- Saudi Arabia

- /

- Electric Utilities

- /

- SASE:5110

Global Value Stocks Estimated Below Intrinsic Worth In December 2025

Reviewed by Simply Wall St

As global markets navigate the final month of 2025, investors are closely watching for potential interest rate cuts from central banks, while grappling with mixed economic signals such as declining manufacturing activity and resilient service sector growth. Amid these conditions, identifying undervalued stocks—those trading below their intrinsic worth—can offer opportunities for investors seeking value in a fluctuating market landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.59 | CN¥25.18 | 50% |

| Truecaller (OM:TRUE B) | SEK23.06 | SEK45.76 | 49.6% |

| Streamwide (ENXTPA:ALSTW) | €71.60 | €141.65 | 49.5% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.48 | 49.6% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK753.30 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| COVER (TSE:5253) | ¥1564.00 | ¥3094.01 | 49.5% |

| B&S Group (ENXTAM:BSGR) | €5.95 | €11.84 | 49.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.28 | CN¥55.83 | 49.3% |

Here's a peek at a few of the choices from the screener.

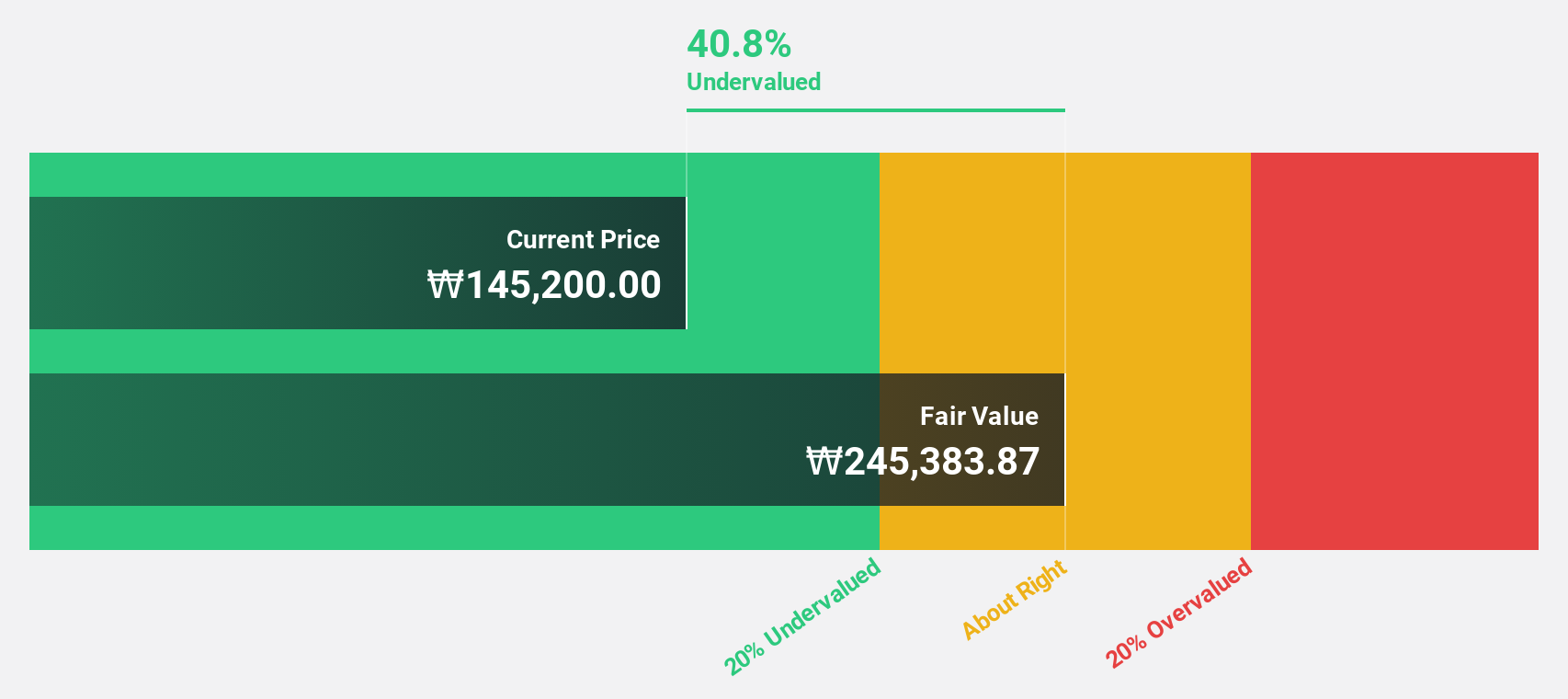

MNC SolutionLtd (KOSE:A484870)

Overview: MNC Solution Co.,Ltd is a Korean company that manufactures and sells hydraulic parts for the construction machinery and defense markets, with a market cap of ₩1.25 billion.

Operations: The company generates revenue of ₩263.89 million from its machinery and industrial equipment segment, focusing on hydraulic components for construction and defense sectors in Korea.

Estimated Discount To Fair Value: 44%

MNC Solution Ltd is trading at ₩137,300, significantly below its estimated fair value of ₩245,280.53. Despite high share price volatility recently, earnings are projected to grow substantially by 37.7% annually over the next three years, outpacing the KR market's growth rate. Revenue is also expected to rise significantly at 30.6% per year. The company announced a dividend of ₩1,480 per share for April 2026, highlighting its robust cash flow position amidst non-cash earnings concerns.

- According our earnings growth report, there's an indication that MNC SolutionLtd might be ready to expand.

- Click here to discover the nuances of MNC SolutionLtd with our detailed financial health report.

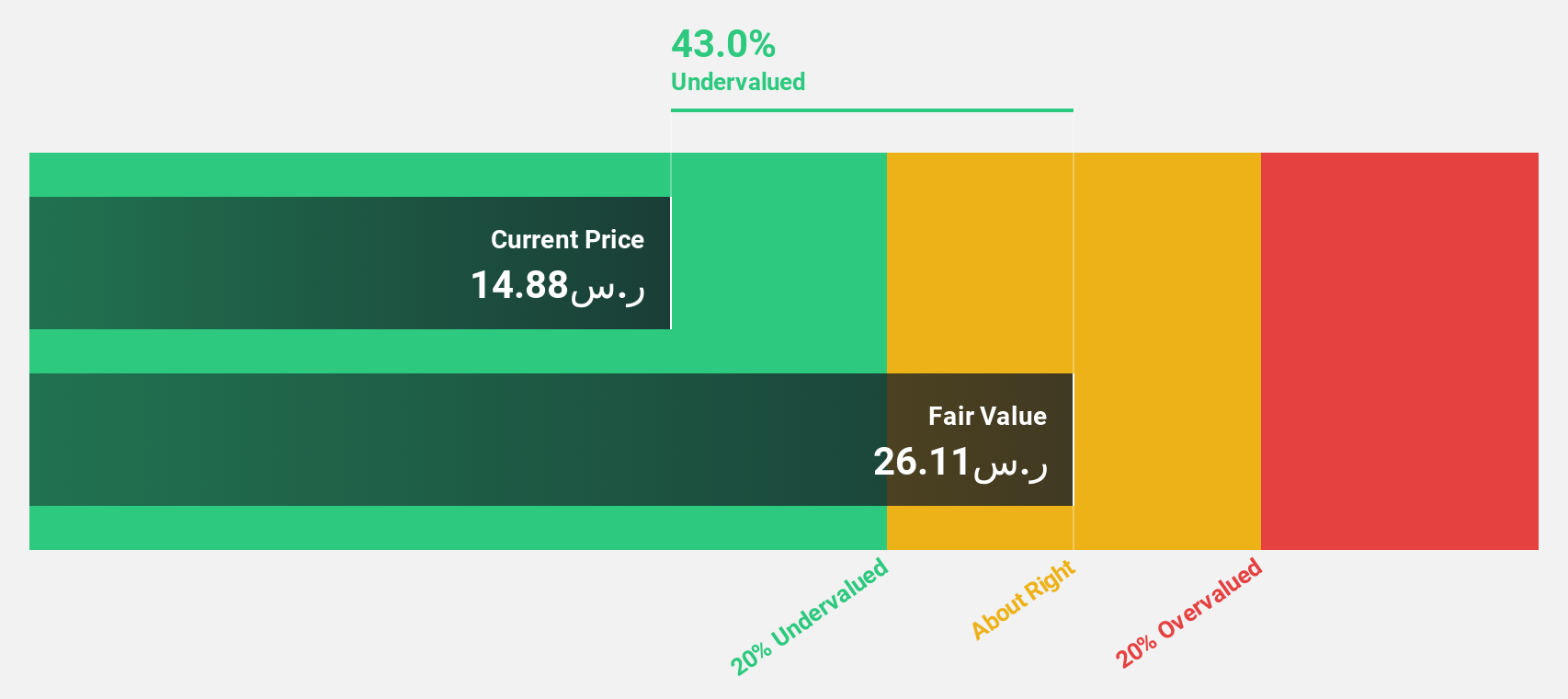

Saudi Electricity (SASE:5110)

Overview: Saudi Electricity Company, along with its subsidiaries, is involved in the generation, transmission, and distribution of electricity across Saudi Arabia and has a market cap of SAR59.21 billion.

Operations: The company's revenue segments include SAR29.24 billion from the National Grid Company, SAR18.37 billion from Generation, and SAR92.79 billion from Distribution and Subscribers Services in the Kingdom of Saudi Arabia.

Estimated Discount To Fair Value: 17.3%

Saudi Electricity is trading at SAR14.21, below its fair value estimate of SAR17.18, suggesting potential undervaluation based on cash flows. Despite high debt levels and a low forecasted return on equity of 7.1%, revenue growth is expected to outpace the Saudi market at 3.6% annually. Recent strategic initiatives include a significant solar power project and securing SAR10.8 billion in financing for energy expansion, reflecting a commitment to sustainable development amidst profitability challenges over the next three years.

- Our expertly prepared growth report on Saudi Electricity implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Saudi Electricity stock in this financial health report.

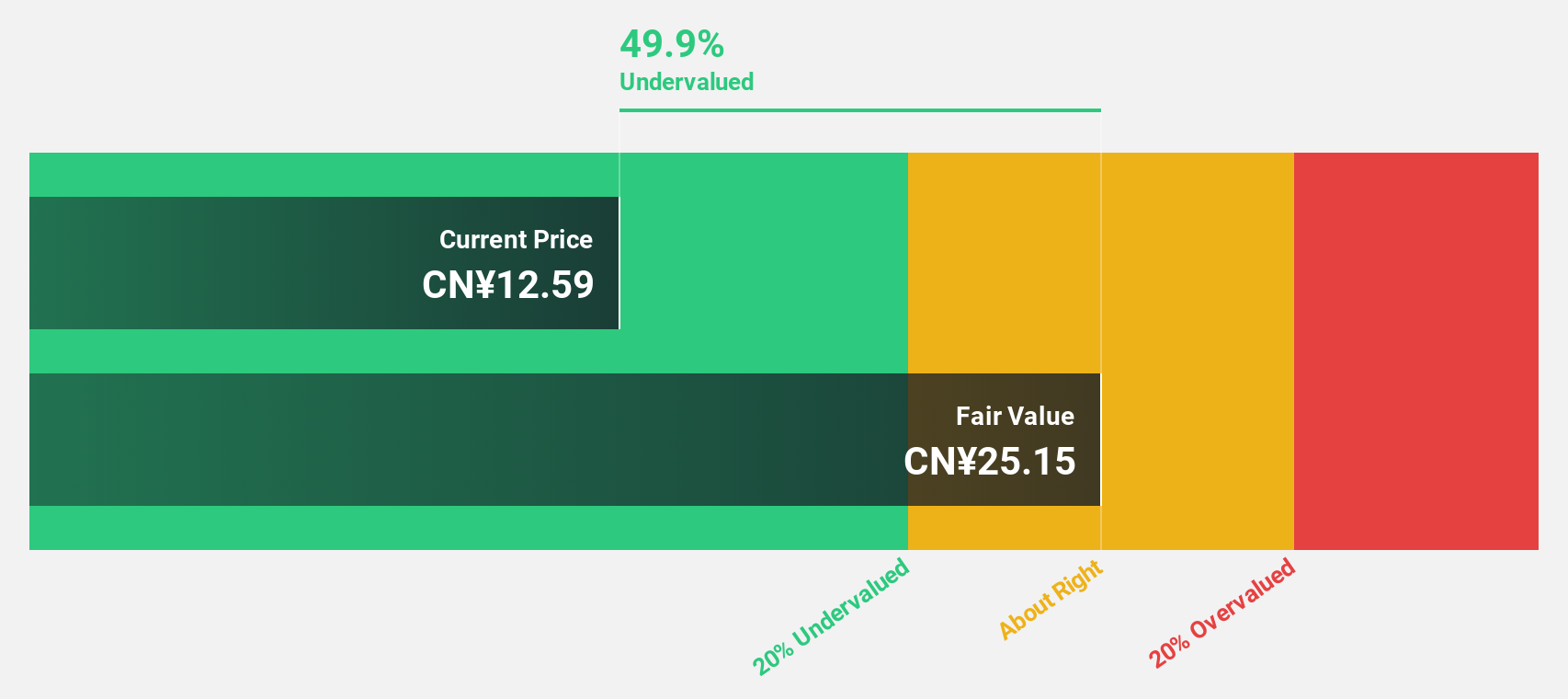

Wuhan Guide Infrared (SZSE:002414)

Overview: Wuhan Guide Infrared Co., Ltd. designs, manufactures, markets, and sells infrared thermal imaging detectors and modules, as well as electro-optical systems both in China and internationally, with a market cap of CN¥53.26 billion.

Operations: Wuhan Guide Infrared Co., Ltd.'s revenue is derived from the design, manufacture, marketing, and sale of infrared thermal imaging detectors and modules, along with electro-optical systems for both domestic and international markets.

Estimated Discount To Fair Value: 50%

Wuhan Guide Infrared is trading at CNY 12.59, significantly below its estimated fair value of CNY 25.18, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income reaching CNY 581.94 million for the first nine months of 2025, up from CNY 50.21 million a year ago. Despite large one-off items impacting results, forecasted earnings and revenue growth rates exceed those of the broader Chinese market over the next few years.

- In light of our recent growth report, it seems possible that Wuhan Guide Infrared's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Wuhan Guide Infrared's balance sheet health report.

Next Steps

- Gain an insight into the universe of 501 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:5110

Saudi Electricity

Generates, transmits, and distributes electricity in the Kingdom of Saudi Arabia.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026