- South Korea

- /

- Hospitality

- /

- KOSE:A039130

3 Top KRX Dividend Stocks With Yields Up To 9.9%

Reviewed by Simply Wall St

Consumer sentiment in South Korea softened slightly in September, with the Composite Consumer Sentiment Index dipping to 100.0 from 100.8 in August, according to the Bank of Korea. Despite this cautious outlook, dividend stocks remain an attractive option for investors seeking steady income and potential capital appreciation amid fluctuating economic conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.34% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.44% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.54% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.32% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.14% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.96% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.35% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.01% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.62% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.54% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

LOTTE Fine Chemical (KOSE:A004000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LOTTE Fine Chemical Co., Ltd. engages in the manufacture and sale of chemical products in Korea and has a market cap of ₩1.26 trillion.

Operations: LOTTE Fine Chemical Co., Ltd. generates revenue from two main segments: the Chemical Division with ₩1.15 trillion and the Green Materials Division with ₩543.11 billion.

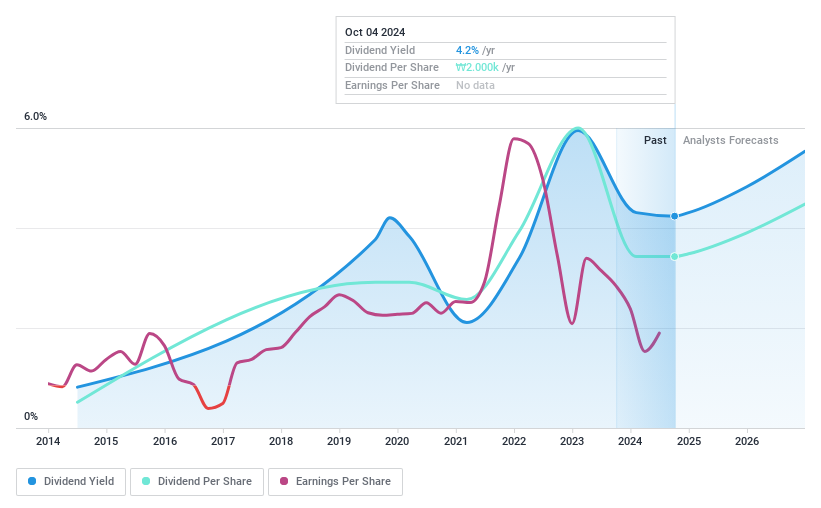

Dividend Yield: 4.1%

LOTTE Fine Chemical's dividend yield of 4.06% ranks in the top 25% of South Korean dividend payers, but its dividends have been volatile and not well covered by cash flows, with a high cash payout ratio of 138.6%. Despite trading at good value and being 38.7% below fair value estimates, recent exclusion from the FTSE All-World Index and declining profit margins highlight potential risks for investors seeking stable income sources.

- Take a closer look at LOTTE Fine Chemical's potential here in our dividend report.

- Our expertly prepared valuation report LOTTE Fine Chemical implies its share price may be lower than expected.

NICE Information Service (KOSE:A030190)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NICE Information Service Co., Ltd. offers credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea with a market cap of ₩625.76 billion.

Operations: NICE Information Service Co., Ltd. generates revenue from corporate and personal credit information (₩426.03 billion) and debt collection services (₩68.44 billion).

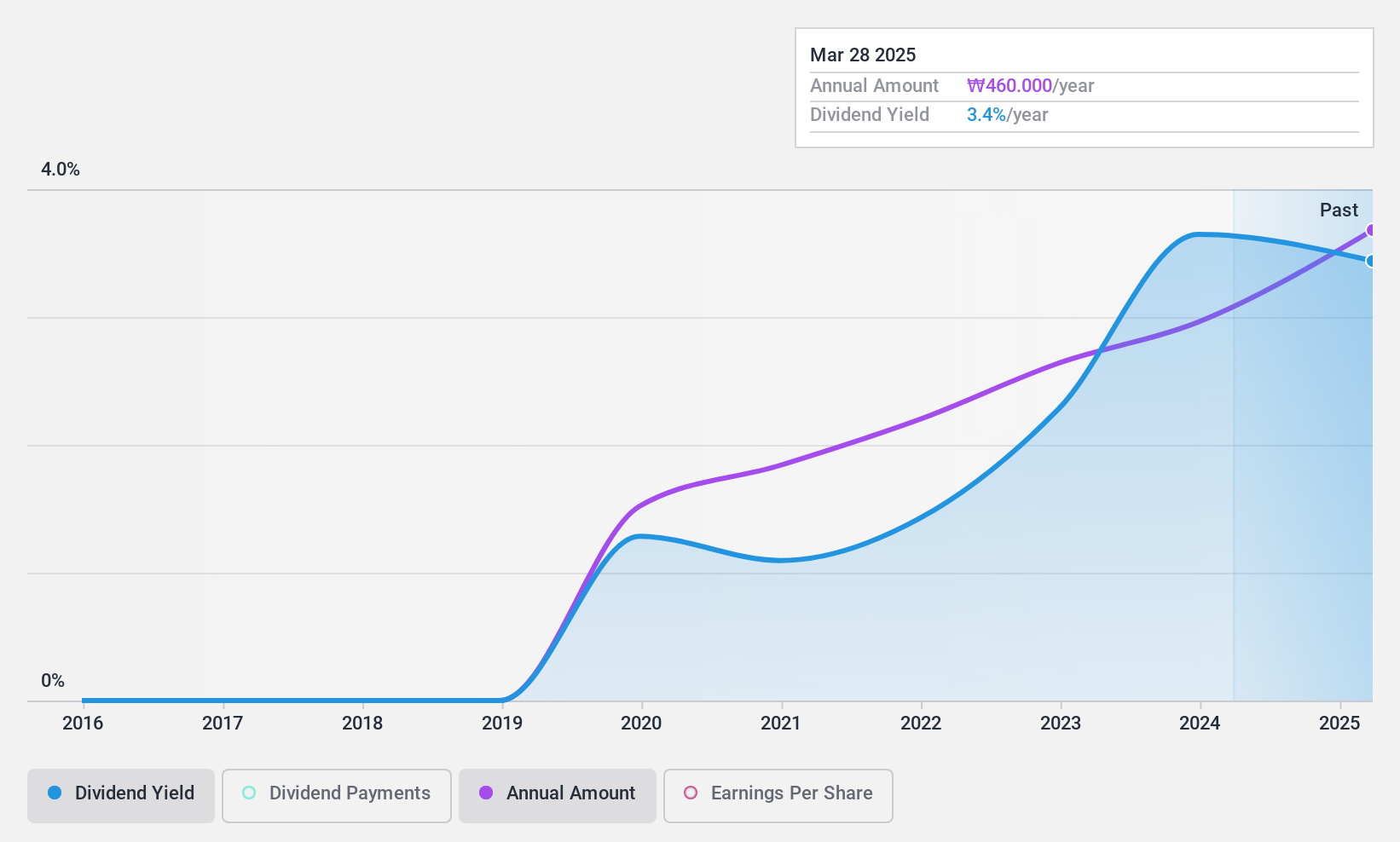

Dividend Yield: 3.8%

NICE Information Service offers a dividend yield of 3.84%, placing it in the top 25% of South Korean dividend payers. The company’s dividends are well-covered by both earnings (payout ratio: 39.2%) and cash flows (cash payout ratio: 31.8%). However, with only five years of dividend payments, its track record is relatively short despite stable payouts. Recent earnings growth supports sustainability, with net income for the second quarter at ₩18.75 billion compared to ₩16.81 billion a year ago.

- Unlock comprehensive insights into our analysis of NICE Information Service stock in this dividend report.

- In light of our recent valuation report, it seems possible that NICE Information Service is trading behind its estimated value.

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market cap of ₩776.05 billion.

Operations: Hanatour Service Inc. generates revenue primarily from its trip services (₩250.87 billion) and hotel services (₩23.89 billion).

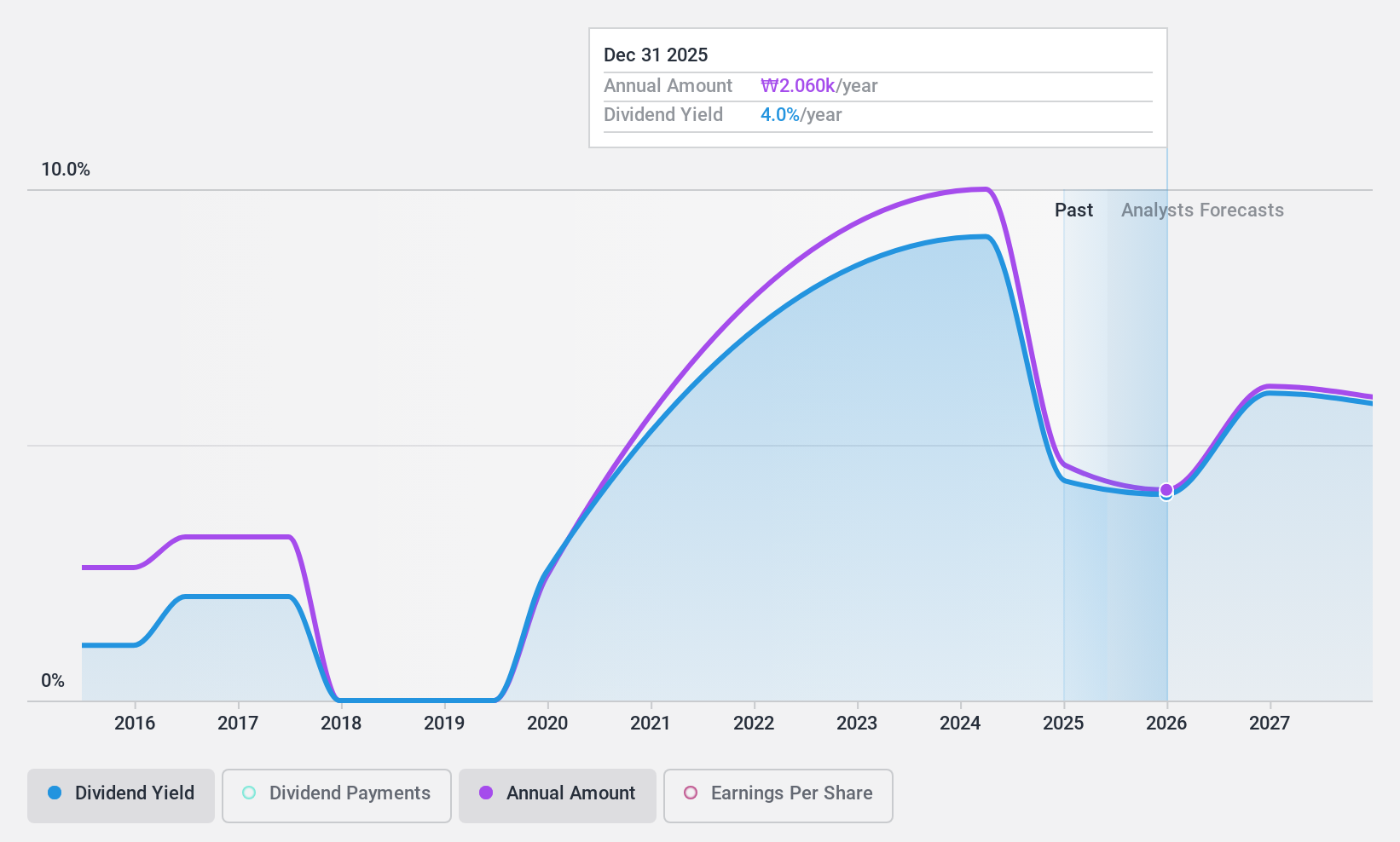

Dividend Yield: 10%

Hanatour Service's dividend yield of 9.98% is among the top 25% in South Korea, but its sustainability is questionable due to a high payout ratio of 140.3%. Despite recent earnings growth, with net income rising to ₩29.99 billion for the first half of 2024 from ₩21.68 billion a year ago, dividends have been volatile over the past decade. The company trades at a significant discount to its estimated fair value and analysts expect further price appreciation.

- Click here and access our complete dividend analysis report to understand the dynamics of Hanatour Service.

- The valuation report we've compiled suggests that Hanatour Service's current price could be quite moderate.

Taking Advantage

- Click here to access our complete index of 76 Top KRX Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanatour Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A039130

Hanatour Service

Provides travel and related services in South Korea, Northeast and Southeast Asia, the United States, and Europe.

Outstanding track record with flawless balance sheet and pays a dividend.