- Hong Kong

- /

- Semiconductors

- /

- SEHK:522

Asian Market Stocks Estimated Below Fair Value In December 2025

Reviewed by Simply Wall St

As we approach the end of 2025, Asian markets are experiencing a notable upswing, with investor enthusiasm for technology and artificial intelligence sectors helping to offset broader economic concerns. In this climate, identifying stocks that are potentially undervalued becomes crucial, as these opportunities may offer value in a market where optimism is tempered by caution.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥860.00 | ¥1700.65 | 49.4% |

| STI (KOSDAQ:A039440) | ₩26100.00 | ₩51792.38 | 49.6% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.16 | CN¥26.01 | 49.4% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29350.00 | ₩57372.06 | 48.8% |

| Japan Eyewear Holdings (TSE:5889) | ¥1980.00 | ¥3878.96 | 49% |

| East Buy Holding (SEHK:1797) | HK$20.60 | HK$40.28 | 48.9% |

| China Beststudy Education Group (SEHK:3978) | HK$4.70 | HK$9.28 | 49.4% |

| Beijing Roborock Technology (SHSE:688169) | CN¥152.79 | CN¥300.81 | 49.2% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.38 | CN¥56.05 | 49.4% |

| ASE Technology Holding (TWSE:3711) | NT$224.50 | NT$439.85 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

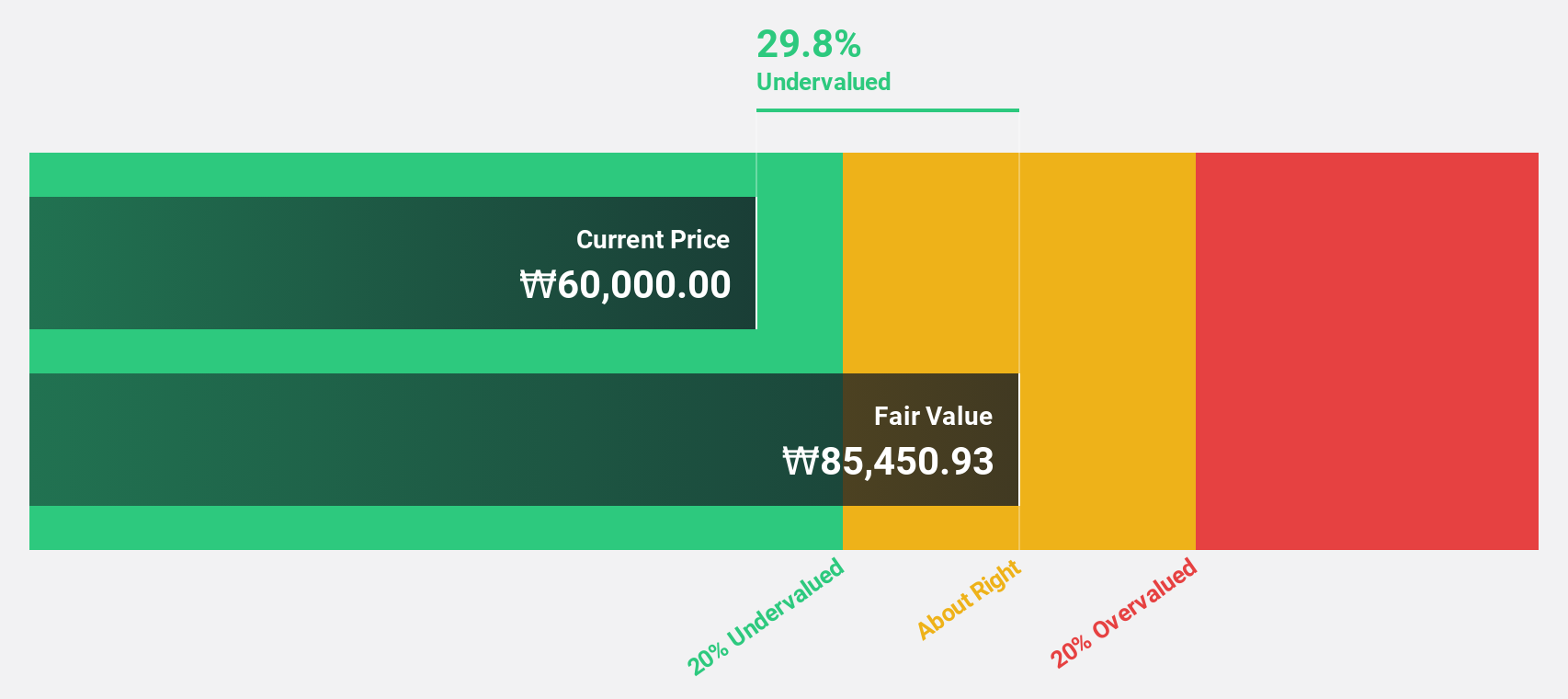

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.85 trillion.

Operations: CLASSYS Inc.'s revenue is generated from its global provision of medical aesthetics devices.

Estimated Discount To Fair Value: 37.1%

CLASSYS is trading at ₩58,900, significantly below its estimated fair value of ₩93,682.63. The company's earnings are projected to grow at 30.9% annually, outpacing the KR market's 28.5%. Recent Q3 results show net income surged to ₩33 billion from ₩16.49 billion a year ago, despite a slight sales decline. CLASSYS's innovative Ultraformer MPT device is expanding in Canada, potentially boosting revenue through increased demand for non-invasive skin procedures and enhancing cash flow prospects.

- Our growth report here indicates CLASSYS may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of CLASSYS stock in this financial health report.

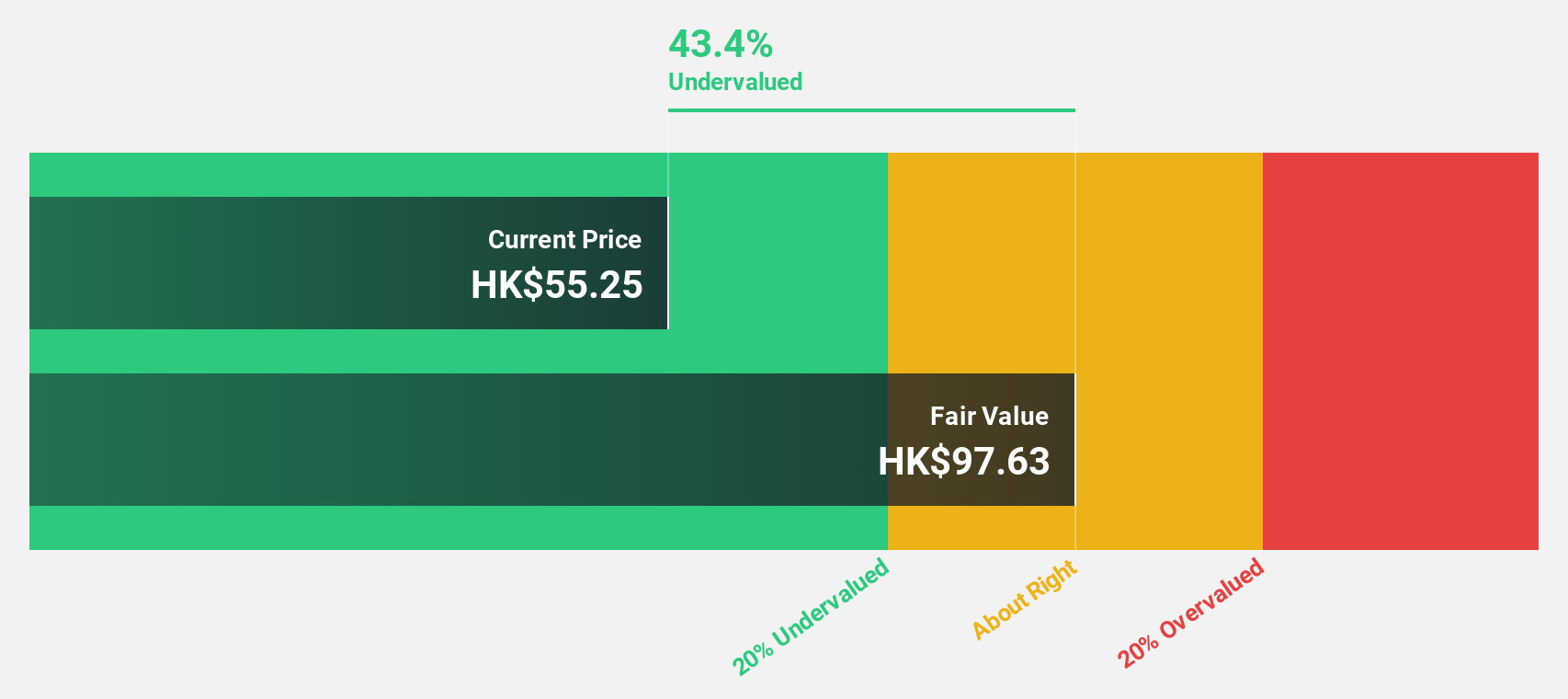

East Buy Holding (SEHK:1797)

Overview: East Buy Holding Limited is an investment holding company involved in the livestreaming e-commerce business, focusing on the sale of private label products in the People's Republic of China, with a market cap of HK$21.71 billion.

Operations: The company's revenue from its online live commerce business amounts to CN¥4.39 billion.

Estimated Discount To Fair Value: 48.9%

East Buy Holding is trading at HK$20.6, significantly below its estimated fair value of HK$40.28, representing a 48.9% discount. Despite a low current profit margin of 0.1%, earnings are expected to grow significantly at 58.8% annually over the next three years, surpassing the Hong Kong market's growth rate of 12.2%. Revenue is also forecast to increase by 13.4% per year, outpacing the local market's average growth rate of 8.5%.

- The growth report we've compiled suggests that East Buy Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of East Buy Holding.

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in designing, manufacturing, and marketing machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of HK$31.86 billion.

Operations: The company generates revenue through its Semiconductor Solutions segment, which contributes HK$7.86 billion, and its Surface Mount Technology (SMT) Solutions segment, which adds HK$5.73 billion.

Estimated Discount To Fair Value: 14.7%

ASMPT is trading at HK$76.5, below its estimated fair value of HK$89.67, reflecting a 14.7% discount. Analysts expect revenue growth of 12.4% annually, faster than the Hong Kong market's average of 8.5%. Although the company reported a net loss in Q3 2025 due to lower earnings, it anticipates revenue between US$470 million and US$530 million for Q4 2025, surpassing market expectations and driven by strong SEMI and SMT momentum.

- According our earnings growth report, there's an indication that ASMPT might be ready to expand.

- Click to explore a detailed breakdown of our findings in ASMPT's balance sheet health report.

Make It Happen

- Delve into our full catalog of 271 Undervalued Asian Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:522

ASMPT

An investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026