- South Korea

- /

- Metals and Mining

- /

- KOSE:A001430

Top KRX Dividend Stocks SeAH Besteel Holdings And 2 More

Reviewed by Simply Wall St

The South Korean stock market has been on a positive trajectory, buoyed by a series of gains following the Chuseok Thanksgiving holiday. The KOSPI index now sits just above the 2,580-point mark, reflecting optimism driven by favorable global economic forecasts and interest rate outlooks. In this promising environment, dividend stocks offer an attractive proposition for investors seeking stable returns. This article will explore three top dividend stocks listed on the Korea Exchange (KRX), starting with SeAH Besteel Holdings.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.30% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.25% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.60% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.38% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.29% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.78% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.01% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.91% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.18% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.33% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SeAH Besteel Holdings (KOSE:A001430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SeAH Besteel Holdings Corporation manufactures and sells special steel, heavy forgings, auto parts, and axles in South Korea with a market cap of ₩720.83 billion.

Operations: SeAH Besteel Holdings Corporation generates revenue primarily from its Special Steel segment, which accounts for ₩4.03 billion, and its Aluminum Extrusion Division, contributing ₩94.05 million.

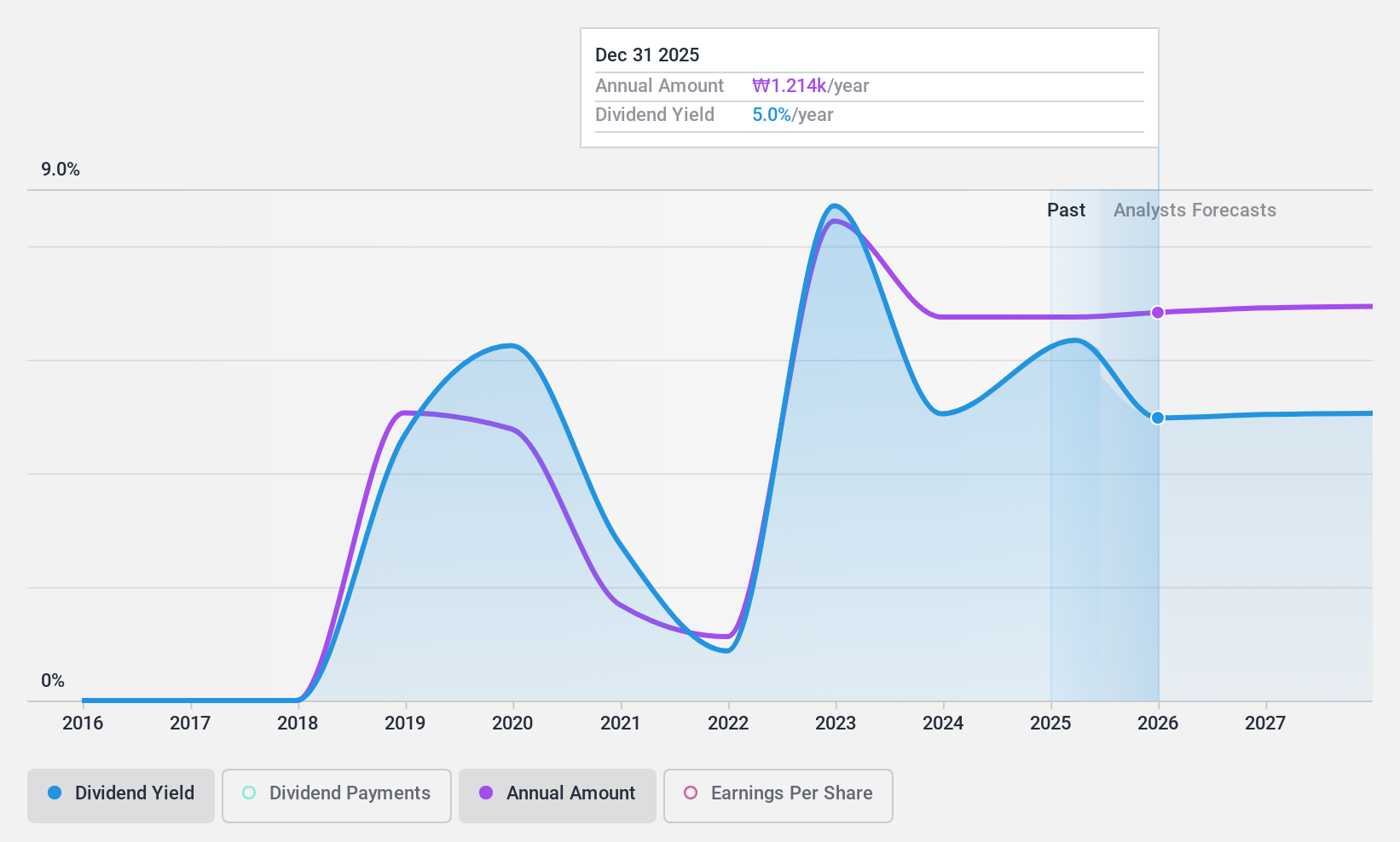

Dividend Yield: 6%

SeAH Besteel Holdings offers a mixed outlook for dividend investors. While its dividend yield is in the top 25% of South Korean payers and payments are well-covered by both earnings (50.4%) and cash flows (22.9%), the company has only been paying dividends for seven years, with a history of volatility including annual drops over 20%. However, it trades at 16.2% below our fair value estimate, suggesting potential undervaluation despite its unstable track record.

- Unlock comprehensive insights into our analysis of SeAH Besteel Holdings stock in this dividend report.

- The analysis detailed in our SeAH Besteel Holdings valuation report hints at an deflated share price compared to its estimated value.

Muhak (KOSE:A033920)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Muhak Co., Ltd. manufactures and sells liquors in South Korea with a market cap of ₩166.87 billion.

Operations: Muhak Co., Ltd. generates revenue primarily from its Liquor Division, which accounts for ₩146.33 billion, with an additional contribution of ₩2.94 billion from its Other Business Division.

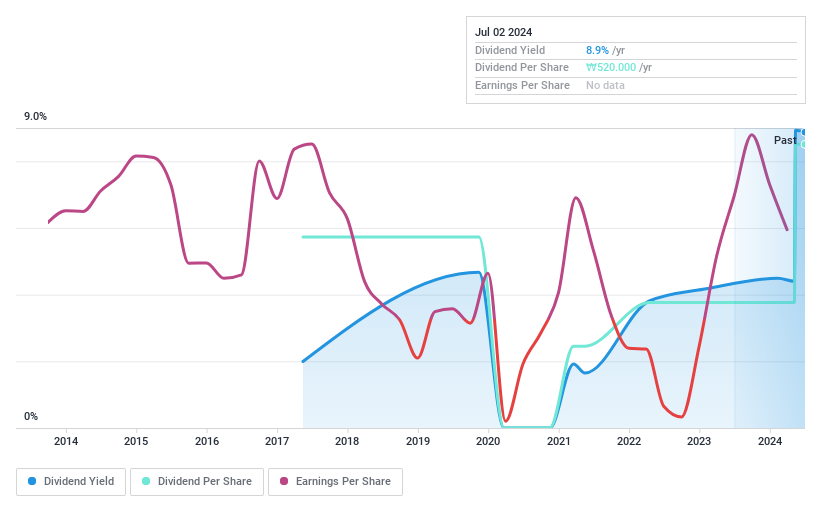

Dividend Yield: 8.3%

Muhak's dividend yield is among the top 25% in South Korea at 8.25%, and its payments are well-covered by earnings with a payout ratio of 27.1%. However, the company's dividend history over the past seven years has been volatile, with significant annual drops. Despite trading at 36.1% below our fair value estimate, Muhak's dividends have not been consistently reliable or growing, raising concerns about their sustainability.

- Navigate through the intricacies of Muhak with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Muhak is trading behind its estimated value.

JW Holdings (KOSE:A096760)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JW Holdings Corporation, along with its subsidiaries, operates as a healthcare company in South Korea and internationally, with a market cap of ₩252.04 billion.

Operations: JW Holdings Corporation generates revenue primarily from its Medicine segment (₩1.10 billion), followed by Holding Business (₩53.69 million) and Medical Equipment (₩23.31 million).

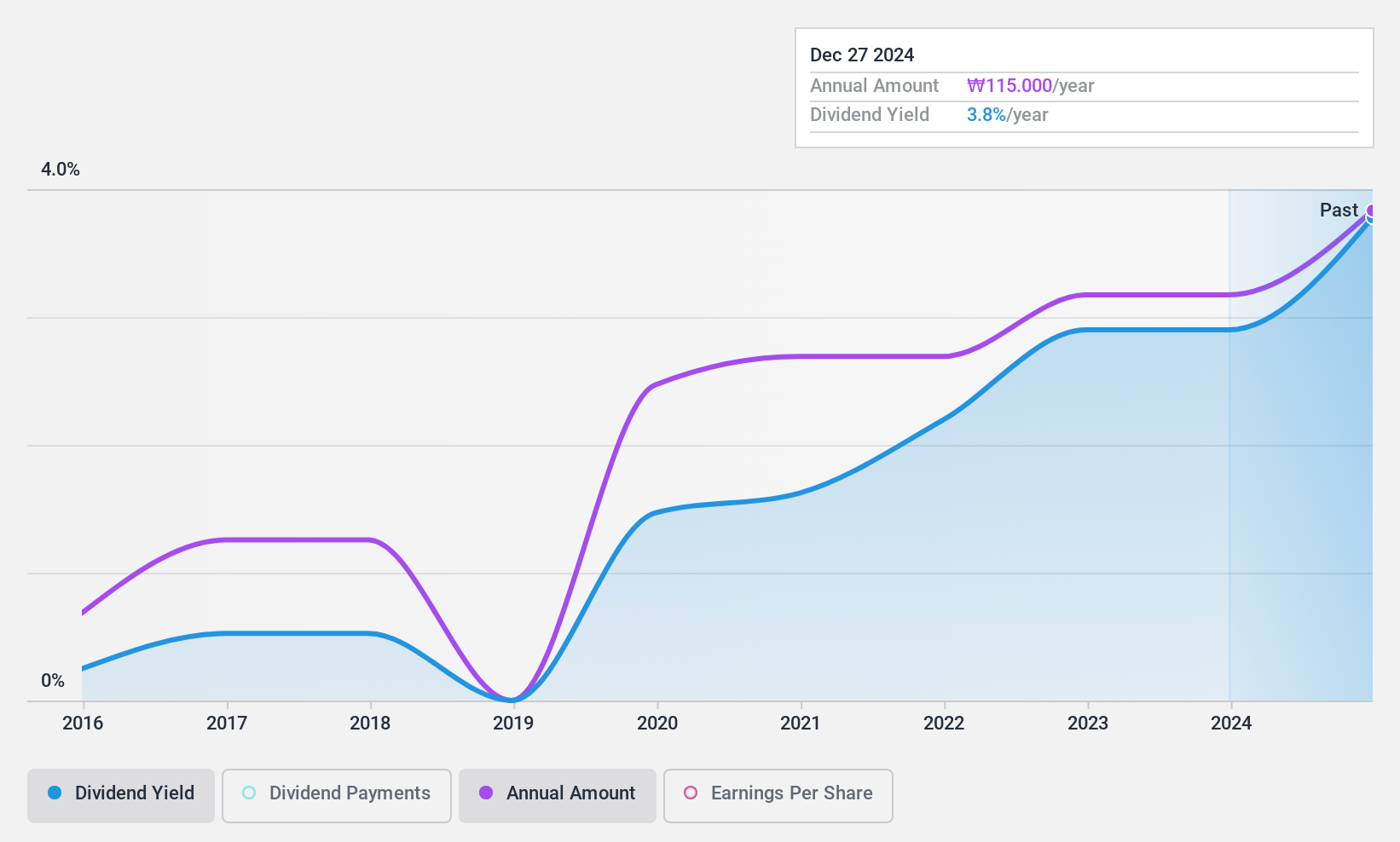

Dividend Yield: 3%

JW Holdings has shown strong earnings growth, with net income rising to KRW 42.18 billion for the first half of 2024. The company completed a significant share buyback, repurchasing 2.11% of shares for KRW 5.05 billion by August 30, 2024. Despite a dividend yield of only 3.01%, dividends have been stable and covered by both earnings (payout ratio: 13%) and cash flows (cash payout ratio: 6.7%) over the past decade, indicating sustainability but not top-tier yield in South Korea's market.

- Click here and access our complete dividend analysis report to understand the dynamics of JW Holdings.

- Our comprehensive valuation report raises the possibility that JW Holdings is priced lower than what may be justified by its financials.

Seize The Opportunity

- Explore the 75 names from our Top KRX Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001430

SeAH Besteel Holdings

Engages in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea.

Flawless balance sheet, good value and pays a dividend.