- South Korea

- /

- Auto

- /

- KOSE:A000270

Top 3 Asian Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets closely watch the Federal Reserve's upcoming decisions, Asian markets have been navigating a complex landscape characterized by mixed economic signals and cautious optimism. In this environment, dividend stocks can provide a measure of stability and income potential, making them an attractive consideration for investors seeking to balance risk with consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.92% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.51% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.72% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.81% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.45% | ★★★★★★ |

Click here to see the full list of 1035 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

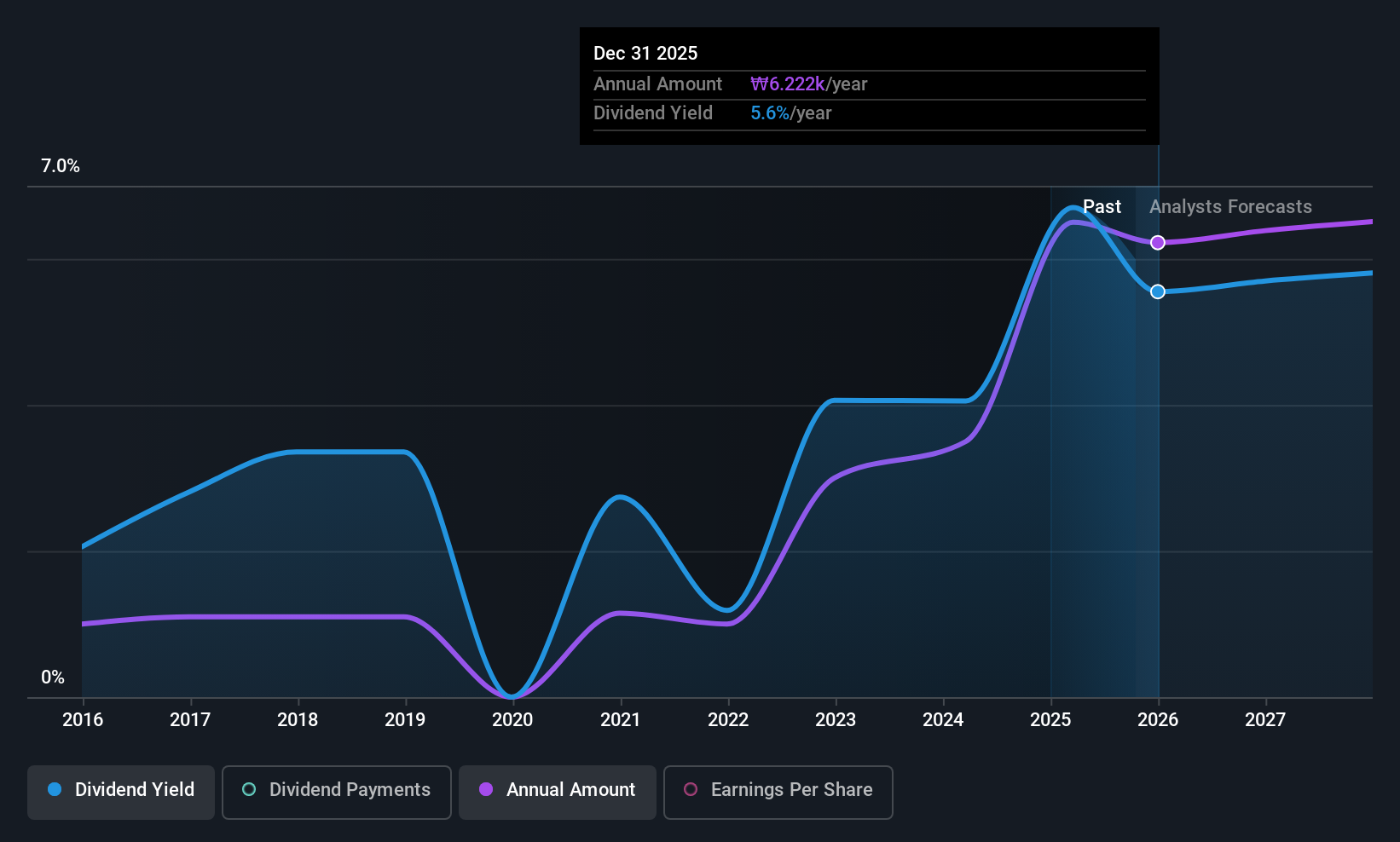

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation manufactures and sells vehicles across South Korea, North America, and Europe, with a market cap of ₩47.37 trillion.

Operations: Kia Corporation's revenue from the Auto Manufacturers segment is ₩113.20 billion.

Dividend Yield: 5.3%

Kia Corporation offers a compelling dividend profile with a high and reliable yield of 5.26%, ranking in the top 25% of Korean market dividend payers. The company's dividends are well covered by earnings and cash flows, with payout ratios at 32.5% and 41%, respectively, ensuring sustainability. Despite recent legal challenges, Kia's dividends have grown consistently over the past decade without volatility, indicating stability for income-focused investors even amidst operational changes like its Malaysian distribution reorganization.

- Get an in-depth perspective on Kia's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Kia's share price might be too pessimistic.

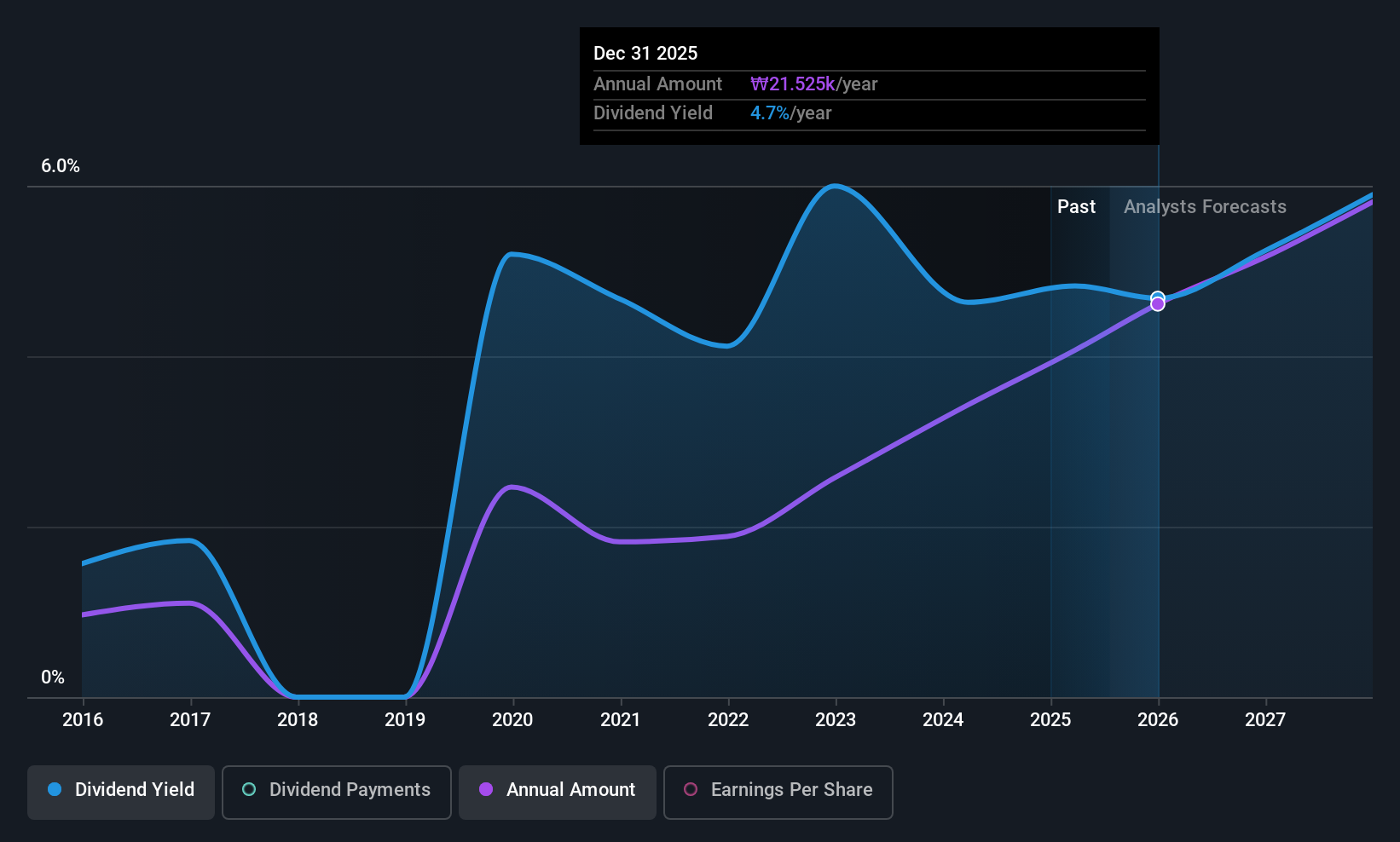

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. operates as a provider of non-life insurance products and services across several countries including South Korea, China, Indonesia, Vietnam, Singapore, the United States, and the United Kingdom with a market cap of ₩21.81 trillion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenue through offering a range of non-life insurance products and services across multiple international markets.

Dividend Yield: 3.6%

Samsung Fire & Marine Insurance offers a noteworthy dividend profile, with a yield of 3.64% placing it among the top 25% of Korean market payers. The dividends are well covered by earnings and cash flows, with payout ratios at 43.4% and 37.2%, respectively, suggesting sustainability despite past volatility in payments. Recent earnings showed a slight decline; net income for Q3 was ₩537.97 billion compared to ₩554.05 billion last year, reflecting some financial pressures.

- Click here and access our complete dividend analysis report to understand the dynamics of Samsung Fire & Marine Insurance.

- Our expertly prepared valuation report Samsung Fire & Marine Insurance implies its share price may be too high.

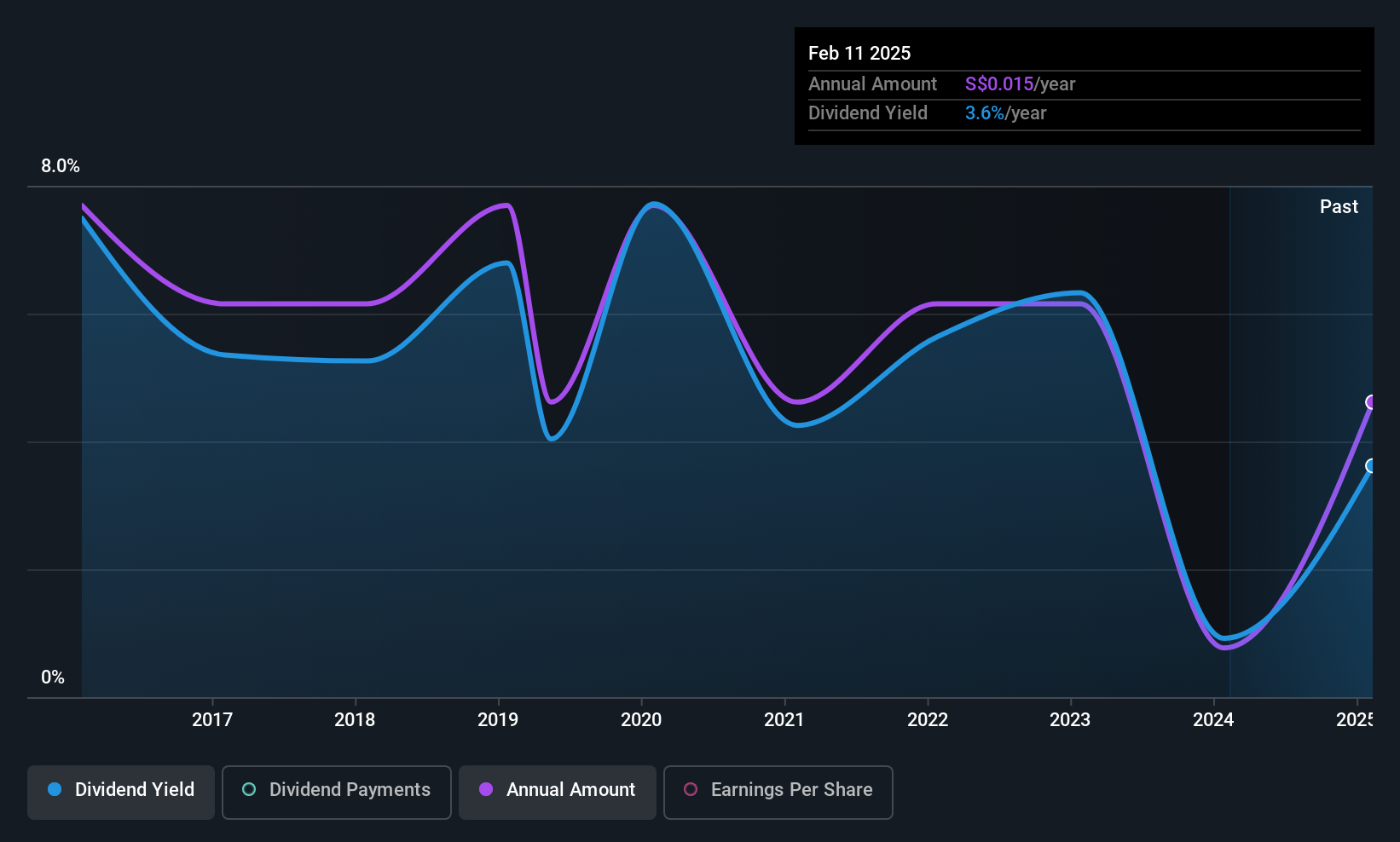

Nam Lee Pressed Metal Industries (SGX:G0I)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nam Lee Pressed Metal Industries Limited operates in the design, fabrication, supply, and installation of steel and aluminum products in Singapore and Malaysia with a market cap of SGD142.81 million.

Operations: Nam Lee Pressed Metal Industries Limited generates its revenue primarily from Aluminium (SGD134.72 million), followed by Mild Steel (SGD38.14 million) and Unplasticised Polyvinyl Chloride (SGD35.73 million).

Dividend Yield: 5.1%

Nam Lee Pressed Metal Industries' dividend yield of 5.08% is slightly below the top 25% of Singaporean market payers, but its dividends are well covered by earnings and cash flows, with payout ratios of 29.3% and 27.5%, respectively. Despite a volatile dividend history over the past decade, recent earnings growth—net income rose to S$24.81 million from S$12.24 million—suggests potential for improved stability in future payouts.

- Take a closer look at Nam Lee Pressed Metal Industries' potential here in our dividend report.

- Our valuation report unveils the possibility Nam Lee Pressed Metal Industries' shares may be trading at a discount.

Seize The Opportunity

- Click this link to deep-dive into the 1035 companies within our Top Asian Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026