- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035900

3 High Growth KRX Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown robust performance, rising 4.1% over the past week and climbing 5.2% in the last year, with earnings forecasted to grow by 28% annually. In this favorable environment, stocks of growth companies with significant insider ownership can be particularly attractive due to their potential for strong performance and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 72.9% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 90.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 81.6% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 20% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's explore several standout options from the results in the screener.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

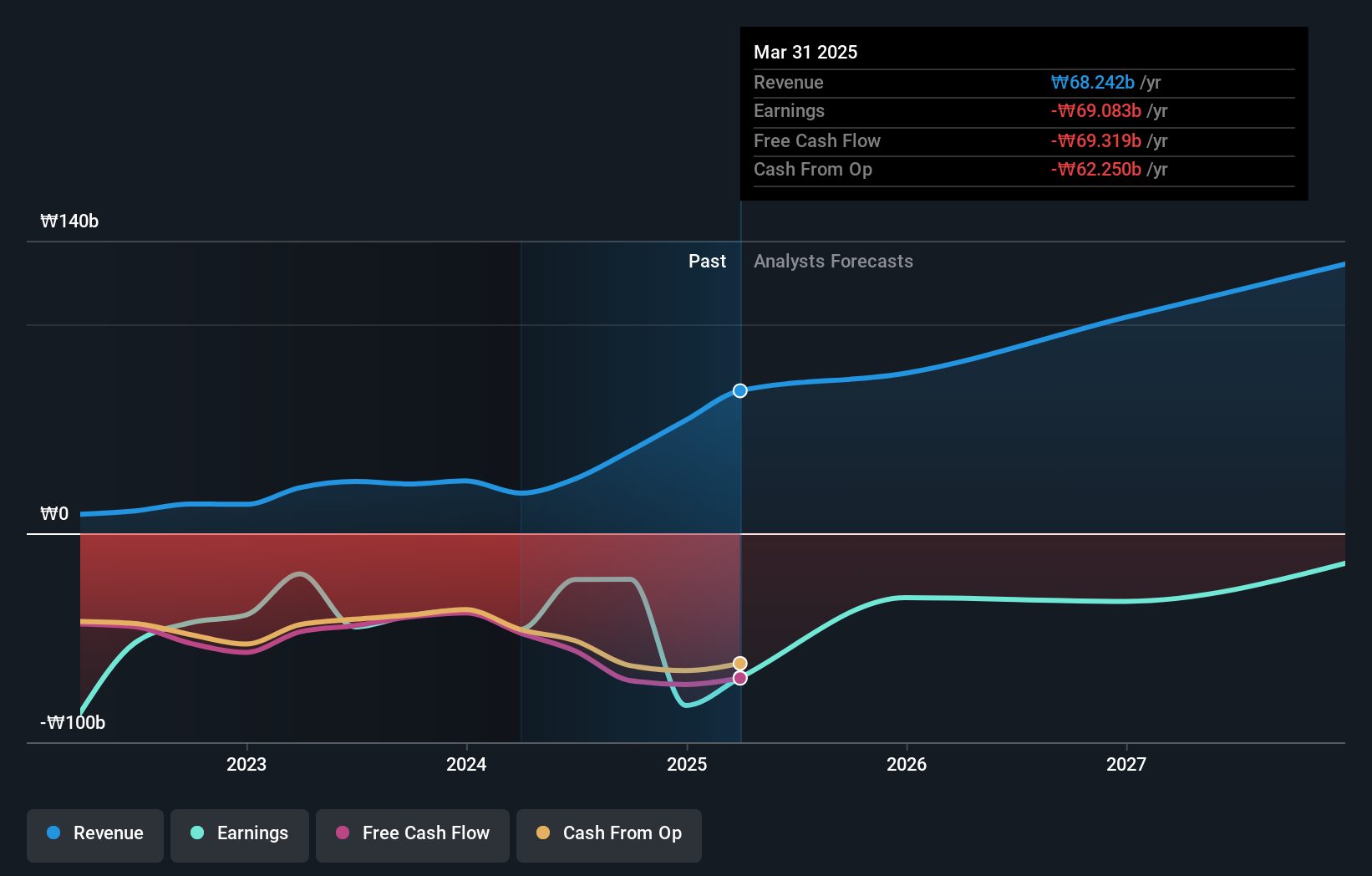

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally, with a market cap of approximately ₩1.67 trillion.

Operations: The company generates revenue from various segments, including artist management, music production and distribution, concert and event organization, and merchandise sales.

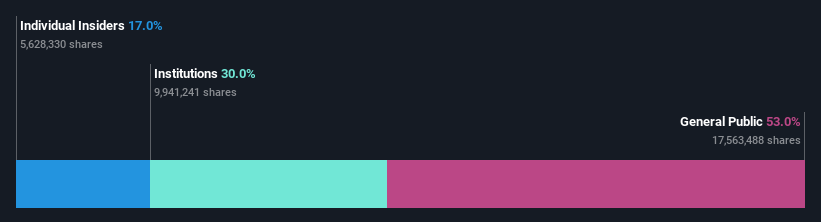

Insider Ownership: 17%

Earnings Growth Forecast: 23.7% p.a.

JYP Entertainment, a growth company with high insider ownership in South Korea, is expected to see significant earnings growth of 23.68% per year over the next three years. However, this is slower than the broader Korean market's forecasted growth of 28.2%. Despite trading at 56% below its estimated fair value and having a high forecasted return on equity of 22%, its profit margins have decreased from 21.4% to 13.5%, and it has an unstable dividend track record.

- Get an in-depth perspective on JYP Entertainment's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that JYP Entertainment's share price might be on the cheaper side.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. develops and provides AI-based software solutions for cancer screening, diagnosis, and treatment, with a market cap of ₩1.06 trillion.

Operations: Lunit Inc.'s revenue from healthcare software amounts to ₩19.25 billion.

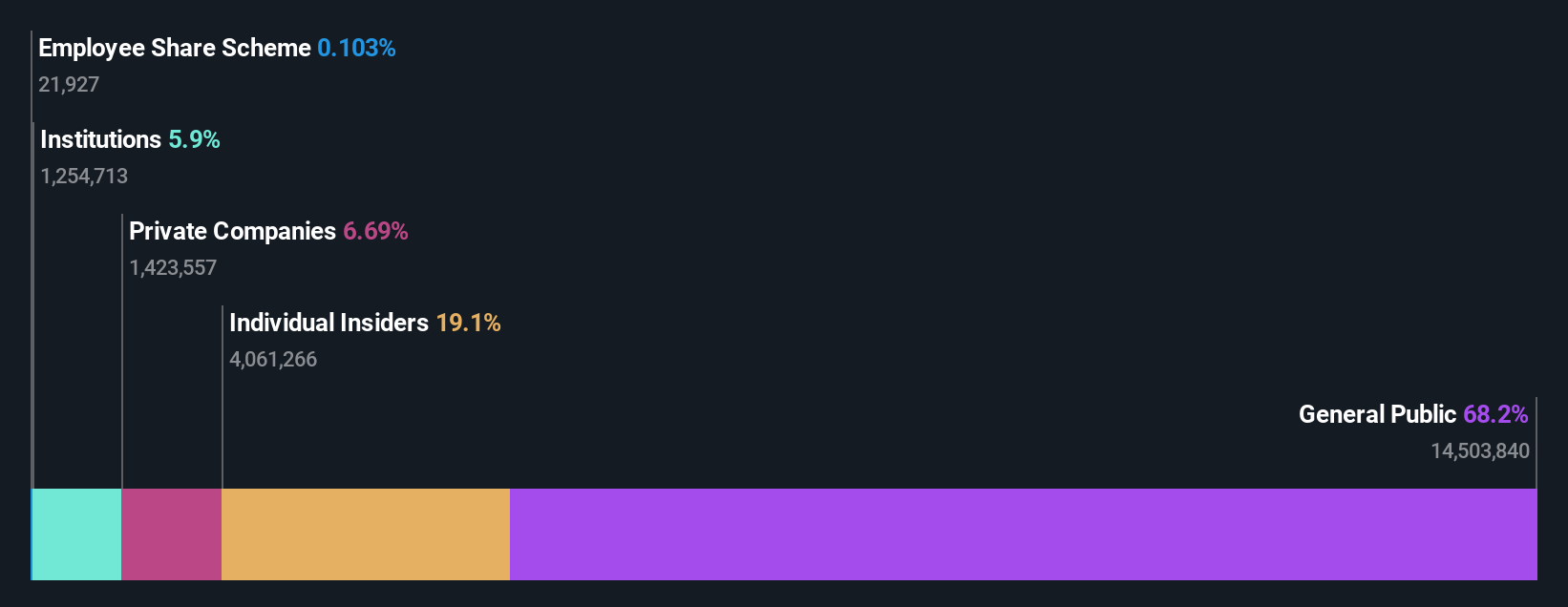

Insider Ownership: 21%

Earnings Growth Forecast: 101.2% p.a.

Lunit, a South Korean growth company with high insider ownership, has demonstrated robust performance in AI-powered medical imaging. Its Lunit INSIGHT CXR software showed superior TB detection capabilities in a recent study, achieving the highest AUC of 0.902 among competitors. Additionally, Lunit's revenue is forecast to grow 51.3% annually, significantly outpacing the market average of 10.4%. Despite previous shareholder dilution and low forecasted return on equity (5.3%), the company is expected to become profitable within three years.

- Navigate through the intricacies of Lunit with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Lunit implies its share price may be too high.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.39 trillion.

Operations: Enchem's revenue primarily comes from its Electronic Components & Parts segment, generating ₩357.37 billion.

Insider Ownership: 19.4%

Earnings Growth Forecast: 144.8% p.a.

Enchem, a South Korean firm, is forecast to achieve high revenue growth of 56.5% annually and become profitable within three years. Despite recent shareholder dilution and a highly volatile share price over the past three months, Enchem's projected earnings growth of 144.8% per year positions it well above the market average. However, there is insufficient data on its return on equity forecast and no substantial insider trading information in the last three months.

- Click to explore a detailed breakdown of our findings in Enchem's earnings growth report.

- Our valuation report unveils the possibility Enchem's shares may be trading at a premium.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 86 more companies for you to explore.Click here to unveil our expertly curated list of 89 Fast Growing KRX Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A035900

JYP Entertainment

Operates as an entertainment company in South Korea and internationally.

Flawless balance sheet and good value.