- China

- /

- Electrical

- /

- SHSE:688408

Global Insights Into 3 Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the current global market landscape, concerns over elevated stock valuations and increased scrutiny on artificial intelligence spending have led to a pullback in growth-oriented stocks, with major indices like the Nasdaq Composite and Russell 1000 Growth Index experiencing notable declines. Amidst these fluctuations, insider ownership can serve as an indicator of confidence in a company's long-term potential, as insiders often possess unique insights into their business's prospects.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

We'll examine a selection from our screener results.

Seers Technology (KOSDAQ:A458870)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seers Technology Co., LTD. offers telemedicine solutions focused on patient monitoring in South Korea, with a market cap of ₩1.27 trillion.

Operations: Seers Technology Co., LTD. generates its revenue primarily from providing telemedicine solutions centered on patient monitoring in South Korea.

Insider Ownership: 33.9%

Revenue Growth Forecast: 53.2% p.a.

Seers Technology is forecast to experience substantial growth, with revenue expected to rise by 53.2% annually, outpacing the KR market's 10.4% growth rate. Earnings are projected to increase by 84.64% per year, and the company is anticipated to become profitable within three years, surpassing average market growth rates. Despite recent share price volatility, Seers Technology's addition to the S&P Global BMI Index highlights its growing prominence in the market.

- Unlock comprehensive insights into our analysis of Seers Technology stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Seers Technology shares in the market.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China with a market cap of CN¥39.24 billion.

Operations: The company's revenue primarily comes from the development, production, and sales of insulin and related products, amounting to CN¥3.85 billion.

Insider Ownership: 36.3%

Revenue Growth Forecast: 19.9% p.a.

Gan & Lee Pharmaceuticals is experiencing robust growth, with earnings increasing by 59.4% over the past year and forecasted to grow at 28.6% annually, outpacing the Chinese market's average. Recent strategic moves include a significant partnership in Brazil aimed at insulin self-sufficiency and appointing Dr. Ting Jia as Chief Medical Officer to bolster global R&D efforts. While insider ownership remains high, no substantial insider trading occurred recently, and its P/E ratio of 43.2x suggests reasonable valuation compared to the market.

- Delve into the full analysis future growth report here for a deeper understanding of Gan & Lee Pharmaceuticals.

- Our valuation report here indicates Gan & Lee Pharmaceuticals may be overvalued.

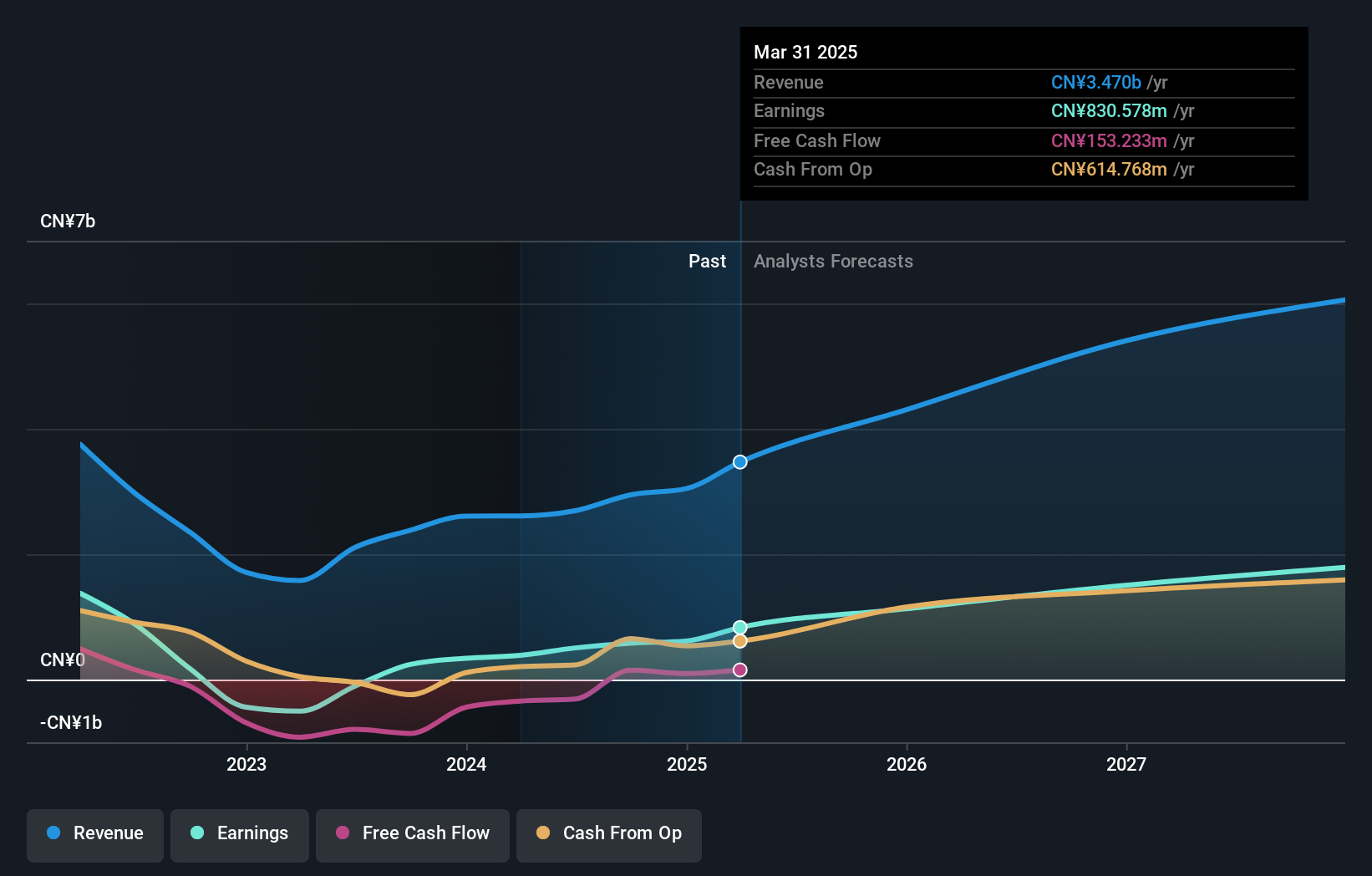

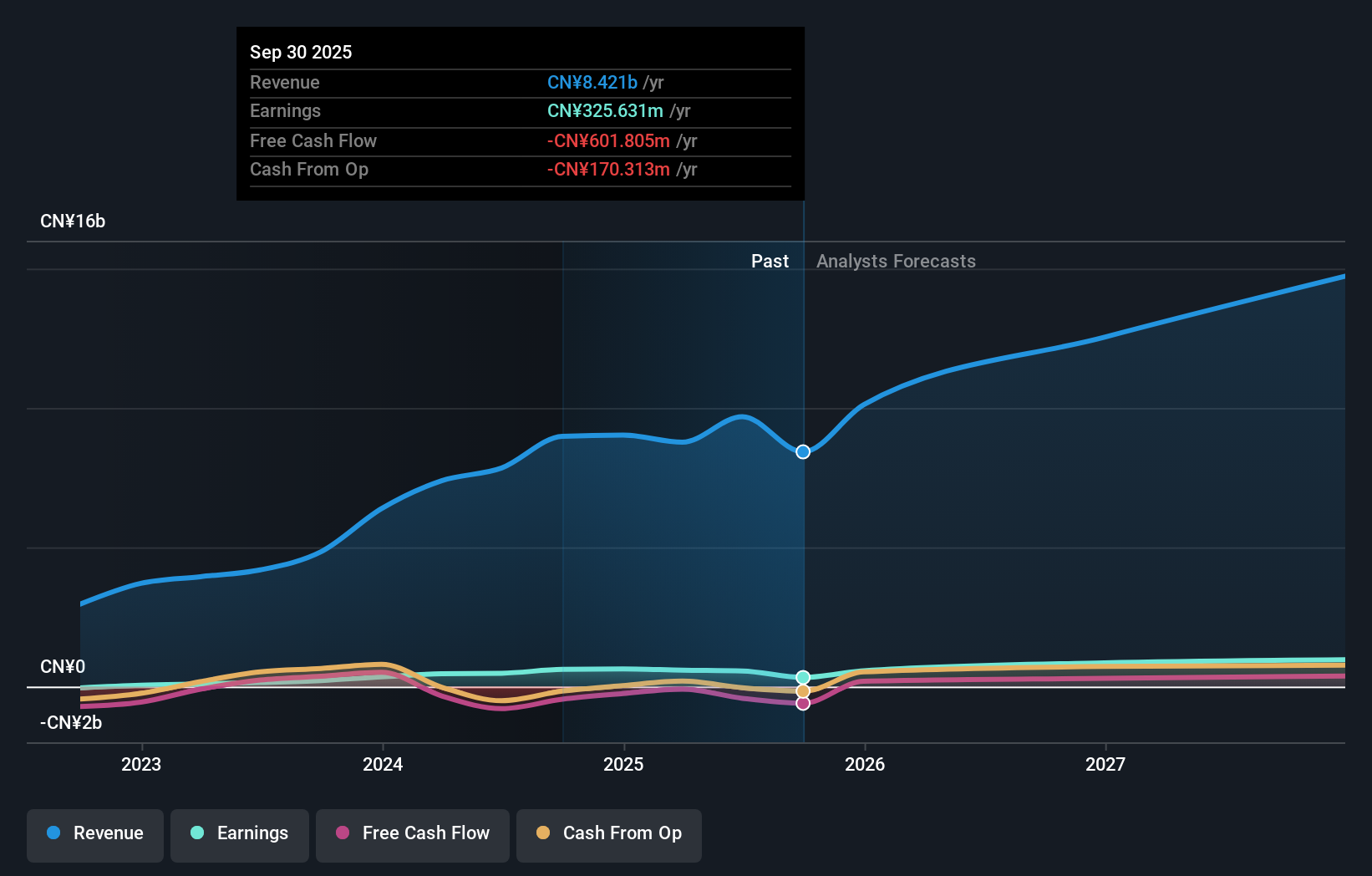

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arctech Solar Holding Co., Ltd. is a global manufacturer and supplier of solar trackers, fixed-tilt structures, cleaning robots, and energy storage solutions with a market cap of approximately CN¥10.37 billion.

Operations: Arctech Solar Holding Co., Ltd. generates revenue through its global provision of solar trackers, fixed-tilt structures, cleaning robots, and energy storage solutions.

Insider Ownership: 35.2%

Revenue Growth Forecast: 23.7% p.a.

Arctech Solar Holding is poised for substantial growth, with earnings expected to increase significantly at 41.7% annually, surpassing the Chinese market average. Despite a recent decline in net income and profit margins, the company trades at a favorable P/E ratio of 35.6x compared to the market's 45.2x, indicating good value. Recent developments include a share buyback program worth CNY 85.27 million, reflecting management's confidence in its future prospects despite no notable insider trading activity recently.

- Take a closer look at Arctech Solar Holding's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Arctech Solar Holding's current price could be quite moderate.

Make It Happen

- Unlock our comprehensive list of 829 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688408

Arctech Solar Holding

Manufactures and supplies solar trackers, fixed-tilt structures, cleaning robots, and energy storage solutions worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives