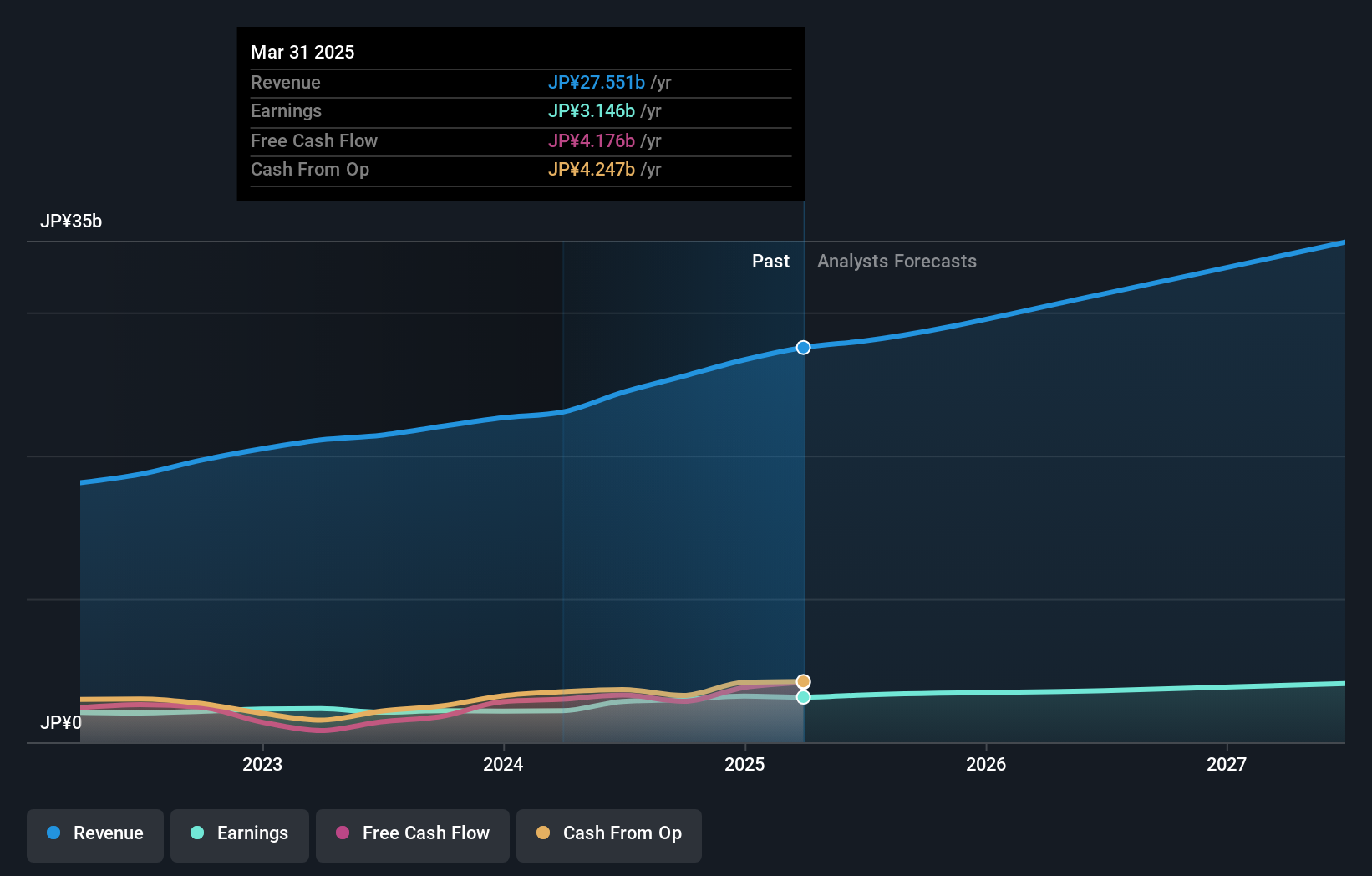

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥71.37 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group's revenue is primarily derived from its accounting, business intelligence, and outsourcing services.

Insider Ownership: 34%

Avant Group's insider ownership aligns with its growth trajectory, as the company is trading significantly below its estimated fair value. Revenue is forecast to grow at 15.8% annually, outpacing the JP market's average, while earnings are expected to increase by 18.1% per year. The recent completion of a buyback program involving ¥828.93 million underscores management's confidence in future prospects despite no substantial insider trading activity recently reported.

- Click here to discover the nuances of Avant Group with our detailed analytical future growth report.

- Our expertly prepared valuation report Avant Group implies its share price may be lower than expected.

Seize The Opportunity

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1530 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with mediocre balance sheet.