- South Korea

- /

- Machinery

- /

- KOSE:A009540

These 4 Measures Indicate That HD Korea Shipbuilding & Offshore Engineering (KRX:009540) Is Using Debt Safely

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KRX:009540) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is HD Korea Shipbuilding & Offshore Engineering's Debt?

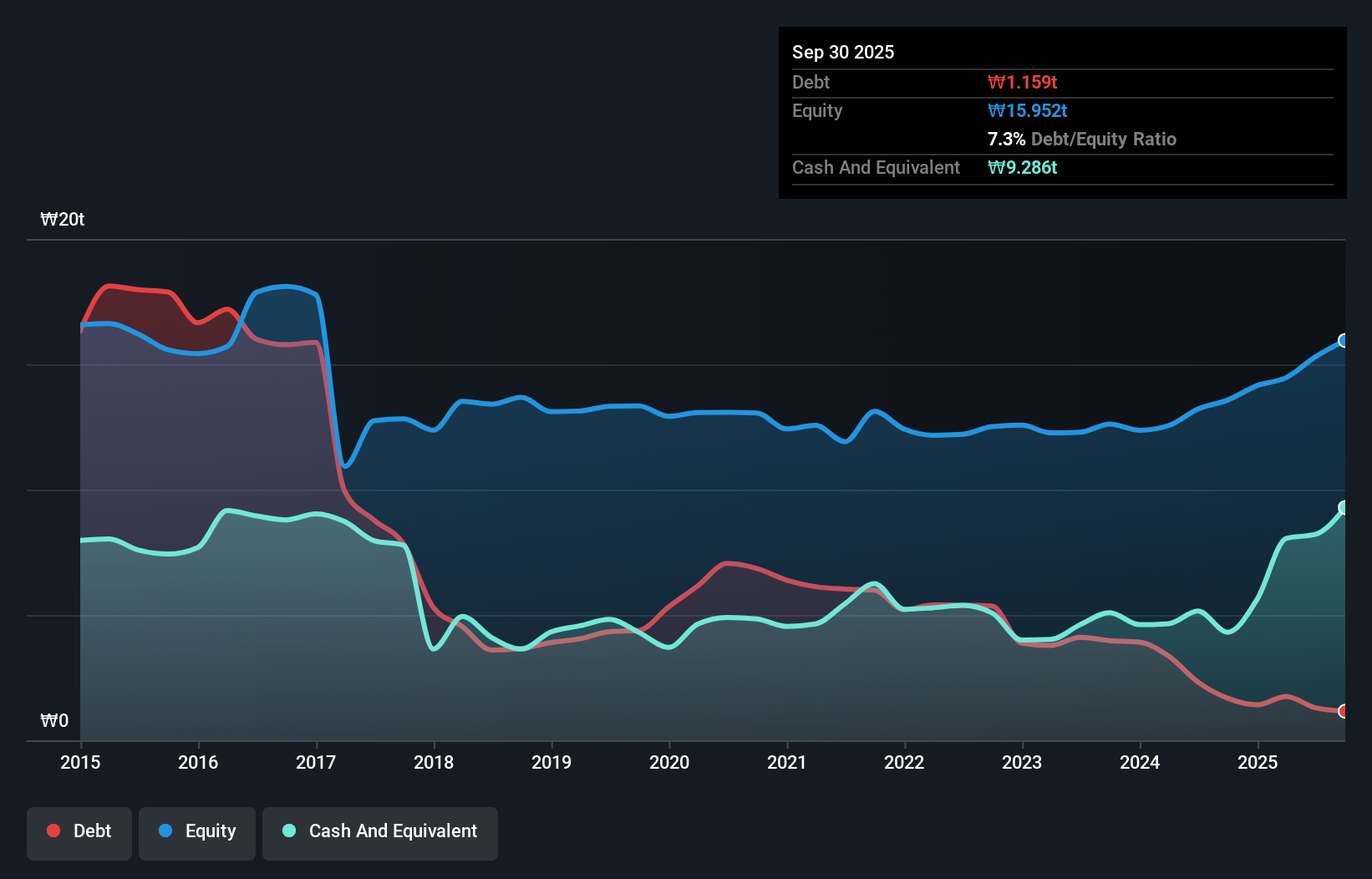

You can click the graphic below for the historical numbers, but it shows that HD Korea Shipbuilding & Offshore Engineering had ₩1.16t of debt in September 2025, down from ₩1.68t, one year before. But it also has ₩9.29t in cash to offset that, meaning it has ₩8.13t net cash.

How Strong Is HD Korea Shipbuilding & Offshore Engineering's Balance Sheet?

The latest balance sheet data shows that HD Korea Shipbuilding & Offshore Engineering had liabilities of ₩20t due within a year, and liabilities of ₩2.31t falling due after that. Offsetting these obligations, it had cash of ₩9.29t as well as receivables valued at ₩1.67t due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩12t.

This deficit isn't so bad because HD Korea Shipbuilding & Offshore Engineering is worth a massive ₩31t, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, HD Korea Shipbuilding & Offshore Engineering also has more cash than debt, so we're pretty confident it can manage its debt safely.

See our latest analysis for HD Korea Shipbuilding & Offshore Engineering

Even more impressive was the fact that HD Korea Shipbuilding & Offshore Engineering grew its EBIT by 209% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if HD Korea Shipbuilding & Offshore Engineering can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. HD Korea Shipbuilding & Offshore Engineering may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, HD Korea Shipbuilding & Offshore Engineering actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

Although HD Korea Shipbuilding & Offshore Engineering's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₩8.13t. The cherry on top was that in converted 183% of that EBIT to free cash flow, bringing in ₩5.9t. So is HD Korea Shipbuilding & Offshore Engineering's debt a risk? It doesn't seem so to us. Over time, share prices tend to follow earnings per share, so if you're interested in HD Korea Shipbuilding & Offshore Engineering, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026